TRIA Price Prediction is getting attention today because its price is rising at a time when most of the crypto market is struggling to find support.

Bitcoin and major altcoins are still under pressure, and traders remain cautious.

In this weak market environment, TRIA is trading at $0.02364, up 45% from its launch price.

Since its launch on February 3 and 4, 2026, the token has shown steady upside while many new coins fail to hold their opening levels.

When the broader market looks tired and a fresh coin starts moving higher, it creates mixed reactions.

Some traders see early opportunity. Others see risk building up.

Right now, TRIA is in that zone where price action feels active, but the direction is still being tested.

This makes today’s move important to watch while the rest of the market searches for stability.

The recent price jump does not look like a simple launch-day reaction.

Several combined factors appear to be driving demand even while the broader crypto market remains weak.

TRIA entered the market with a world premiere listing on Binance Alpha on February 3, 2026.

At the same time, it was also listed on KuCoin, Kraken, Bybit, and MEXC.

This type of launch matters because it gives traders more places to buy and sell.

Liquidity spreads across exchanges instead of staying on one platform.

In the first 24 hours, trading volume crossed 300 million dollars. That level of activity reduced early price drops and allowed to hold its gains.

Binance Alpha launched a trading campaign for TRIA with volume-based rewards worth around 200,000 dollars.

Users had to register for the event and trade TRIA to become eligible for rewards.

Only trading volume generated after successful registration was counted.

This rule pushed users to actively buy and sell token instead of just holding it passively.

As more traders joined the campaign, transaction activity increased.

Higher activity helped token maintain visibility and kept short-term demand alive during the early trading phase.

Instead of volume fading after launch, the campaign helped sustain participation and price movement.

Token operates as a self-custodial neobank with a Visa card usable in over 180 countries, and the launch of the Tria Foundation with reported growth to 150,000 users and over 20 million dollars in annual revenue has strengthened market confidence in the project.

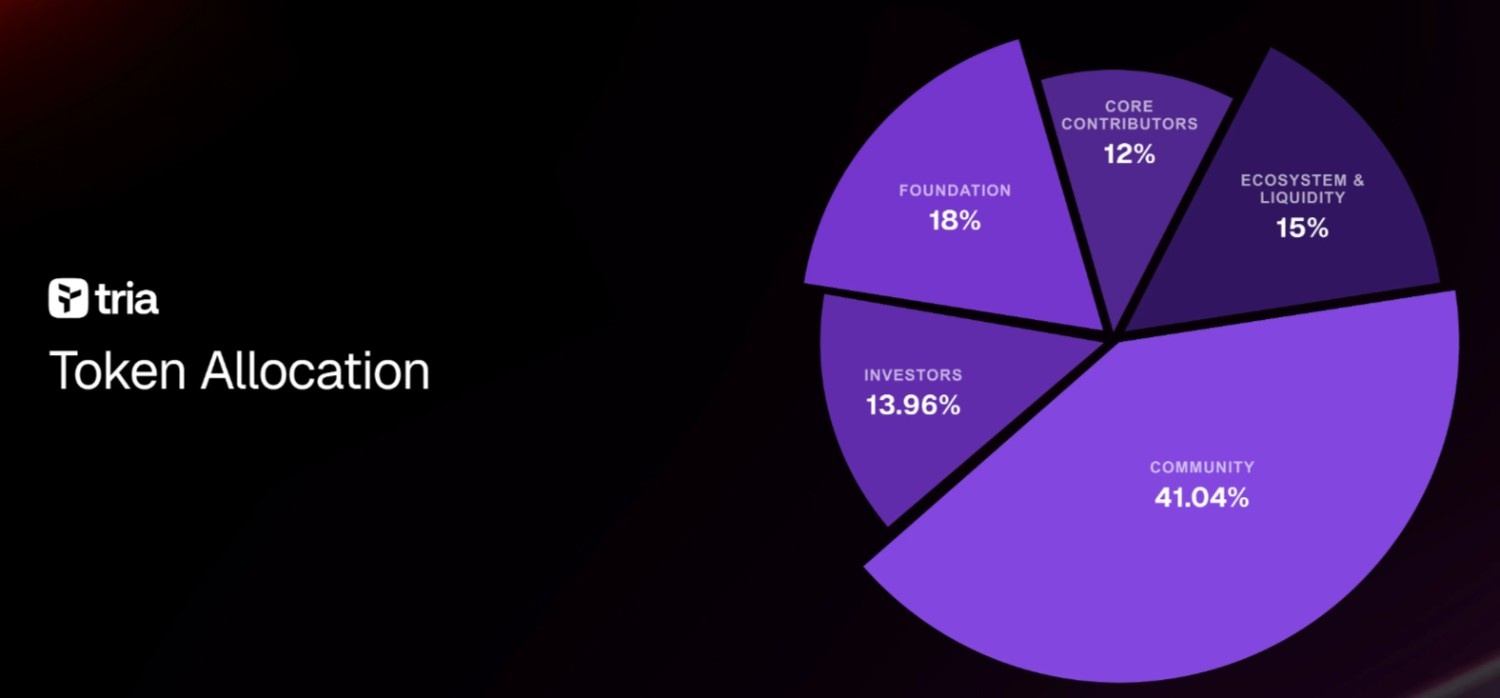

Around 41.04% of TRIA’s total supply is reserved for the community.

Only 2.15 billion token are in circulation out of a 10 billion total supply, with over 20,000 holders, which has reduced dumping pressure and supported holding behavior after launch.

TRIA has built early interest after launch, but price direction will depend on how trading activity and project progress develop over time.

1. Short-Term View

Target: $0.0280 to $0.0350

Current momentum is supported by the Binance Alpha trading campaign worth around $200,000, which runs until February 11. Trading volume is likely to stay active while the campaign is live.

This Token has also been added to the Coinbase Listing Roadmap.

If a final Coinbase listing is confirmed, a short-term price spike of 30–50% is possible.

Risk: Early investors may book profits after launch, which can cause short-term pullbacks.

2. Midterm View

Target: $0.050 to $0.085

The 2026 roadmap focuses on revenue growth and transaction expansion.

The project aims to reach $100M in annual revenue and process up to $1B in transactions.

As the self-custodial neobank model and Visa card usage expand across more countries, demand may shift from speculation to utility.

Risk: Total supply is 10B token , and only about 21.89% is currently in circulation. Future token unlocks could increase selling pressure.

3. Long-Term View

Target: $0.15 to $0.38

In the long term, token is expected to function as both a governance and utility token.

Growth depends on whether the Tria Foundation can expand its user base from around 150,000 to several million.

Community allocation of 41.04% supports a more decentralized ecosystem, which may help maintain long-term trust.

Reaching $0.38 is possible if this token successfully captures a significant share of the global neobanking market, similar to projects like Revolut or Crypto.com

Risk: Regulatory pressure and competition from other crypto banking platforms could slow adoption.

TRIA price prediction shows that the token’s strength after launch is supported by high trading activity and growing project visibility.

Short-term movement will depend on volume and listing updates, while long-term direction will rely on user growth and utility adoption.

For now, token remains in a phase where momentum is active but the trend is still forming.

YMYL Disclaimer: This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile, and market conditions can change quickly based on macro data. It is always essential to do your own research before making any investment.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.