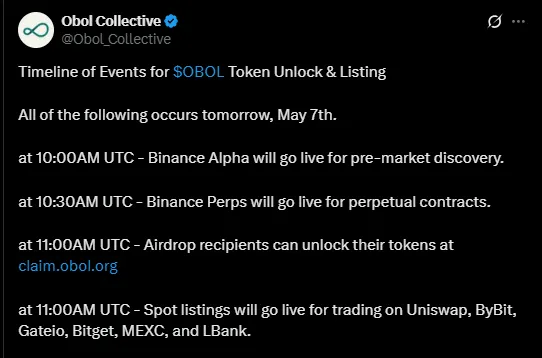

With the release of the $OBOL token unlock, the Obol Collective is making serious waves in the crypto space. With Binance Alpha initiating the pre-market discovery and major platforms like Uniswap, ByBit, and Gateio offering the spot listings, all eyes will truly be on the price actions. This article will give you the price prediction for the short, mid, and long terms while considering its strategic unlock, distribution, and imminent market events.

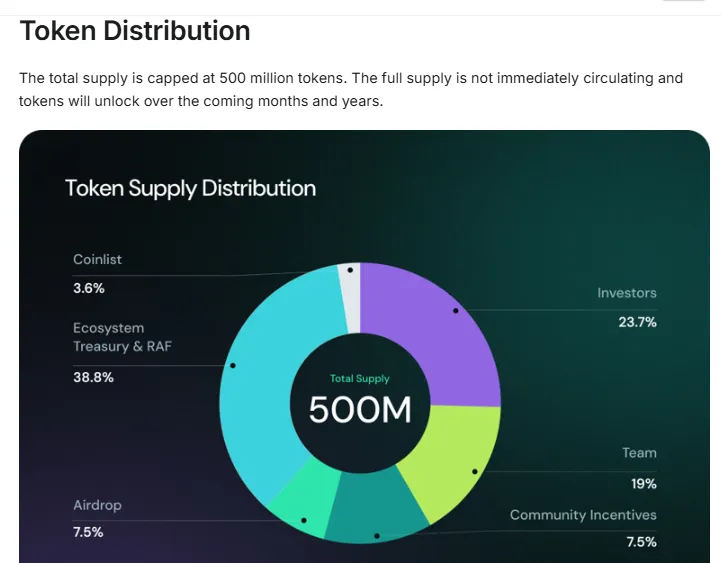

The $OBOL token, which has a maximum supply set at 500 million, is strategically allocated to support the long-term growth of the ecosystem, and the distribution mechanisms include:

38.8% to Ecosystem Treasury and RAF

23.7% to Investors

19% to the Team

7.5% to Community Incentives and Airdrops

3.6% to Coinlist

With such a diverse and well-structured allocation, the token is meant to slowly unlock and therefore has enough time to gain some momentum and create value in the long term.

Market buzz is likely to be high for a strong initial impact, given the token's strategy of allocation and future listings. At an initial launch, only a fraction of its total supply of 500 million tokens would actually circulate. With listings on credible exchanges like Uniswap, Binance, ByBit, etc.; supply may thus get overwhelmed by early demand, posing the potentiality of an early price hike.

Short-term Prediction (First Week Post-Launch):

The first week will likely see some volatility on account of airdrop activity, exchange listings, and price discovery. It may open anywhere between $0.30 and $0.60, with exchange listings in major exchanges having the potential to shock the price and an unexpected demand pull coming from airdrop recipients.

Mid-term Prediction (3 to 6 Months):

Following the initial volatility, the altcoin will likely stabilize to between $0.45 and $0.85 as the development activity persists. Long-term price stability will be backed by the adoption of the ecosystem along with the staking rewards and validator infrastructure.

Long-term Potential (1 Year+):

Long-term, the token could be worth $1.00-$1.50 if the ecosystem continues to grow, operators see real use, and validator coordination turns to the centre of attention. As tokens get unlocked and adoption starts rising, actual demand for the coin could increase.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.