Ethena ENA has been under pressure for a while. The drop has been sharp, and sentiment around the token clearly looks weak now. Price moved down fast, and a lot of confidence was lost along the way. Traders who were expecting continuation are mostly on the sidelines. Fresh buying is also not very visible at the moment. After a fall like this, the question changes. Is ENA starting to slow down here, or is this just a small pause before more selling?

That is why the Ethena price prediction after the fall matters right now. When a token corrects this hard, the next move usually sets the tone. Either price finds some stability, or sellers stay in control. Support levels, volume, and the overall market mood will decide what happens next for this coin.

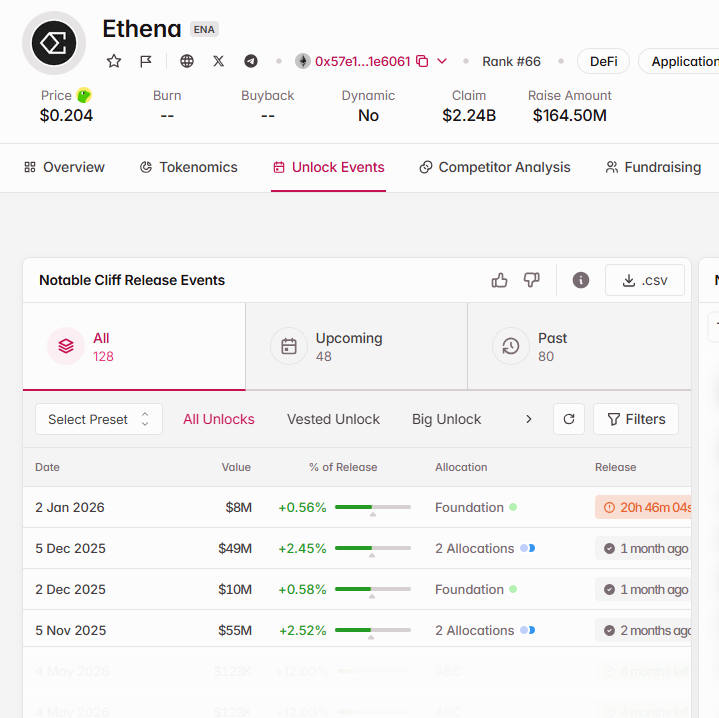

One of the main reasons behind ENA's weakness is the ongoing token unlock schedule. Over the last few months, regular unlocks have added a steady supply into the market. This pressure is not sudden but continuous.

Source: Tokenomist

In November 2025, around $55 million worth of ENA was unlocked, which was close to 2.5 percent of the supply. After that, December 2025 also saw heavy unlocks, including nearly $59 million released in two events, again on 2 January and on 5 January 2026, with amounts ranging between $8 million and $35 million. Most of these token unlocks are coming from foundation and vested allocations.

That means this supply is planned and keeps coming in phases. Even if all tokens are not sold immediately, the market usually expects selling. That is why buyers are cautious and limit upside moves with this coin already trading near lower price zones; these unlocks make recovery difficult. Until this unlock pressure slows down or demand clearly improves, Ethena is likely to remain under pressure, with downside risk still present.

The short-term chart shows ENA moving inside a falling wedge, but there are no buyers. The price is currently trading near the structure's lower end. Bounce is unconvincing; it appears weak and short.

Chart Source: TradingView

The $0.2251 level is important here. Earlier, this zone was acting as support. Now the price is below it, and the same level has turned into resistance. Each time price tries to move higher, selling pressure comes back around this area. On top of that, the 100 EMA is sitting above the price and acting like a strong wall.

As long as ENA stays below $0.2251 and the 100 EMA, bearish pressure remains active. If the current support breaks, the price can slide toward $0.18, and after that, $0.15 is also possible. Even if the wedge breaks upward, the upside looks limited for now, with $0.26 and $0.30 acting as resistance zones. Ongoing token unlocks are also adding supply, which makes short-term recovery harder.

Ethena is still struggling after a sharp fall, and the current setup does not offer much relief yet. Selling pressure remains active in the Ethena price prediction, supported by ongoing token unlocks and weak short-term momentum. While small bounces are possible, they appear unstable and fail in continuation.

For now, price action suggests caution. ENA needs strong volume and clear support to shift sentiment. Until that happens, downside risks remain on the table, and recovery attempts may continue to face resistance. In the short term, ENA appears to be more concerned with establishing stability than initiating a meaningful reversal.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Crypto investments involve risk; always do your own research.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.