While gold and silver are shining and making new all-time highs, the investors are raising a big question: is the yearly Christmas rally going to change from the trend of the Bitcoin to the precious metals one, or is the BTC just relaxing for a while before another major move? The increase in world uncertainties and the flow of money into safe-havens have placed the crypto market at a very important turning point.

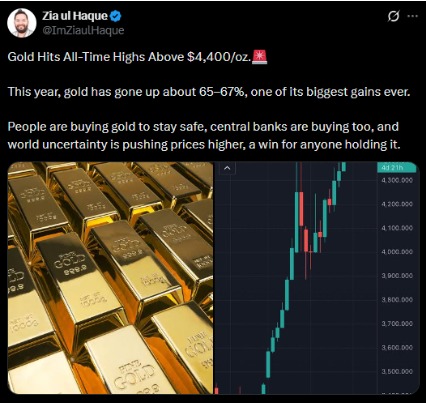

Another day, and once more, the precious metals have reached a new record. The price of precious metal has jumped to an all-time high of around $4,453 per ounce lately, and the price of silver is still near its historical peak of approximately $69.44. On the other hand, Bitcoin, which has been often called "digital gold," is failing to get back to the $90,000 level.

In the past year, the price of the yellow metal has risen by nearly 70%, silver has gone up more than 140%, and Bitcoin has gone down by almost 4.4%. This contrast in price movements indicates a strong shift in the preferences of short-term investors.

The escalating military conflicts in Ukraine and Venezuela, along with the uncertainty over the economy, have increased the demand for gold and other assets that have a long tradition of stability.

The price has managed to successfully exceed the $4,450 mark, driven by a mixture of buying by institutions and central banks. The central banks around the world have been quietly hoarding gold and this in turn has been one of the reasons behind the massive price rise of approximately 65%–67% so far in the year 2025.

One of the most vocal gold-supporters, Peter Schiff, is of the opinion that the gold bull run might still have a long way to go. He suggests that if the danger of inflation and geopolitical crises do not go away, then the price of gold can hit the $5,000 mark in a few months.

The unbroken upward trail of gold prices reinforces its position as the best hedge against all the uncertainties—especially when the risk assets are taking a pause.

Silver has actually outshined gold by a greater extent. The price reached almost $69.50 per ounce, thereby setting a new milestone and bringing its 2025 gains up to over 140%.

However, silver, unlike gold, enjoys double demand. It is a safe-haven asset and a vital industrial metal at the same time. The rally was further supported by the mega demand from the clean energy, electric vehicles, solar panels, and advanced technology sectors.

The market analysts believe that silver's distinctive characteristic gives it a strongest position and it will be one of the top-performing assets in the coming year.

Precious Metals soars, but Bitcoin is still in the consolidation phase. After reaching a record high on October 6, BTC could not maintain its high and fell almost 36%. Nevertheless, the price recovery after the drop has placed it in a narrow band.

Analyst Ted believes that Bitcoin has not yet found a proper trading zone and is still in a no-trade zone. The two scenarios he outlines are:

An upward break of $90,000 and then a rise to $95,000 and $100,000, or

The complete drowning of the support zone at $87,000–$88,000 before any considerable upward movement takes place.

This kind of price movement signals uncertainty in the market rather than a total lack of interest.

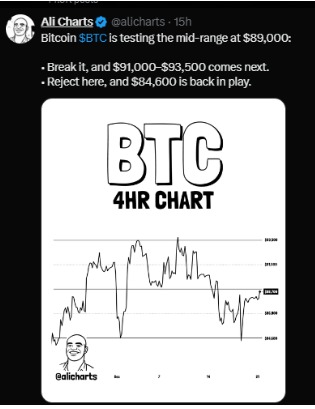

Crypto analyst Ali informs that currently, Bitcoin is at the mid-range level of $89,000 and testing this level on the 4-hour chart.

A clear breakout above $89,000 could push BTC to $91,000 and $93,500 in the near future.

On the other hand, rejection of the price at this level may cause it to be pulled back to $84,600, which is the recent local low.

These levels now set the near-term direction for Bitcoin.

From a technical perspective , Bitcoin is showing early signs of stabilization. In the 4-hour time frame, the asset has already made a bullish pole-and-flag pattern with a breakout very close to $89,500.

The RSI index is moving around the neutral zone at level 50, which means that more and more time is needed for the selling pressure to ease.

The MACD maintains the positive reading and its line continues to go up, thus indicating a possible trend reversal.

All the analysts are in the opinion that if the $87,000–$88,000 support zone is not broken, the bullish structure will remain in place for the next short to medium term. However, if the price goes below this range for a prolonged period, the recovery will be harder.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.