Bitcoin price prediction is suddenly back in focus.

Bitcoin is standing at a fragile point where one wrong move could drain confidence across the entire crypto market. The past few weeks have been rough, almost unsettling.

In the last seven days alone, Bitcoin has dropped more than 22%. The pressure has not eased yet.

A fresh 8.8% fall in the past 24 hours has pushed price back toward a level everyone is watching closely—the $60,000 zone.

Right now, BTC is barely holding above what many traders still call an iron-clad support.

Fear is visible.

Short-term traders look nervous. Long-term holders are watching quietly. The market feels tense rather than panicked.

For Bitcoin price prediction, the real question is no longer about upside targets. It is about survival.

Can this level absorb selling pressure, or is this where confidence finally starts to crack?

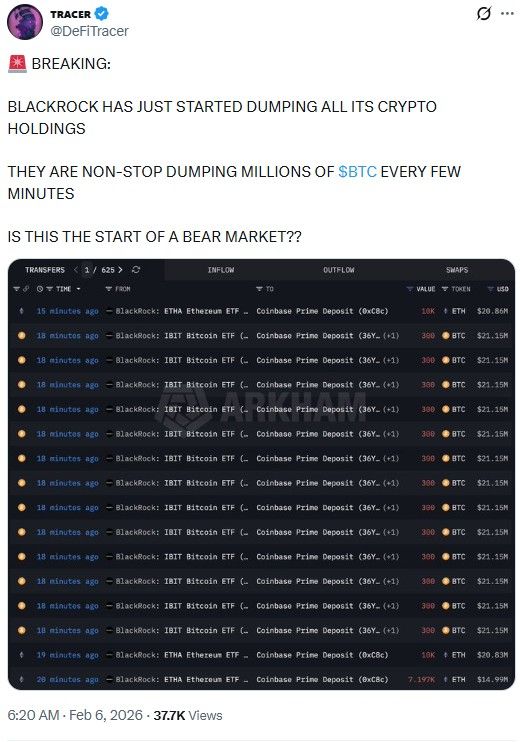

As per the tweet shared by DeFiTracer, it has added fresh tension to the market, claiming BlackRock-linked wallets are moving large amounts of Bitcoin to exchanges

Screenshots showing repeated BTC transfers have circulated widely, keeping traders on edge.

Even without full clarity, this kind of flow chatter hits confidence hard during weak price action.

In fragile conditions, perception alone is enough to keep buyers cautious and selling pressure alive.

Recent chatter intensified after a post by CryptoNobler highlighted the White House rejecting the crypto market structure bill.

The decision itself does not change Bitcoin’s fundamentals overnight, but timing matters.

When markets are already weak, regulatory uncertainty hits harder than usual.

Traders do not like grey areas.

A tweet shared by Coin Bureau has pushed institutional stress back into focus.

MicroStrategy reported $17.4 billion in unrealized digital-asset losses for Q4 2025, alongside a $12.4 billion net loss, while holding 713,502 BTC acquired at an average price of $76,052 per Bitcoin.

The firm has raised $25.3 billion and built a $2.25 billion USD reserve, easing immediate pressure.

Still, such deep drawdowns test conviction.

Markets notice when even long-term institutional holders are sitting through heavy losses.

The absence of clarity feeds hesitation, reduces risk appetite, and keeps confidence fragile.

In this environment, even policy-related noise becomes another weight on price.

On the TradingView daily chart, Bitcoin had been trading inside a falling channel for a long time; this is something we also highlighted in the previous BTC update.

That structure has now broken.

Near the $60,000 area, selling pressure started to ease as buyers stepped in to defend the level.

This suggests demand is present, even if confidence remains fragile.

However, if selling pressure builds again and this support fails to hold, downside levels around $55,595, followed by $52,537, come back into focus.

The 9 EMA and 21 EMA bearish crossover continues to support the downside bias.

Until a bullish crossover appears, sentiment remains bearish.

Short-term bounces may occur, but they still look vulnerable to fading rather than turning into a trend reversal.

Recent debate has tried to pin Bitcoin’s decline on political headlines, but the weekly chart tells a longer story.

As highlighted by CryptoBullet1, the structure closely mirrors past four-year cycles.

Similar peaks in December 2017 and November 2021 were followed by deep corrective phases before the next expansion began.

If this cycle continues to play out in the same rhythm, the chart points toward a potential lower-low zone closer to the $35,000 region.

This is not a forecast but a historical roadmap the market has respected before. Cycles often feel obvious only in hindsight.

In the context of Bitcoin price prediction, the answer to “Is BTC in a danger zone below $60k?” is yes, but it is not broken yet.

The $60,000 level remains a critical defense zone where buyers are still active.

As long as Bitcoin holds above this area, downside risk stays controlled. However, a clean break below $60k could open the path toward $55,595, followed by $52,537.

Failure to stabilize there may shift attention toward deeper cycle-based supports.

Until strength returns above key resistance, risk remains skewed to the downside.

YMYL Disclaimer: This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile, and market conditions can change quickly based on macro data. It is always essential to do your own research before making any investment.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.