The $2,000 psychological level, which bulls tried to defend for weeks, has finally given way.

Ethereum Price Prediction is back under pressure, with ETH moving through one of its roughest phases in recent months.

The sell-off has been sharp, and the mood has shifted fast.

Currently Ethereum is now hovering near the $1,960 zone. That alone has changed how traders are looking at the market. A similar weakness has already been visible in Bitcoin, adding to broader market anxiety.

Over the last seven days, ETH has dropped more than 28.36%, pushing the market out of a normal correction and into something more uncomfortable.

In the past 24 hours alone, another 6.64% slide has erased billions from market value.

Short-term traders are stepping aside. Long-term players are quieter, watching one level closely—$1,800.

Can $1,800 hold as a meaningful support, or is this just a pause before a deeper downside starts to unfold?

According to recent on-chain data shared by Lookonchain, Aave founder Stani Kulechov sold 4,503 ETH worth around $8.36 million near the $1,857 level roughly six hours ago.

While this single transaction does not signal broader distribution, such activity draws attention when markets are already weak.

In fragile conditions, founder-linked selling tends to make traders more cautious, reinforcing defensive positioning rather than aggressive dip buying.

Recent data shared by Mr. Whale suggests that Trend Research has deposited another 8,000 ETH, worth around $14.8 million, into Binance, reportedly to avoid liquidation risk.

In total, nearly 203,000 ETH valued at about $457 million has now been moved to exchanges near the $2,252 level, while remaining holdings still exceed 463,000 ETH.

With reported losses crossing $855 million, this points to stress-driven positioning rather than strategic selling.

In weak markets, such defensive moves often add to short-term downside pressure, even without broad panic.

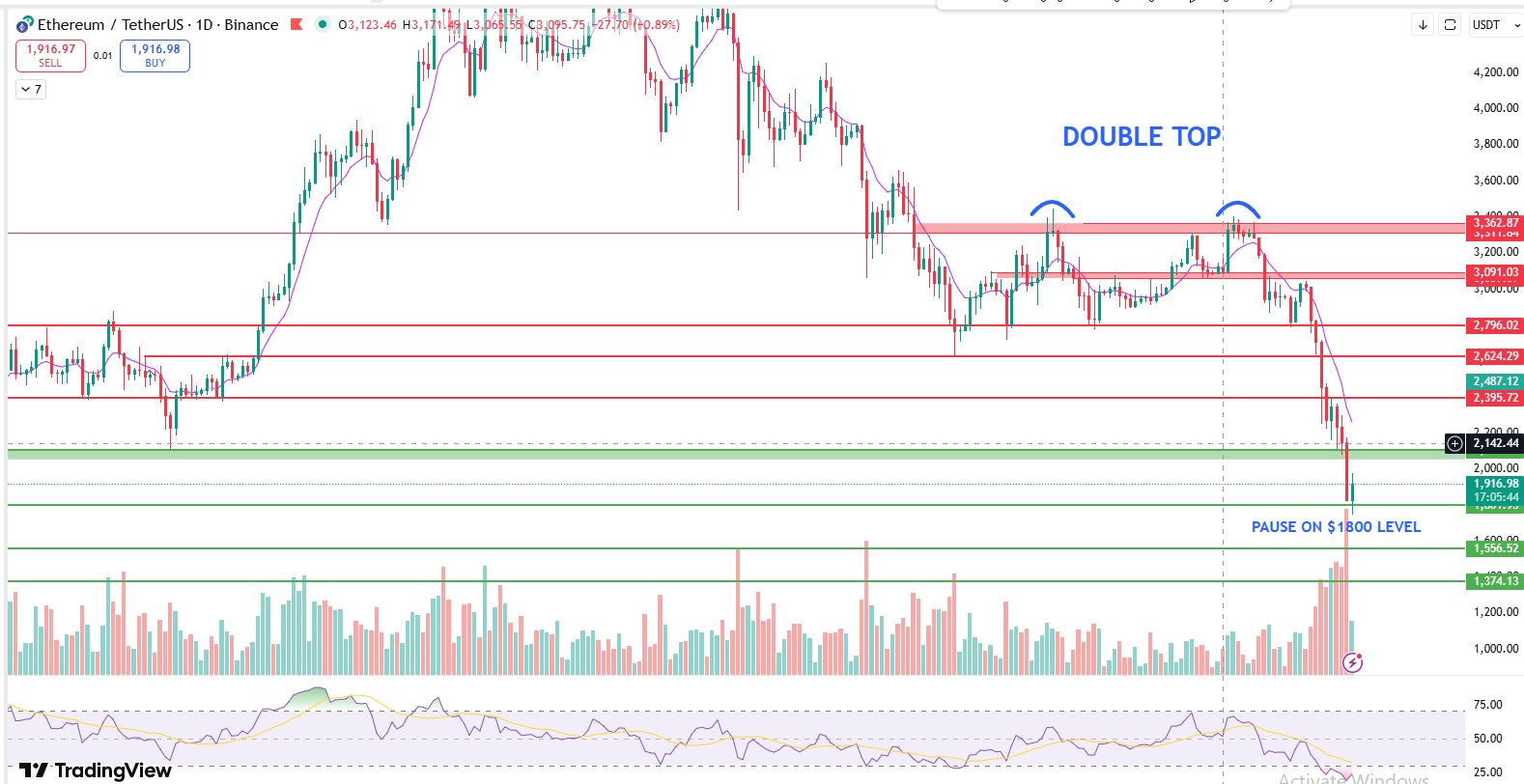

The daily chart on TradingView shows a clear double top formation, which has played a key role in accelerating Ethereum’s decline.

After failing to hold above the $3,000 zone, the price broke below the $2,100 level, a support that had held multiple pullbacks earlier.

Once this level gave way, selling pressure intensified quickly, pushing ETH toward lower demand zones.

Right now, $1,800 remains the immediate hurdle where price has started to pause.

If selling pressure builds again and this level fails to hold, the next downside zone comes in around $1,550, where historical buying interest is visible.

A deeper breakdown could then expose the $1,380 area, which marked the April 2025 low and acted as a key demand zone in the previous cycle.

On the momentum side, RSI is deep in oversold territory near 25, so a short-term bounce cannot be ruled out, even if sentiment remains weak.

However, any bounce toward the upside is likely to face strong resistance near the $2,100 level.

Until Ethereum can sustain above this zone, upside attempts remain fragile, and recovery calls stay doubtful.

Right now, Ethereum price prediction looks stuck in a defensive stretch rather than a clean breakdown or a recovery phase.

The slip below $2,000 has clearly changed how traders are behaving, and most eyes are now locked on the $1,800 area.

This zone is holding for now, but holding alone is not the same as strength.

If $1,800 starts giving way under renewed selling, downside attention naturally shifts toward $1,550 and possibly the $1,380 region, which previously acted as a floor during the April 2025 decline.

On the upside, nothing really changes unless ETH can move back above $2,100 and stay there. Until that happens, rebounds are likely to feel more like pauses than the start of a new trend.

YMYL Disclaimer: This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile, and market conditions can change quickly based on macro data. It is always essential to do your own research before making any investment.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.