Ethereum has finally done what large investors had been quietly fearing.

The $2,100 psychological support, which acted as the last line of defense for bulls over months, has now broken, and Bitcoin has lost its $74,000 support, trading closer to the $70,000 zone.

This was not a slow leak. It was a decisive failure.

As of 5 Feb, in the last 24 hours, ETH has already slipped more than 7%, but the real concern shows up on the broader chart.

Ethereum price prediction turns uneasy; as an important level like this breaks with heavy volume, it signals a dangerous shift in sentiment.

Liquidity is thinning, liquidations are building, and traders are glued to their screens, watching every bounce with suspicion.

The question now feels unavoidable—is this breakdown pulling the price straight toward the dark zone?

Because when ETH loses its base, history shows it rarely stops until panic sellers are fully cleared out.

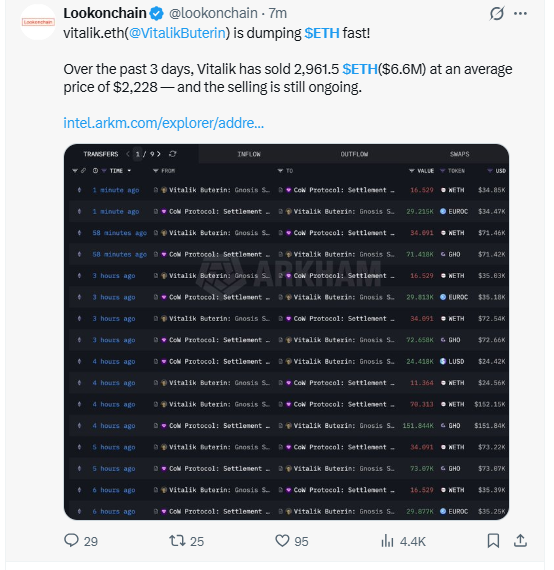

As per the latest on-chain data shared by Lookonchain, Vitalik Buterin has sold around 2,961.5 ETH worth $6.6 million over the past three days, and the selling is still ongoing.

When selling pressure comes from the project’s own founder, it changes how the market reads the situation.

It does not confirm panic, but it deepens uncertainty.

Vitalik has historically sold for ecosystem grants, but the timing adds to current market fear, especially when ETH has already lost key support and sentiment is fragile.

The firm holds 4.28 million ETH worth around $8.42 billion, and the pressure has intensified as price slips below the $2,100 level.

When losses reach this scale at the institutional level, market pressure tends to build quietly.

It does not point to immediate forced exits, but it underlines how stretched the current ETH drawdown has become.

On the daily chart, price was moving inside a falling channel, which has now broken to the downside.

Price has also lost the key $2,100 support, shifting focus toward the next technical support near $1,800.

From a broader view, ETH is already around 40% down from its 2026 high, showing how deep the correction has become.

The 9 and 21 EMA bearish crossover is also supporting the downside structure. Until a bullish crossover appears, upside attempts are likely to remain limited rather than decisive.

Based on the long-term chart shared by Greeny Trades, Ethereum’s structure is pointing toward the $1,380-$1,400 zone, a level that also marked the 2025 cycle low.

With ETH repeatedly failing to hold higher trend support, this area is starting to re-enter the discussion.

The context matters.

Bitcoin has already broken its previous year’s low, and historically, Ethereum tends to follow when broader market structure weakens.

With key supports already lost and momentum still fragile, the $1,380-$1,400 zone stands out as a logical downside reference rather than an extreme scenario.

According to market commentary shared by Myles G Investments.

Tom Lee has put forward one of the most bearish views of this cycle, suggesting Bitcoin could drop toward $15,000 and ETH toward $500 in the near term.

Whether these levels are reached or not, Tom Lee's price predictions usually surface when market sentiment is already stretched and confidence is fragile, rather than acting as a precise roadmap for price.

This reflects prevailing market sentiment and opinions, not certainty or financial advice.

Analysts see the current Ethereum price prediction phase as a high-risk reset rather than panic.

Founder selling, institutional drawdowns, and broken technical structures suggest confidence is thinning.

With key supports lost, Ethereum remains vulnerable until liquidity stabilizes and the price structure shows clear signs of balance returning.

YMYL Disclaimer: This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile, and market conditions can change quickly based on macro data. It is always essential to do your own research before making any investment.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.