The crypto market turned red after the Budget 2026 shock, and fear is visible across most charts.

However, one token is moving in the opposite direction.

As of today, STABLE price prediction is back in focus after the token jumped 23.02% in 24 hours and is now trading near $0.02818.

Most major assets remain under pressure, including crypto, gold, and silver.

Bitcoin is struggling to hold key support levels, highlighting how weak market sentiment still is.

In contrast, STABLE is drawing attention with an aggressive move when traders are mostly in risk-off mode.

This unusual strength is raising fresh questions. s

Price is moving toward an important resistance area, and trader interest around STABLE is starting to build.

The key issue now is whether this move marks the beginning of a larger upside phase or simply a sharp reaction inside a fragile market.

While the wider crypto market is still digesting the Budget 2026 shock, this token has moved in the opposite direction.

This move is not coming from hype alone. It is tied to specific market triggers.

1. BitTap Listing Brought Fresh Money In

The most direct trigger behind today’s rally came from STABLE’s listing on the BitTap exchange.

According to the official BitTap announcement, trading for STABLE/USDT went live on 2 February 2026, giving the token access to a new pool of buyers.

As trading opened, liquidity improved and price reacted quickly.

Volume picked up within hours, showing that fresh demand entered the market rather than a thin spike.

New exchange access brought new attention, and price followed that attention.

2. Upgrade Hype Is Building Ahead of Mainnet v1.2.0

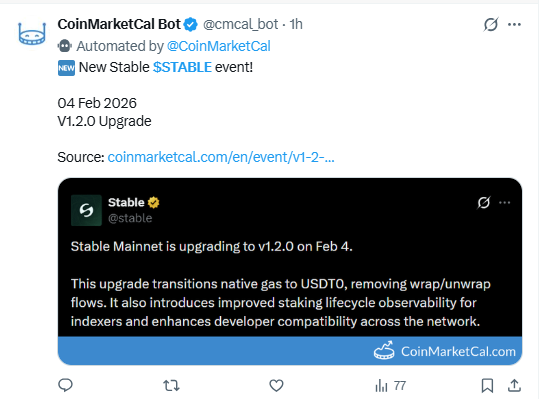

The market is also positioning ahead of the upcoming StableChain Mainnet v1.2.0 upgrade.

According to CoinMarketCal, the upgrade is scheduled for 4 February 2026, and it brings a major shift in how the network handles transactions.

The update introduces USDT0 as a native gas token, removing the need for wrap and unwrap processes.

For traders and users, this means smoother transactions and lower friction while using the network.

The effect is already visible in behavior.

Instead of selling into market fear, participants are accumulating STABLE in anticipation of better network efficiency and higher on-chain activity after the upgrade.

3. Safe Haven Rotation After Budget Shock

After the Indian Union Budget 2026 tightened rules on volatile assets like Ethereum, market sentiment turned defensive.

Traders started rotating capital away from high-risk tokens and toward projects that look more infrastructure-focused.

STABLE fits that shift right now. In a nervous market, it is being treated as a temporary shelter trade.

That is why its move feels different: STABLE is rising while much of the market stays under pressure.

On the TradingView short-term chart, STABLE first made a high near $0.03246, where selling pressure pushed price lower.

The decline paused near the 50 EMA, showing that buyers were still willing to defend the trend.

After that, price entered a falling channel, signaling controlled weakness rather than panic selling.

The structure shifted near the $0.02265–$0.02225 zone.

This area acted as a strong base and also aligned with the lower end of the channel.

From there, price began to reverse.

At the same time, the 21 EMA crossed above the 50 EMA, adding confirmation that momentum was turning back in favor of buyers.

With support and crossover in place, price broke out of the falling channel and moved above both moving averages.

This keeps the short-term bias on the bullish side for now.

Currently, price is facing resistance around $0.02900–$0.02959.

A clean break above this zone could open the way toward $0.03245–$0.03316.

As long as price stays above the 21 and 50 EMA, the bullish structure remains valid.

A move back below them would weaken this setup.

On the daily chart, price has taken support from the Fibonacci 0.5–0.618 zone and is now moving upward.

This area acted as a reversal base, showing that buyers stepped in at a key retracement level.

If momentum stays strong, the first resistance comes near $0.03264.

After that, the next upside target sits around the Fibonacci 1.618 level at $0.04711.

Over the longer term, if price breaks its all-time high, it can extend toward the Fibonacci 2.618 level near $0.07052.

This bullish setup remains valid as long as price holds above the 0.5–0.618 Fib zone.

If price fails to stay above this support, the structure weakens, and lower levels like $0.01354 and $0.00929 could come into view.

From an analyst perspective, STABLE price prediction is now being driven by both event-based demand and improving chart structure.

The recovery from key support and the breakout from the falling channel show that buyers are gaining control again.

A move toward a new ATH is possible, but only if price holds above its current support zones and clears the near-term resistance with strong momentum.

Without sustained volume and follow-through, the rally risks turning into a short-lived spike rather than a full trend shift.

In simple terms, the path to a new high is open, but it still depends on how price behaves around the next resistance levels.

YMYL Disclaimer: This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile, and market conditions can change quickly based on macro data. It is always essential to do your own research before making any investment.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.