Crypto often moves fast before it moves hard, and SIREN just showed how quickly things can flip.

In the last 48 hours, token shot up to an all-time high near $0.376, rising more than 400% and grabbing attention across the memecoin space.

For many traders, it felt like the party had just started.

Then the mood changed.

The green candles faded, and SIREN price action dropped back toward the $0.091 area.

What looked like a strong breakout suddenly felt fragile, raising a simple question across the market—is the party already over, or is this just a rough pause?

A reminder of how sharp memecoin volatility can be.

As the SIREN price prediction starts getting discussed, the key question stays the same.

Is this drop just a breather after a fast move, or did token turn peak excitement into exit liquidity for early buyers? The next few moves may answer that.

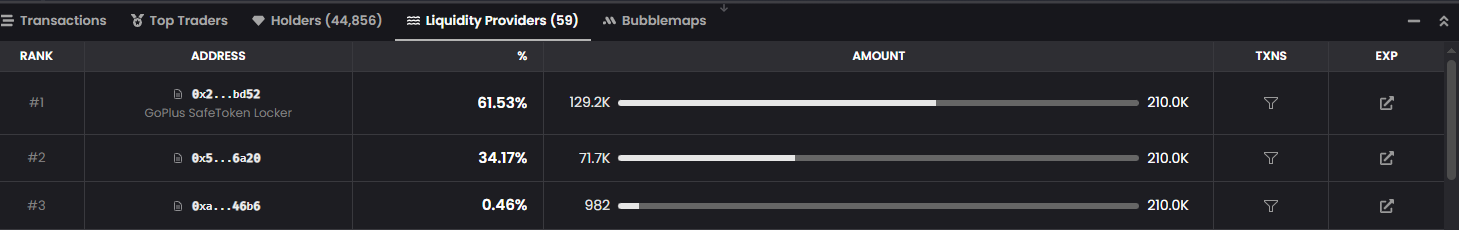

Based on Dexscreener's recent liquidity provider data, around 61.53% of SIREN’s liquidity is locked in GoPlus SafeToken Locker, which helps reduce immediate rug risk and sudden liquidity removal.

That provides a basic layer of stability after such a sharp move.

However, the bigger shift is visible in volume. The earlier trading spike has started to cool, suggesting that the burst of speculative activity is fading.

Without fresh buying interest returning, it may be difficult for this memecoin to quickly reclaim higher levels like the $0.30 zone.

For now, liquidity looks present, but momentum clearly needs rebuilding.

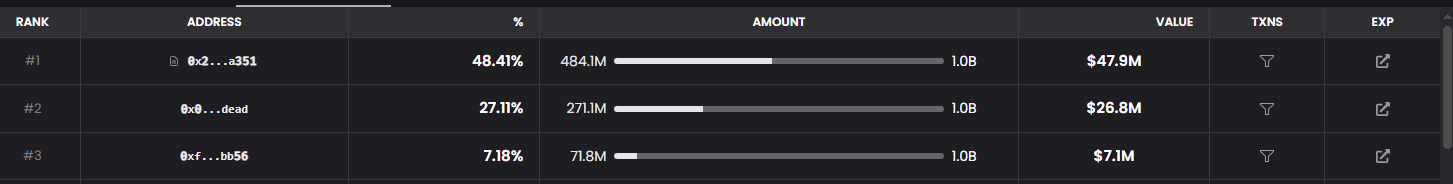

As per Dexscreener data, token supply remains heavily concentrated, with the top wallet holding around 48.41% and the second-largest close to 27.11%.

Together, the top two addresses control more than 75% of the supply, which helps explain the sharp price swings.

As long as these wallets stay inactive, the price can stabilize, but any major move from them could shift this memecoin quickly.

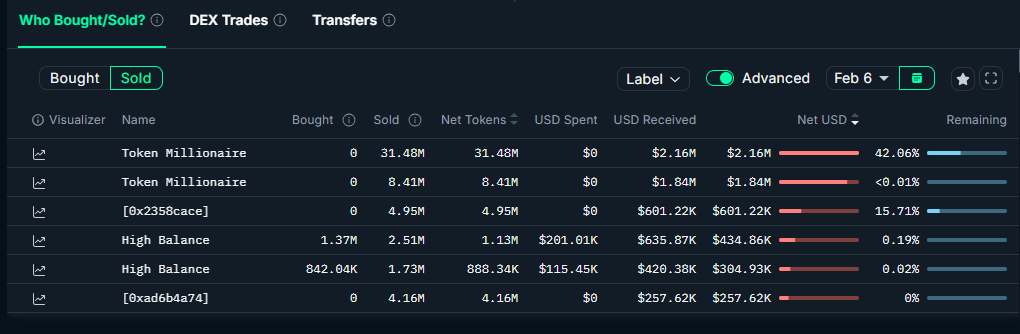

When a token runs over 400%, retail excitement usually peaks, but on-chain data tells the real story.

Nansen’s Token God Mode shows that top-tier wallets started selling aggressively near the highs.

Two “Token Millionaire” addresses alone cashed out roughly $2.16M and $1.84M, locking profits while the price was elevated.

This gap between retail buying and whale selling explains why the drop felt sudden rather than gradual.

Looking at the daily chart on TradingView, it becomes clear that the 400% rally was not a random move.

Price had been consolidating inside a symmetrical triangle pattern for a long time.

The breakout from this structure released the momentum the market was waiting for.

Three key technical signals stand out from the chart:

Fibonacci 1.618 Target Hit: After the breakout, SIREN moved straight toward the 1.618 Fibonacci extension near $0.31. This level is often treated as a major technical target, and price faced a strong rejection from there, followed by a sharp drop.

RSI at 88—Overbought Warning: At the peak, the RSI climbed to around 88, signaling extreme overbought conditions. Such high RSI levels usually point to buying exhaustion, which often leads to a correction.

50 EMA Acting as Support: Despite the sharp decline, price is currently reacting near the 50 EMA breakout zone. For any recovery attempt to hold, SIREN will need to stay above this EMA. Losing this level could increase downside pressure.

Based on the current technical setup and the whale distribution data seen on Nansen, here is the realistic outlook for SIREN:

Short-Term Outlook

The market is currently in a cool-off phase. Since the RSI reached such an extreme high, the price needs time to consolidate and form a new floor.

Key Support: The $0.08 - $0.09 zone must be defended by the community.

Immediate Resistance: The first major hurdle for a recovery is the $0.15 - $0.20 range. Until SIREN flips this into support, new highs are unlikely.

Long-Term Outlook

If SIREN manages to stabilize its supply and attract new institutional interest, the long-term targets will remain ambitious.

Realistic 2026 Target: If the momentum returns, the next major Fibonacci milestone is the Fib(2.618) level at $0.48.

The "Whale" Risk: The ultimate success of this prediction depends on the Rank #1 holder, who controls 48.41% of the supply. Any sudden move from this wallet could invalidate the technical setup.

SIREN’s 400% run made headlines, but the correction exposed what really matters now.

Liquidity is still present, volume has cooled, whale exits are visible, and supply remains concentrated. That keeps the risk side very much alive.

From a SIREN Price Prediction point of view, this phase is less about chasing moves and more about watching behavior.

If price can hold support and interest slowly returns, the story may continue. If big holders move again, the setup can break fast. For now, the market is observing, not committing.

YMYL Disclaimer: This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile, and market conditions can change quickly based on macro data. It is always essential to do your own research before making any investment.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.