Solana Price Prediction Signals Pressure as SOL Reject From Resistance Zone

Solana Price Prediction short-term performance reflects persistent pressure as the price continues to drift lower despite brief recovery attempts.

With trading activity softening and open interest retreating from recent highs, market participants are closely watching to determine whether SOL can stabilize within its current range.

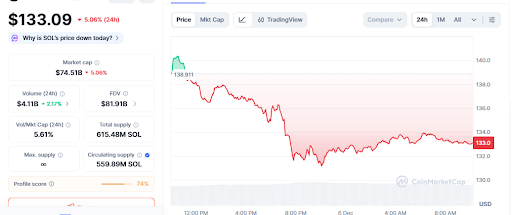

The 24-hour SOL/USD chart displays a clear downward trend as the price declines from $138.91 to approximately $133.09.

A sequence of lower highs and lower lows formed throughout the session, with the most notable drop occurring when SOL Price Prediction toward the $131–$132 region.

This lower boundary defined the day’s weakest point and confirmed persistent bearish momentum shaping short-term direction.

Source: CoinMarketCap

After establishing the low, the coin staged a mild rebound into the $133–$134 zone. However, the attempt lacked strength, highlighting weak buyer conviction and limited momentum across the trading.

Supporting data reflects a market cap of $74.51 billion, a 24-hour volume of $4.11 billion, and a circulating supply of 559.89 million tokens.

These figures reinforce a cautious environment consistent with ongoing corrective behavior observed in Solana Price Prediction scenarios.

The 1-hour SOL/USD chart illustrates a broader cycle of decline, recovery, and consolidation. Price begins near the $140–$145 region before trending lower into the $130–$135 zone.

A sharper sell-off later pushes the crypto toward $123–$125, forming a short-term bottom. From there, buyers re-enter the trading, driving a strong rally that brings the price back toward $145, marking the chart’s local high and briefly restoring positive sentiment.

Source: Open Interest

As prices advanced, open interest increased from around 2.68 billion to nearly 3.0 billion, indicating new long positions entering the market. Once the crypto reached the $145 region, the price gradually reversed toward $132–$135.

During this move, open interest declined to approximately 2.75 billion, reflecting profit-taking and reduced participation rather than aggressive short positioning.

By the final candles, price steadied around $133 with flat OI, pointing to a neutral market awaiting new catalysts within Crypto Price Prediction modeling.

At the time of trading, shows fragile momentum even after modest recovery attempts. Weak buyer participation during rebounds highlights ongoing hesitation following recent volatility.

Volume patterns and price behavior suggest the exchange remains in a consolidation phase, typical when directional swings are pausing. This environment often precedes stronger moves once liquidity and trader conviction return.

Source: TradingView

Key near-term levels to watch include resistance between $136–$138 and support around $131–$132.

A decisive break above resistance could pave the way for higher retracement zones, while a drop below support may extend the existing downtrend.

Current conditions point to a cautious outlook until momentum improves and trading participation strengthens.

Shristy Malviya is a skilled English Blog Writer and Content Writer associated with Coin Gabbar, specializing in producing well-researched and SEO-friendly content on cryptocurrency, blockchain innovation, and financial technology. She is passionate about making complex industry topics accessible and valuable to a wide audience. Shristy’s work reflects her commitment to delivering credible and high-quality information that aligns with current market trends. Outside her writing career, she enjoys reading books, an activity that deepens her understanding of global markets and continuously inspires her professional growth.