After Bitcoin, Zcash is the only coin that is in the discussion of traders, but this time not for the most comfortable reasons. After a strong move earlier, the market has started asking tougher questions. Developer exits, governance chatter, and sharp price swings have all added to the uncertainty around ZEC. At the same time, the broader crypto market is trying to stabilize, which makes Zcash’s position feel even more unclear.

Some see recent weakness as a temporary reaction to news, while others are unsure how much confidence has actually been shaken. That mix of recovery attempts and lingering doubt is exactly why Zcash Price Prediction 2026 is becoming harder to pin down. Right now, ZEC is not trading on hype or momentum alone. It is trading on trust, structure, and how the next phase of development unfolds. The future remains open but far from predictable.

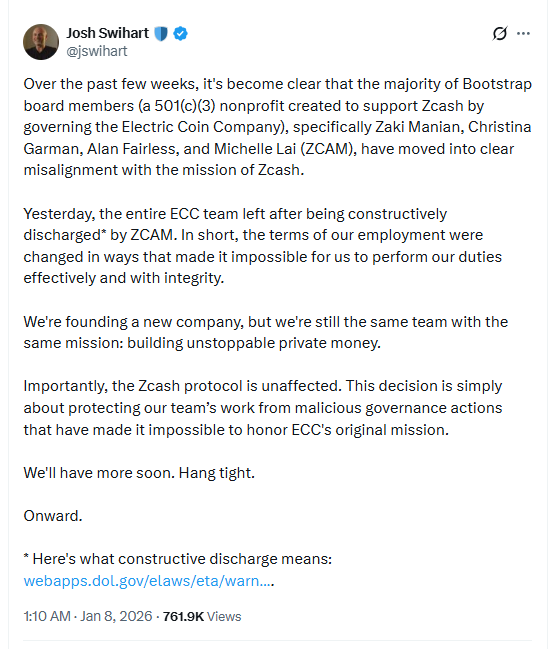

The last few weeks have been uncomfortable for Zcash; news around the core development team stepping away from ECC created more confusion than answers. There was talk around governance, direction, and disagreements, and the market did not take it well. Even though the network itself was said to be unaffected, Price did not wait for explanations. It reacted first.

Source: X @jswihart

After the news, trading became unstable, and confidence clearly took a hit. The selling felt rushed, and the bounce that followed looked hesitant. This did not feel like a clean reset. It felt like the market was trying to process something it did not fully understand yet. Because of that, this altcoin price prediction has become less about clear narratives and more about how the market digests uncertainty over time.

Zcash experienced a sharp sell-off as the price dropped by almost 21% in a very short span of time. The sharp fall was not gradual; otherwise, it would have indicated panic selling. The sharp fall can be noticed when certain news becomes public before the market has a clear understanding of what has actually happened.

Source: X @NekozTek

The selling was driven more by confusion than by structure. Orders hit fast, support did not get much time to react, and the price slipped lower almost in one go. Even though a bounce showed up later, it felt hesitant. The market still looks unsure about what to do next after the shock.

When we look at the 4-hour chart, the altcoin was moving inside a rising channel for some days, making higher highs and higher lows; the structure was clean. Price kept respecting that channel until it reached around $550. From there, sellers slowly started showing up. If things were normal, this could have been just a healthy pullback, but then the news hit, and that changed everything.

Source: TradingView

Panic selling kicked in, and the whole channel broke. The 200 EMA, which was supporting the price earlier, flipped its role and started acting as resistance. Price dropped fast and reached the $370 support zone. A bounce did come from there, but it did not look strong—no real follow-through, no buying confidence.

As long as the price stays below the 200 EMA, the structure remains weak. If selling pressure continues, $370 will act as a support again, but in case of a heavier sell-off, $300 is also possible; it will still depend a lot on broader market conditions.

This setup only fails if the price manages to give a daily closing above the 200 EMA. In that case, $470 becomes the first resistance, and if momentum builds, a move back toward $550 can follow.

On the daily chart, ZEC did not look comfortable after the recent sell-off; the structure that was holding price steady has weakened, and the recovery so far feels slow and hesitant rather than strong. Price is trying to stabilize, but confidence is clearly missing, which keeps the ZEC price outlook under pressure for now.

Source: X @VegetaCrypto1

According to the analyst, the key shift happened once ZEC slipped below the $470–$455 zone. This area earlier acted as solid daily support, but now the price is struggling to reclaim it. As long as Zcash remains below this level, upside momentum stays capped, and rallies may face selling pressure on the downside; the $370–$350 range stands out as the next important area where buyers could step in again. This zone has acted as support in the past and may slow down further weakness.

For the daily structure to improve, ZEC would need to move back above $470 and hold there. Until that happens, the daily chart suggests consolidation with a cautious bias rather than a clean trend reversal.

Looking at the weekly timeframe, Zcash has faced a strong rejection from a major macro supply zone. Historically, this area has acted as a ceiling in the past, and price is once again struggling to hold above it.

Source: X @cryptclay

The zone around $305 stands out as a key line in the sand. If ZEC starts closing below this level, the broader structure turns weak, and downside momentum can pick up quickly. As long as the price stays above it, some balance remains, but the risk clearly increases on the lower side.

Looking at the bigger picture, this altcoin price outlook still feels unsettled. Governance noise, the sudden sell-off, and the slow bounce after that have clearly shaken confidence. Short-term charts look messy, and higher timeframes show price running into supply more than strength. At the same time, ZEC is still reacting around key zones, so the structure is not fully broken either. For now, this feels like a waiting phase, where the market is trying to figure things out before showing any clear direction.

YMYL Disclaimer: This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile. It is always essential to do your own research before making any investment.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.