Can Espresso (ESP) bounce back after the post-listing dip, or is another drop still possible?

That is the main question investors are asking after the token debuted on MEXC, and BingX Spot trading with the ESP/USDT pair and promotional zero-fee trading.

Right after listing, hype pushed the price sharply upward. Social media attention, new exchange access, and early trading excitement attracted fast buyers. But just as quickly, the price pulled back as early investors locked in profits. This is a normal “listing cycle” in crypto — pump first, correction later — and it does not automatically signal a failed project.

Espresso is different from many newly launched tokens. Instead of being only a meme or speculation coin, it focuses on infrastructure. The project aims to act as a coordination and confirmation layer for rollups, helping Ethereum Layer-2 networks process transactions faster and more securely.

Because Ethereum scaling is one of the biggest long-term trends in crypto, infrastructure projects often attract steady interest. Espresso already connects with ecosystems such as Arbitrum, Polygon, and Celo. As a result, many investors see ESP as a utility token, not just a trading asset.

That narrative alone increases long-term demand potential.

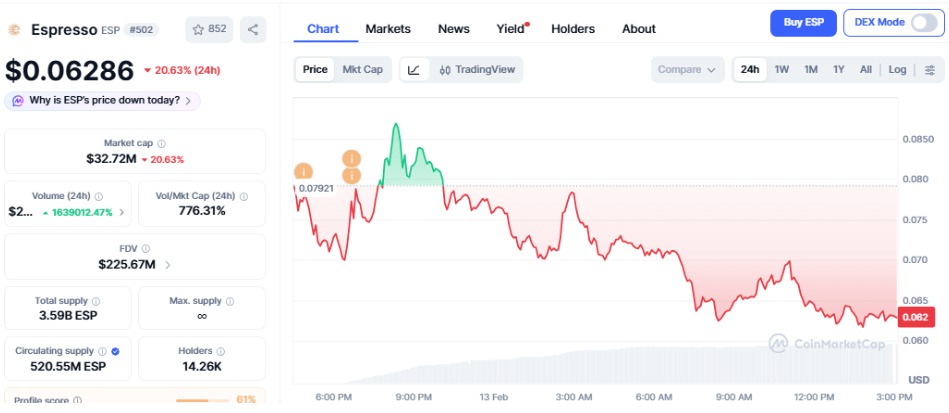

Espresso is trading near $0.062–$0.063, down about 20% from its recent peak around $0.087. The chart shows a typical post-listing reaction. After an initial pump, the price began forming lower highs with gradual selling pressure. This usually happens when early investors secure profits while new buyers wait for a safer entry.

The key level to watch is the $0.060 support. If buyers hold this zone, it could rebound toward $0.070–$0.075 as short-term traders return and confidence improves.

But if the price drops below $0.060, the next support may appear around $0.052–$0.055, where the market could consolidate and start to accumulate. Because the chart continues to show lower highs, the short-term outlook stays neutral to slightly bearish until a clear reversal forms.

For recovery, ESP needs to create a higher-low structure, meaning the price stabilizes and slowly trends upward. If accumulation increases and overall crypto sentiment improves, the token may revisit the $0.08+ range.

In the longer term, ESP’s performance will depend mainly on real network usage rather than hype. Important factors include rollup adoption, developer activity, Ethereum scaling demand, and partnerships.

If Espresso becomes widely used infrastructure for Layer-2 ecosystems, the price could grow steadily. Otherwise, growth may remain gradual even if market attention continues.

Disclaimer: This content is educational, not financial advice. Cryptocurrency investments are risky. Always do your own research before investing.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.