Will the repeated delay of Spur Protocol’s token generation event (TGE) hurt its price, or could the extra time help the project launch in a stronger position?

With the $SON token now expected to list on January 30, investors are asking one key question: Is this delay a red flag, a strategic reset, or could more delays still come?

After multiple postponements, weak crypto market sentiment, and a temporarily inaccessible website, the project has reached a critical phase.

In this article, we break down why the delay happened, how it may affect the listing price, and what investors should realistically expect next.

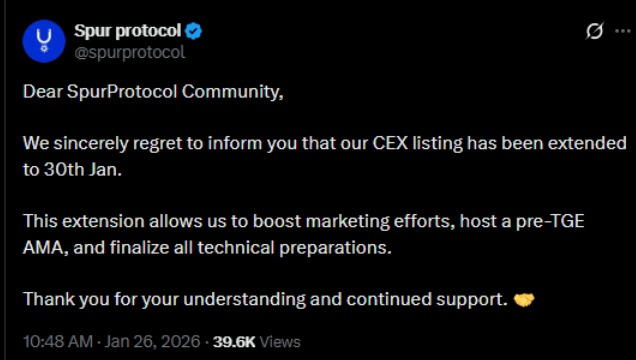

The team originally planned to launch on December 19, 2025, but later moved the date to January 8, then January 26, and now finally to January 30, 2026.

According to the team, the reasons include:

Weak overall crypto market conditions

Low token sale participation

Ongoing technical preparations

Additional time for marketing and community engagement

A planned pre-TGE AMA session

Historically, projects tend to delay listings when less than 20–30% of tokens are sold, as launching with low demand often results in heavy sell pressure on day one.

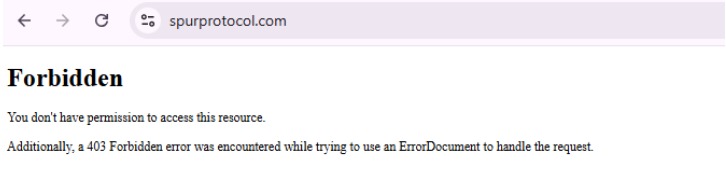

Spur Protocol’s website currently shows a 403 Forbidden error, which has raised concerns among community members. While the team describes this as technical maintenance, prolonged downtime close to a TGE can impact trust and sentiment.

In crypto markets, confidence matters as much as fundamentals. Any uncertainty — even temporary — can affect short-term price action.

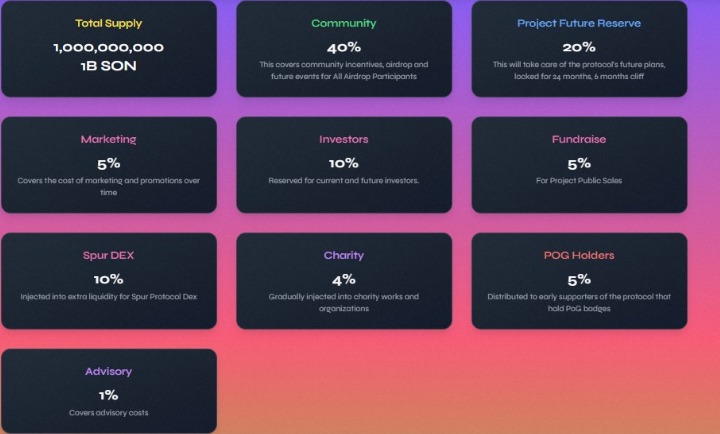

The total supply of SON is 1 billion tokens, distributed as follows:

49% — Community rewards, airdrops, and events

20% — Project Future Reserve (locked 24 months, 6-month cliff)

10% — Investors

10% — DEX liquidity

5% — Marketing and fundraising

4% — Charity

1% — Advisors

While this distribution appears balanced, short-term price performance will depend more on demand, liquidity, and market sentiment than tokenomics alone.

Expected Listing Price Range (Short Term)

Based on current conditions, comparable launches, and the impact of delays, it may open within this range:

Conservative scenario: $0.003 – $0.006

Neutral scenario: $0.007 – $0.010

Bullish scenario (strong marketing & recovery): $0.012 – $0.018

Due to repeated delays, initial volatility is likely. Early buyers may take quick profits, especially if token sale participation remains low.

Negative Impact

Reduced short-term hype

Trust erosion from repeated postponements

Potential sell pressure at launch

Positive Impact

Better technical stability

More time to attract liquidity

Improved marketing push before TGE

If Spur Protocol successfully executes its AMA, restores the website, and confirms listings on MEXC, BingX, CoinStore, and PancakeSwap, price stability could improve after the first few days.

Short term (listing week): High volatility, price swings expected

Mid term (1–3 months): Price depends on product delivery and transparency

Long term: Strongly tied to real utility, ecosystem growth, and execution

A delayed launch does not automatically mean a scam, but consistent communication and delivery after listing will be critical.

At this stage, Spur Protocol shows both warning signs and legitimate planning efforts. Delays, low sales, and a down website raise valid concerns, but transparent explanations, locked reserves, and planned exchange listings suggest the project is still active.

Investors should stay cautious, avoid overexposure, and wait for on-chain activity and post-listing performance before making long-term decisions.

The January 30 listing is a defining moment for Spur Protocol. If the team delivers a smooth launch and restores confidence, the project could stabilize after early turbulence. However, another delay or weak debut could significantly damage credibility.

Disclaimer: The content on this page is for informational and educational purposes only and does not constitute financial, investment, or trading advice. Cryptocurrency investments are highly volatile and involve significant risk.

Always conduct your own research (DYOR) and consult with a licensed financial advisor before making any investment decisions. The authors and publishers are not responsible for any profits, losses, or damages arising from your use of this information.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.