With the Spur Protocol having officially announced its SON token listing on CoinStore, the investors are now putting one very important question on the table: is this going to be sufficient to pull the price of SON up, or is it that the real breakout is going to be dependent on a Binance listing?

With the presale dates changing and the rumors around exchanges getting stronger, the next step of the Spur Protocol could determine the direction of its market.

Spur Protocol has revealed that $SON will be listed on CoinStore by January, thereby declaring it the first confirmed centralized exchange (CEX) for the token. While announcing this, the team also indicated that further CEX listings are being planned, but no names have been mentioned officially yet.

In the meantime, rumors of a Binance listing are going around in the community, but there is no confirmation from either Binance or the Spur Protocol team at this point. Currently, CoinStore is the only exchange that has been confirmed, and investors should be very careful about treating any speculation related to Binance as being credible.

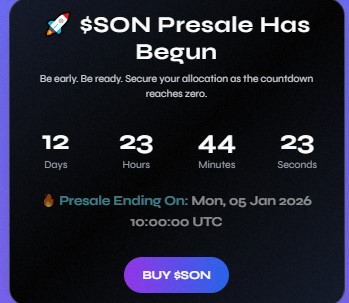

Spur Protocol has made a remarkable announcement regarding the presale extension, changing the end date to January 5, 2026, at 10:00 UTC, instead of the previously set deadline of December 19, 2025. In saying that, the team made it clear that the move is to invite more participants, especially those who wish to join the presale through the ECFS (First Come, First Serve) method.

Up to now, the amount of tokens sold reaches 571,401.43 out of the entire 8,333,333 token which will be allocated for the presale at a price of 1 SON = 0.0000337 BNB. The remaining time is approximately 13 days, and the extension is being set up as the last chance for the investors to buy SON at its lowest presale price, before the official launch of the project, which is creating more urgency among the late buyers.

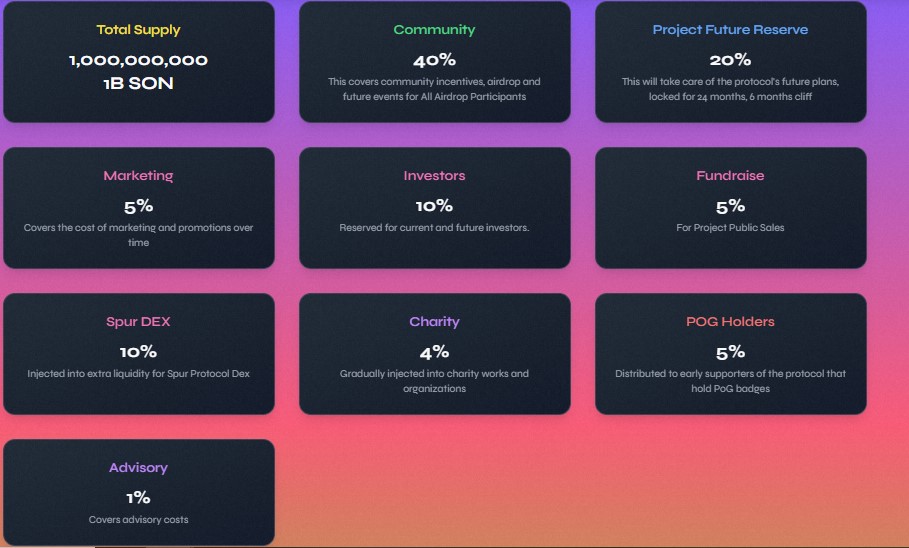

The total supply of Spur Protocol is 1 billion tokens, where 49% has been assigned to the community for rewards, airdrops, and events. The Project Future Reserve controls 20%, which is locked for 24 months with a 6-month cliff, and thus will be supporting long-term development.

Allocations for Others include 10% for investors, 10% for DEX liquidity, 5% for marketing, fundraising, and POG holders, 4% for charity, and 1% for advisory. This ensures a fair and sustainable distribution of tokens among all.

With a total supply of 1 billion tokens and 40% set aside for community rewards, SON is predicted to debut the market in the range of $0.60 to $0.80 at the listing, therefore, facilitating the liquidity and active community participation of the project from its inception.

If it gets the Binance listing, the situation could turn extremely bullish. It is well known that such listings increase liquidity, global exposure, and, thus, investor participation. Under these circumstances, it might experience a short-term increase to $1.00-$1.50 temporarily; however, this is still very speculative until the announcement is made.

In the near term, a listing on a major exchange—especially Binance—would trigger SON's price lifting that eventually unchains a feather. If the listing is done immediately after the launch, SON’s price has the chance of rocketing as high as $1.00-$1.50, owing to augmented trade activities, larger markets being exposed to the coin, and speculative investors participating in the momentum.

In the long term, SON’s price will be governed by ecosystem growth, community incentives, and reward programs, quizzes, and possibly airdrops as the engagement methods. If the user base continues growing and the utility becomes as wide as planned, the long-term price forecasts say it could even be up to $5, given that the market is favorable and the development is consistent.

The presale will be over in January 2026, but the future exchange listing is coming, so the next phase will be very important. The big question is: will Spur Protocol be able to manage a Tier-1 listing to maximize its price potential or will CoinStore be the one that sets the pace for its early market journey?

Crypto price predictions are for informational purposes only and not financial advice. The crypto market is highly volatile, and prices can change at any time. Do your own research before investing. We are not responsible for any financial losses.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.