ZKP has surprised the market with an extremely sharp increase of 45% in just a day, thus taking the range after a few weeks of very high volatility. This unexpected move in price has brought the investors’ interest back again, particularly as the big trade involving exchanges and the trading incentives that are very attractive meet the weak market sentiment.

But the question is whether ZKP can carry this momentum or correction is in the picture once again? Let’s analyze the factors that are influencing ZKP’s price nowadays and where it could possibly go next.

ZKP’s super excited movement is not a coincidence. Rather, it is an indication of the perfect mixing of liquidity growth, incentivized trading, and technical breakout structure, all taking place at one of the critical psychological levels of traders.

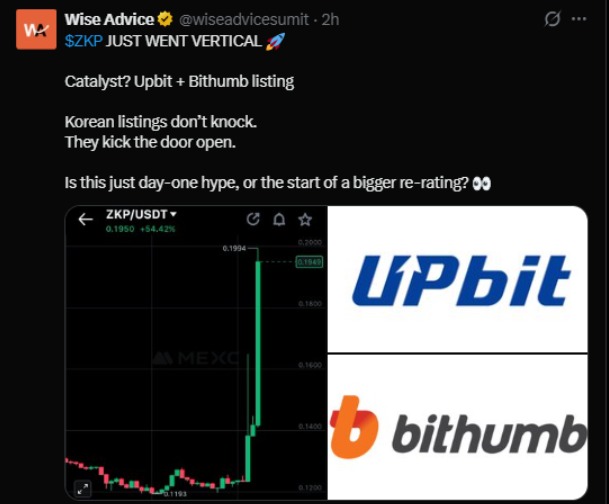

zkPass got listed on Upbit and Bithumb, which are the biggest cryptocurrency exchanges in South Korea, thus boosting its credibility and liquidity profile instantly. These exchanges account for a major part of the trading volumes in Asia and have a reputation for maintaining high compliance standards—this is indeed a good signal for the institutional traders.

A trader can access over $1.2 billion liquidity daily from Upbit alone

The audience for Asia’s privacy-oriented crypto market will be more exposed

According to historical trends, listings on Upbit usually lead to an increase of 50–100% in the price within 48 hours

On the other hand, traders should be careful since the privacy-focused tokens usually face regulatory scrutiny which can cause fluctuations in prices and hence, increase volatility.

Binance contributed to the BNB Smart Chain Trading Competition's success, giving 1.25 million tokens as rewards. The event lures limit orders with 4x trading weight, fostering accumulation over impulsive selling.

Main impact:

Trading volume increased by 280.59% in 24 hours

Incentives for rewards reduced short-term selling pressure

Binance's inclusion means a strong platform confidence in zkPass's technology

However, history indicates that reward-based events usually result in sell-offs once competitions are over, so the post-January 6 period is crucial.

The token had a rough start and fell by 35% after its December 19 debut, which was triggered by the aggressive airdrop selling and weakness in the altcoin market in general. In the meantime, fear has lessened as the Crypto Fear & Greed Index has increased from 21 to 27, which is a sign of reduced fear.

The situation implies:

A short-term relief rally is still valid

Long-term pressure is there as Bitcoin's dominance remains high

Altcoin dominance RSI is close to historic lows

This situation will not support broad-based altcoin rallies, only selective breakouts.

As per TradingView hourly ZKPASS/USDT chart shows a typical pattern of volatility increase after a long period of accumulation. The token was in a range for a few sessions close to the bottom, which was a sign of the end of selling pressure and the start of stealth accumulation.

The breakout over the resistance of the range caused a strong bullish movement of the price, which was a confirmation of the change in the short-term market structure. However, the last candle had a long upper wick; this is a sign that the bulls are booking profits near resistance in the short term.

Immediate support: $0.17–$0.18 (breakout zone)

Bullish targets: $0.22 → $0.25

Bearish invalidation: Down to $0.17

Downside risk: $0.14–$0.15 retest if the support fails

The bullish continuation setup is still valid as long as ZKP is above $0.18, and it is more likely that there will be a consolidation before the next move higher.

Short-Term Price Prediction (Next 7 Days)

If ZKP maintains its support level of $0.18 alongside high trading volume, then the price may range and after that proceed to the target area of $0.22–$0.25. Expect a fluctuating price scenario as traders will make their profits.

Near-Term Price Prediction (January 2026)

Volatility after the Binance competition might lead to a price drop. Yet, the liquidity on exchanges, and the interest in privacy infrastructure could help ZKP not to go below $0.15, thus maintaining the high-low structure.

ZKP’s price explosion is not simply due to speculation; it is the result of well-planned exchange listings, effective trading, and a technically justified breakout. The price will face ups and downs in the short term, but the overall market will continue to go up instead of reversing immediately—assuming the support levels are not breached.

Crypto price predictions are for informational purposes only and not financial advice. The crypto market is highly volatile, and prices can change at any time. Do your own research before investing. We are not responsible for any financial losses.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.