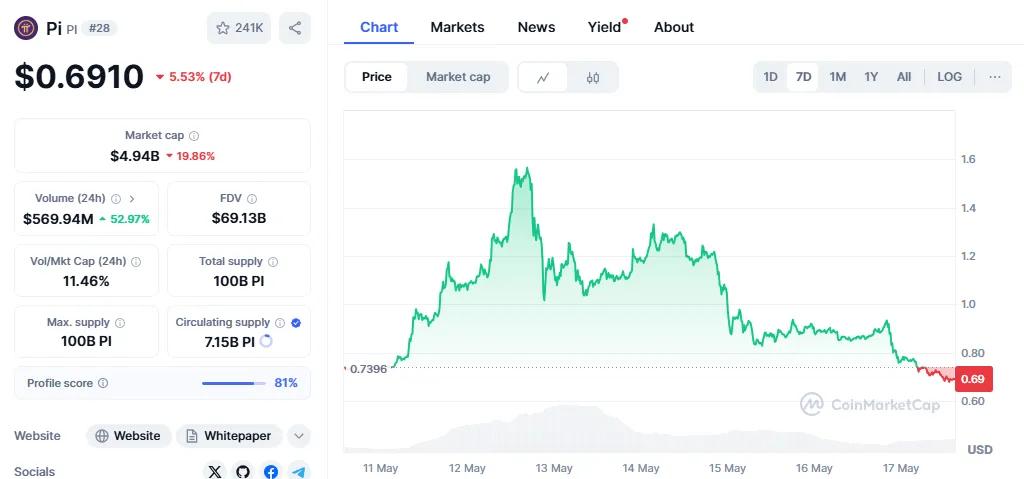

Following the Consensus announcements of 2025, the native token of Pi Network, PI, sharply dipped and lost over 58% of its value from its recent peak of $1.67. Trading at $0.6910 now, this staggeringly fast-paced crash is astonishing the market. The question in everybody's mind is: can PI hold, or will it be declined further to retest the lows of $0.40 in April?

Between May 8 and May 13, The altcoin witnessed its market value more than doubling from $4.17 billion to $11.94 billion! Two major announcements were shared during Consensus 2025 — the shutdown of Pi central node and the kickoff of a $100 million Pi Network Ventures fund. These events lifted bullish sentiments temporarily, but the excitement soon began to fizzle.

By May 17, the market cap had plunged again below $5 billion, showing how flimsy the price surge really was. The downfall had been accelerated by heavy depositing of the token onto another crypto exchange, OKX, where on-chain data showed about 1.2 million tokens transferred and likely to be sold off. This indicated the profit-taking movement employed by early holders, hence furthering the correction in its price.

One big signal witnessed during the rally was the unprecedented redistribution of tokens among big holders to mention a few. By CoinCarp Wallet data, the concentration of the Top 100 wallets fell drastically from 98.76% as at May 6 to about 3.89% on May 17. On May 13 alone, the top 10 holders owned just 1.31%, while the top 50 held 2.7%.

Such drastic changes are unlikely to have been retail-driven but rather suggest some internal wallet reshufflings or profit-taking measures adopted by early investors and insiders: a bearish sign right up with the parabolic rise and the immediate correction of the token.

The 4-hour chart still shows a classic blow-off top formation with a parabolic rise and swift correction attached to it. Price first broke above $1.60, and since then, it's crashed below the 20, 50, 100, and 200 EMAs, a good sign of the erosion of momentum.

The altcoin currently stands at $0.6974, its strength from above capped by the 20 EMA of $0.8599. Relative Strength Index has dropped to 34.03, which means the asset is headed towards overselling.

Source: TradingView

If the selling pressure continues, the next key psychological support remains at $0.60. A breakdown below here can set the stage for a free fall toward April's low price of $0.40. On the contrary, if the RSI starts recovering and buying interest comes into play, a relief rally toward 100 EMA ($0.8278) or 50 EMA ($0.8599) might be awaiting.

The altcoin deemed bullish in the near term, it ought to retain the $0.89–$0.90 zone with concerted buying volumes sweeping in. Here strong technical support can give confidence to newer investors. This recovery phenomenon needs a major catalyst from either Binance or Coinbase listing.

Dr. Altcoin said that the altcoin is set to retest April's bottom at around $0.40 unless good news of an exchange listing or adoption impacts the market. Volume divergence and descending order EMAs add more weight to the bearish scenario.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.