Every Dogecoin holder shares one dream—the moment $1.00 finally flashes on the screen.

We’ve endured the crashes and the fading hype, but 2026 feels different.

This isn't just a "meme" anymore; it's a testament to the patience of millions who refused to let go.

As we analyze the latest Dogecoin price prediction, the coin stands at a crossroads where the path to the "Moon" is becoming visible.

Despite recent volatility in many altcoins and memecoins, the technical structure is forming the very foundation we've awaited for five years.

This Dogecoin price prediction explores how the $0.09 support floor could launch memecoin toward its legendary $1.00 milestone.

Data shared by BSCNews, citing SoSoValueCrypto, shows that spot Dogecoin ETFs launched in September 2025 have seen limited inflows so far, totaling around $6.67 million.

Despite this, DOGE continues to hold a market cap above $16 billion, suggesting broader interest has not faded.

ETF participation may be slow, but spot market demand and long-term holder conviction remain part of the ongoing DOGE price prediction narrative.

According to Trader Tardigrade (@TATrader_Alan), DOGE momentum is showing early signs of relief.

Dogecoin is showing a bullish RSI divergence on the 4-hour chart, even as price made lower lows.

This points to fading selling pressure rather than fresh downside momentum.

RSI has also broken above its descending trendline, suggesting short-term momentum is trying to stabilize.

This does not flip the broader trend, but it reduces immediate downside risk as long as price holds nearby support.

A move back below recent lows would invalidate this setup.

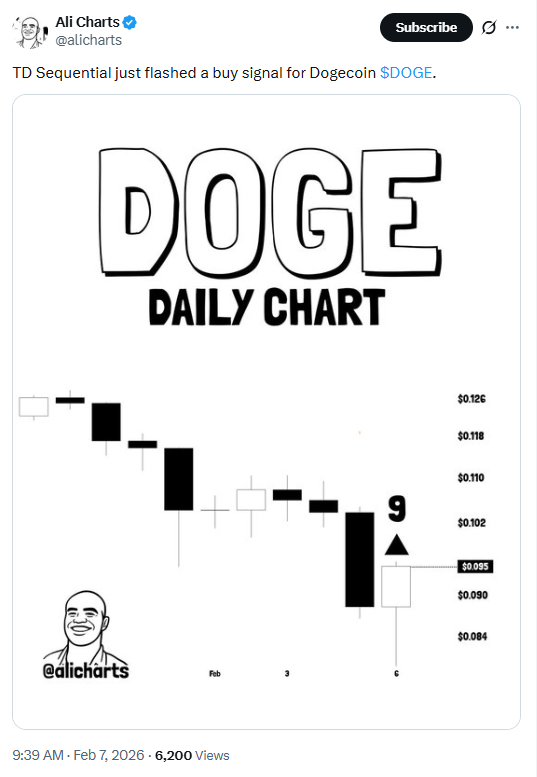

According to Ali Martinez (@alicharts), memecoin has printed a TD Sequential buy signal on the daily chart after an extended pullback.

This signal often appears when selling pressure begins to cool off rather than accelerate.

The timing is notable.

DOGE flashed this signal close to a key support area, where price action has started to slow.

That shift points toward short-term momentum stabilizing and opens room for a recovery attempt in the broader Dogecoin price outlook.

According to CryptoZee (@_CryptoZee), memecoin has entered its January 2026 entry zone near $0.095, sitting right on a long-term major support.

This area has acted as a launch point before, and the weekly structure is starting to look familiar again.

The idea here is simple. This memecoin has completed a full corrective cycle and returned to the same demand zone where earlier rallies began.

With price stabilizing near support, the broader DOGE price prediction leans toward a rebound scenario rather than continued downside.

Based on this structure, CryptoZee highlights upside targets near $0.34 first, followed by $0.60 if momentum builds.

The setup suggests history may be repeating, with patience once again becoming the key theme for DOGE holders.

According to Cantonese Cat (@cantonmeow), Dogecoin's long-term structure is lining up with past expansion phases, even without a strict Elliott Wave framework.

The chart highlights a familiar cycle where memecoin returns to its base before opening room for larger upside moves.

Based on this structure, upside targets cluster around $0.76, followed by $1.60, and extend toward $2.36 to $4.13 in a full expansion scenario.

These levels align with historical Fibonacci extensions seen during previous DOGE cycles.

At this stage, DOGE price forecast sentiment appears to be shifting from exhaustion into early rebuild mode, a phase that has often preceded stronger multi-year rallies.

Looking at the structure across timeframes, the Dogecoin Price Prediction 2026 story is no longer built on hype alone.

Strong support near $0.09, improving short-term momentum, and long-term expansion targets together explain why the $1 level still matters.

This setup does not promise instant moves, but it does show why many DOGE holders believe 2026 could finally be the year when patience starts paying back.

YMYL Disclaimer: This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile, and market conditions can change quickly based on macro data. It is always essential to do your own research before making any investment.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.