The year 2026 has begun with a strong bullish trend in the crypto market, with the total market capitalization rising above the $3.30 trillion mark, as per the data provided by CoinGecko.

The Bitcoin price for 2026 was set at $94,000. Ethereum was back at $3,200, while the altcoins were the center of attraction. XRP was the top gainer among the coins that were up, as it rose 28% in price while Solana's 12% rise was less stunning and even the most absurd of them all, the memecoins—Dogecoin, Pepe, Bonk, and Floki—saw their prices rise by over 100% in some cases and no less than 50-80% for the rest.

The presale has ended, raising expectations, yet the listing date is still uncertain. Let's break down the facts, risks, and realistic price outlook for $SON in an understandable way for every investor. What will happen to the Spur Protocol price at listing?

$SON presale has officially ended. Out of the hard cap of 8,333,333 tokens, only 608,225.02 tokens were sold, which is about 7.3% of the total presale allocation.

Such a low participation level signals a demand that has been selected rather than that of hype-driven buying - a situation that affects the pricing behavior after the listing.

Some investors will undoubtedly consider lower presale sales as a negative factor; however, there are others who perceive it as a positive factor, since it indicates that there will be less pressure on the price at the moment of launch.

Key presale facts:

Listing price: $0.03

Tokens sold: 608,225.02

Presale absorption: ~7.3%

Hard cap: 8,333,333 tokens

The project has revealed important dates for its future events. On 12th January, a snapshot will be taken, which will automatically include all the accounts that pass the eligibility criteria. After the snapshot, Season 2 will start right away without needing any further actions from the qualified users. The thrill is increasing because the TGE listing has been set for 26th January, which is a significant point not only in the project’s development but also gives the participants a chance to interact with the token right from its launch.

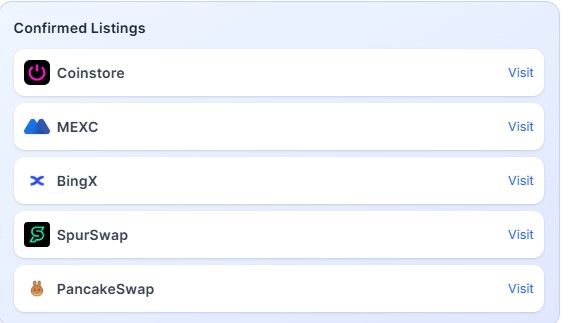

Confirmed $SON Listings and Liquidity Access

Spur Protocol is already confirming several exchange listings that will provide it with strong accessibility from day one:

Coinstore

MEXC

BingX

SpurSwap (DEX)

PancakeSwap

The combination of centralized and decentralized exchanges enhances liquidity and, at the same time, lessens the reliance on a single platform.

$SON’s tokenomics are designed for the long run, thus sustainably, which minimizes the risk of large sell-offs right after the listing.

Token Distribution Breakdown

40% – Community incentives, airdrops, future events

29% – Future development (24-month lock, 6-month cliff)

10% – Investors

10% – Spur DEX liquidity

5% – Marketing

5% – Public fundraising

5% – POG holders

4% – Charity

1% – Advisory

Through locked major allocations and controlled liquidity via Spur DEX, the pattern allows gradual price discovery instead of extreme volatility.

Symbolic Buzz Surrounding the Price Speculation of $0.026

An interesting narrative has come out within the community. The TGE, which is set on January 26, 2026 (26/01/26), has caused an assumption of a $0.026 listing price.

This number has to be seen as a pure speculation at this stage. The real listing price will be determined by the amount of liquidity, the distribution of tokens, and the condition of the market in general.

It is highly likely that the price will be approximately $0.03, which was the price during its presale, at the time of the launch. However, the very start of the price fluctuation is going to be dependent on:

Initial liquidity on Spur DEX

Short-term speculative interest

Overall crypto market momentum

Estimated Range: $0.042 – $0.054 (+40% to +80%)

$SON may not miss the opportunity of being the top-performing coin if:

The community around it stays more active after listing

Locked allocations do not allow early selling

Good liquidity persists all over the exchanges

The general altcoin rally continues to happen

In this case, $SON might experience a short-term surge in the first 24-72 hours due to speculation and the market's momentum.

A small drop in price is rather a scenario if the conditions mentioned below exist:

There are low trading volumes.

The market sentiment is slow.

Early investors quickly take their profits

However, given that more than 90% of the hard cap is still available and a large supply is locked, a serious or long-term sell-off does not seem to be inevitable.

YMYL Disclaimer: This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile. It is always essential to do your own research before making any investment.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.