Is InterLink’s dual-token model and institutional focus going to make ITLG a long-term winner, or is it just the hype that has been getting ahead of the reality?

This is the main question investors are asking as rumors about a potential February listing gain momentum, and InterLink aims at a much wider area than just crypto, towards compliance, use of the family of global payments, and possibly a future listing on the U.S. stock exchange.

Although there hasn't been an official listing announcement yet, there are really strong roadmap signals and growing institutional involvement. Let’s do the ITLG price predictions breakdown in a clear, realistic, and easy-to-understand way.

InterLink is not just another cryptocurrency project that is going to be taken on speculation. It is rather going for infrastructure in payments, layers of identity, and institutional acceptance, all at the same time, with a dual-token economy:

ITL: An asset mainly targeting institutions and treasury

ITLG: A token driven by utility for payments, rewards, and daily use

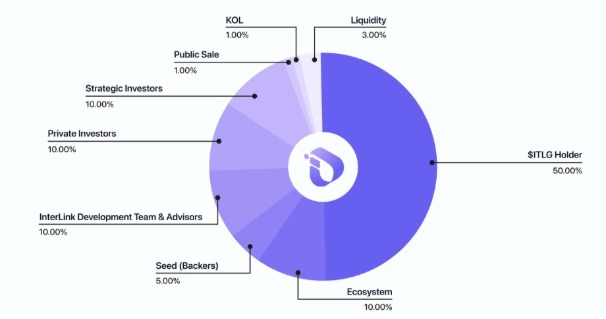

The supply structure, with a cap of 10 billion tokens and the fact that 80% is reserved for human node miners, encourages long-term participation instead of short-term speculation.

Currently, there is no officially confirmed ITLG listing date. Yet, the market gossip is indicating Q1 2026, with February often mentioned—especially in relation to the BlockDAG-based exchange listings.

Adding some credibility to this, early on, several of the worldwide institutions have already placed ITL in the group of treasury assets, thus showing the institutional confidence even before the public exchange exposure.

When the token launches, it is predicted that just about 3% of the whole ITLG supply will be available for trading. Such a small supply might create a very unstable market condition, especially if there is a demand surprise at that time.

Price Influencer activities, ecosystem updates, and early utility announcements may price support; taking profits will likely limit extreme price movements.

Expected price range:

$0.0025 – $0.006

Market mood will be primarily responsible for price changes during this period, not the full fundamentals.

The unlocking of more tokens will be done progressively, and the price will be more dependent on real adoption rather than hype. The factors of importance are:

Payment use cases will be live

ITLG utility will grow across various apps and merchants

Strategic investors are entering the market slowly

If the demand for the token is healthy, the market might be able to deal with the token unlocks without experiencing substantial price drops.

Expected price range:

$0.01 – $0.03

This period will determine if InterLink is able to deliver its roadmap, not just talk about it.

ITLG's value in the long run will depend on the usage of the network, the generation of revenue, and geographical expansion.

Key positives include:

Limitless total supply

Emission cuts and burn mechanisms

Strong incentives to hold rather than sell

Institutional participation is growing

If the InterLink payment network and developer ecosystem are expanded, then ITLG will be a major player in the market during the favorable market cycles.

Expected price range:

$0.08 – $0.15

In a very bullish market situation, the prices might go above this range, but only with the adoption being proven and demand being sustained.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Crypto investments involve risk; always do your own research.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.