At the year's end, most tokens are moving slowly, but the FUNToken price is picking up today, drawing attention after a quiet stretch. This move has not come out of nowhere. A day earlier, coin saw a sharp spike of nearly 13%, which was sold into; the price failed to hold the higher levels, but that spike did one important thing—it brought traders back to the token after a quiet phase.

On 24th December, the FUN/USDC spot trading pair is officially listed. Yesterday’s sudden move worked like a signal. Even though the breakout failed, it showed that buyers were still watching FUN closely. After the spike was sold off, selling pressure started to ease. Prices did not continue falling aggressively, which hinted that demand was slowly returning.

Source: CoinMarketCap

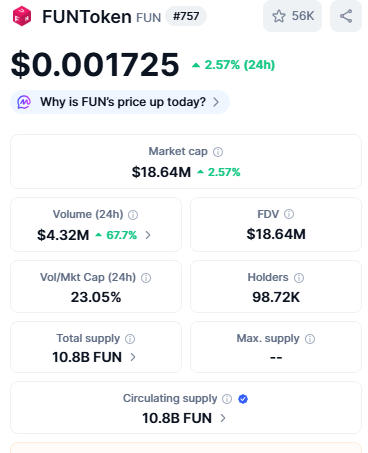

Today’s move looks calmer. Price is not exploding, but buying interest is clearly visible, especially in the volume data. coin's 24-hour trading volume is up by around 67%, which is notable for a small-cap token like this. In thin market conditions, this kind of volume often matters more than the price move itself.

On the daily chart, FUN is still trading below its major resistance zones. However, price recently bounced from the $0.00160–$0.00165 support area, which has acted as a short-term floor.

Source: TradingView

The earlier spike was rejected near the upper supply zone, showing that sellers are still active above. That part is clear, which highlights what happened after the rejection. Instead of falling, the price stabilized and began to move sideways, helped by increased volume.

RSI on the daily time frame is slowly moving up but remain in a neutral range; it is not stretched. This supports the view that coin is showing a slow recovery instead of a fast breakout.

On the 1-hour chart, price is still moving inside a rising channel. Dips are getting bought, and the price is holding within the range for now. The structure stays okay unless this channel breaks.

Source: TradingView

For the short-time price prediciton, the structure is simple

Immediate support is $0.00160

Near-term resistance is $0.00185-$0.00195.

Strong resistance: $0.00220-$0.00230

If price manages a daily close above $0.00195, the next move could extend towards the $0.00220 zone. That area may attract sellers again, so follow-through will be important.

On the downside, a daily close below $0.00160 would weaken the setup and could send the price back into consolidation. As long as support holds, the structure stays stable.

The token is higher today mainly because traders' interest returned after the spike failed, the price did not break down, the volume improved, and support is holding till now. Resistance is still overhead, so this looks more like stabilization than a clear trend of reversal at this stage.

Disclaimer This article is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile; do your own research before making any investment decisions

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.