The crypto market has kicked off the year 2026 with a vigorous bullish momentum, as indicated by the series of consecutive green candles that are interpreted as a sign of the investors' renewed confidence.

The total capitalization of the cryptocurrency market has once again surpassed the $3 trillion threshold, while the leading coins like Bitcoin and Ethereum have gained between 1% and 1.5%, with XRP being the most performing one with a daily increase of 3%.

Yet, the main point is: Is XRP silently setting the stage for a massive breakout as ETF inflows, supply shortage, and long-term technical indicators converge? The evidence points at this rally being somewhat more than just a short-term push.

The most significant factor pushing prices up in the year 2026 is the swift development of XRP ETFs. In less than two months, XRP ETFs have already garnered $1 billion in inflows, thus freezing 746 million tokens, which is 1.14% of what is being circulated.

If the current rate of inflows of $27.7 million per day continues, total ETF assets could reach $5 billion around mid-May 2026, thereby potentially locking up 2.6 billion tokens, which is almost 4% of the total supply.

This development coincides with the scenario where the balances on exchanges have already been reduced by 58% in 2025, thus making the liquidity that is available for buying and selling much lower than before.

The availability of tokens on exchanges has plunged to the lowest level in eight years with only 1.6 billion tokens left, a steep fall from 3.76 billion in October 2025, and the market is going through a typical supply-demand mismatch, which has always been a very powerful price-boosting factor historically.

As per the expert Ali, the bi-weekly chart is currently displaying a TD Sequential macro buy signal. This signal generally shows up when the market is nearly hitting bottom or reversing trend, thereby giving the indication that the selling pressure is running out.

In the higher timeframes, such signals are usually interpreted as the indication of the early trend shifts and the improvement of the momentum rather than the short-term noise. This supports a cautiously bullish view, especially when considering the decline in the supply on exchanges, the increase in the rising institutional demand.

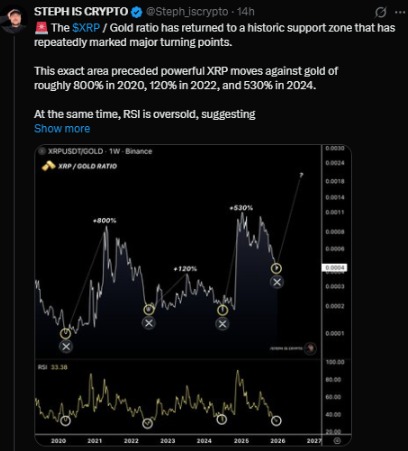

Rather than just looking at the XRP dollar value, the XRP/Gold ratio provides more insights. Altcoin has come back to a historic support area that has been identified as a turning point in the past.

In the previous cycles this particular zone had already signaled the powerful mean reversion moves:

+800% outperformance in 2020

+120% in 2022

+530% in 2024

At the same moment, the RSI shows a very deep and strong oversold condition that implies the downside momentum is almost over. The relaying probabilities of the XRP to gold price ratio have already been very strong—supporting the breakout of these relative strengths.

A key chart looks at the current structural development of XRP through the lens of the pre-2017 consolidation phase. The token has spent 393 days of sideways accumulation—very comparable to the period before its breakout.

During these periods, there has been minimal price movement, yet volatility has increased and interest from the market has stayed low. Now, however, Altcoin is giving signs of a breakout, a condition that has been historically associated with quite strong expansions of the upside.

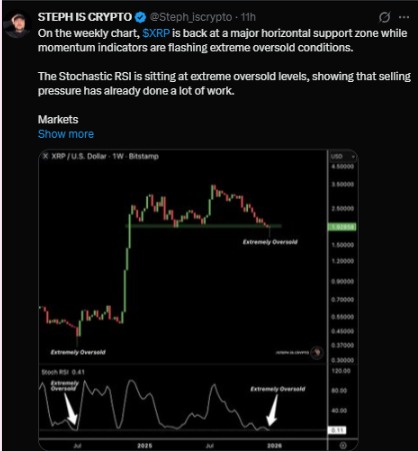

As per Crypto Analyst, Ripple has come back to a long-horizontal support zone on the weekly time frame which saw vast rallies in the past. Notably, the Stochastic RSI and other momentum indicators are at very low levels indicating that the sellers’ strength has been largely used up.

Usually, the markets reverse before the sentiment turns bullish, not the other way around. In the event that this support level holds, then the altcoin may undergo a phase of stabilization first—followed by a fresh move to the upside as momentum resets.

The token is presently engaged in a range-based accumulation activity, oscillating between strong historical support and a visible resistance area above.

$1 is the significant launchpad

A setback at resistance might lead to a decline in the short term

A breakout supported by volume could be the starting point for the next rally

In this pattern, $10 is possible after XRP secures strength above resistance, not before.

From the viewpoint of the Elliott Wave principle, XRP looks to be on the verge of Wave (5)—the last impulsive phase of a traditional five-wave structure.

Accordingly:

Wave (3) gives off tremendous growth

Wave (4) creates a higher low

Wave (5) delivers the most energy and participation

When the breakout patterns from the long-term wedges and triangles come together, the token could be entering a high-momentum expansion phase with possible $20+ targets if the historical behavior gets repeated.

If ETF inflows continue to be robust, exchange supply to be limited, and key support levels to be maintained, XRP's long-term structure will still be bullish. Although fluctuations are anticipated, the overall setup supports accumulation first, followed by expansion.

Short-term: $1–$2 range

Mid-term: $5–$10 after breakout confirmation

Long-term (cycle peak): $20+ possible with momentum continuing

Disclaimer: As always, this is not financial advice. Investors should manage risk and monitor confirmation levels closely.

This article discusses XRP price scenarios based on technical indicators, historical patterns, and current market data. All price levels, forecasts, and potential targets are speculative and may not materialize. Cryptocurrency markets are highly volatile and can result in significant losses. Nothing in this content constitutes financial, investment, trading, or any other form of professional advice. Readers should conduct their own research, consider their financial situation and risk tolerance, and, if needed, consult a licensed financial advisor before making any investment decisions.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.