The OBOL token listing is scheduled for Binance Alpha on May 7, 2025, at 10:00 AM UTC; half an hour after that, the coin will be listed on Binance Futures. Dual listings boost OBOL's visibility and open more avenues for crypto exposure and liquidity.

These exchanges, Gate.io, Bitget, and Bybit, are also going to list on May 7 at 11:00 AM UTC.

The listings indicate strong institutional support and demand for a decentralized validator solution.

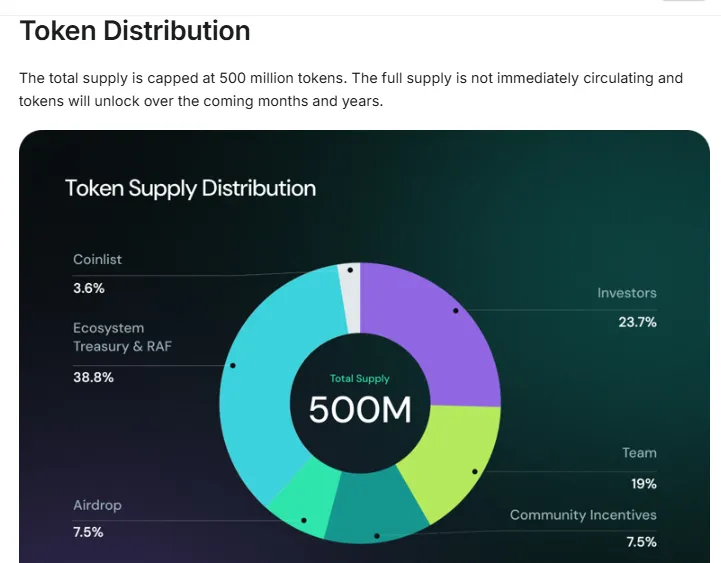

The token is capped at a total supply of 500 million, although not all will be circulating immediately. A tiny percentage enters the circulating supply at the time of launch to limit supply during peak initial hype.

38.8% of tokens are reserved for the Ecosystem Treasury and RAF to provide support for ongoing growth and infrastructure expansion.

Investors get 23.7%, whereas 19% is allocated to core team contributors.

Another 15% gets thrown into the mix of airdrops and community incentives to here reward participation and loyalty.

Hence, unlocking is always done gradually, providing a constant moment to the momentum.

Regarding the token distribution mechanism and major listings on Binance, Gate, Bitget, and Bybit due soon, there may be some slight buoyancy after the launch. Since a portion of the 500 million tokens shall first enter into circulation, the supply shall be limited, and thus, it may tend to exert an upward pressure on the price mutations as exchanges are eager to gain visibility with early airdrop hype.

Short-Term Price Forecast (First Week Post-Listing)

The coin could launch between $0.20 and $0.40, depending on immediate demand and the limited circulating supply.

Price spikes to $0.50 are quite possible with hype and airdrop momentum building.

High exchange volume will fuel speculations during the early listing window.

Mid-Term Price Outlook (1-3 Months)

The price will likely find support and stabilization from $0.35 to $0.65 as token unlocks begin to take shape.

Adoption of Obol's validator technology and staking products could be a positive factor for price development.

Price behaviour will be influenced by market sentiments and activity in the Ethereum ecosystem.

Long-Term Price Projection (6-12 Months)

If the coin goes ahead with ETH staking integration, it could reasonably be looking at a price in the $0.80 to $1.20 range.

A wider DVT adoption and network growth shall drive this curve.

Strategic ecosystem funding and developer engagement would help to keep up the momentum.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.