Shardeum, the long-awaited EVM-based smart contract platform, is now turning the spotlight on itself with its mainnet launch. Its natively built token, SHM, will list on leading crypto exchanges—such as BitMart, CoinW, and MEXC—on May 8, 2025. Following a record-breaking testnet period with over 1.4 million users, SHM is set to make a strong debut in the Layer 1 blockchain space.

So, what can traders, investors, and crypto fans expect from Shardeum (SHM) price performance? Here's a thorough look at tokenomics, market potential, and a realistic price forecast based on solid fundamentals and industry trends.

Shardeum is a Layer 1 blockchain that uses dynamic state sharding—a breakthrough that achieves low gas costs, high levels of throughput, and genuine decentralization. The community aspires to have millions of users without compromising the integrity of the blockchain. It scales up as the demand rises without being costly or insecure.

Due to EVM compatibility, developers can deploy Ethereum smart contracts on Shardeum. This makes it an attractive platform for dApps, DeFi protocols, and Web3 innovators.

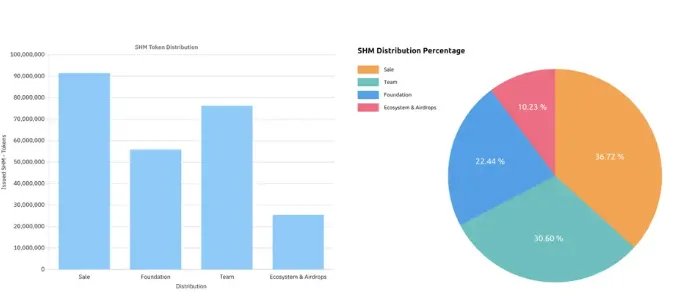

The token launch has a well-thought-out distribution plan for its initial 249 million supply:

36.72% (91.44M) – Public & Private Sale (3-month cliff + 2-year linear vesting)

30.6% (76.2M) – Core Team (same vesting as above)

22.44% (55.88M) – Foundation (fully unlocked at TGE)

10.23% (25.48M) – Ecosystem & Airdrops (also fully unlocked at TGE)

This allocation supports both early contributor incentives and ecosystem expansion, while the delayed unlocks for the team and investors mitigate extreme sell-offs post-TGE.

With the listing set for May 8, SHM will usher in the most crucial phase, as the market sentiment, exchange volume and community activity will become paramount in determining its price.

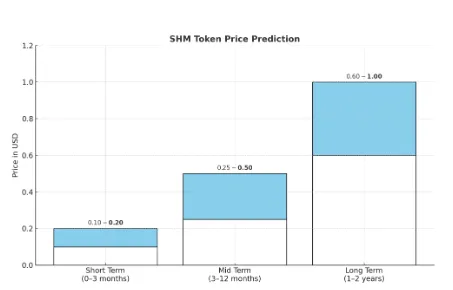

Short-Term (0–3 Months): $0.10 – $0.20

In the short term, the price will probably rise on initial excitement, listing news and community enthusiasm. However, unlocked airdrops and Foundation tokens can apply some sell pressure; only the massive demand on BitMart, CoinW, and MEXC could mitigate it.

Mid-Term (3–12 Months): $0.25 – $0.50

As Shardeum integrates new developers and projects after the mainnet launch, we anticipate a surge in user adoption and utility. However, as the sale and team allocations begin vesting unlocks, there will be a slow increase in circulating supply, which could initiate price corrections and consolidations.

Long-Term (1–2 Years): $0.60 – $1.00+

Expecting the ecosystem to grow and maintain sustained uptime on the network and low fees and attract developers, SHM is bound to emerge as one of the top contending layer ones. It’s reasonable to compare them to Avalanche (AVAX) or Harmony (ONE).

By late 2026, most major unlocks will be completed, and price discovery will depend on organic demand, partnerships, and mainnet usage stats.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.