The RIVER price prediction 2026 has flipped quickly after an explosive January.

The token shocked the market with a near 1,900% surge and set a new all-time high at $87.79. At that point, momentum looked unstoppable.

Now the mood is very different.

Token price is trading around $49.12, sitting almost 45% below its peak. Over the last 24 hours, price has fallen by about 16.39%, placing it among today’s top losers.

The wider market is offering little support.

Crypto markets are down roughly 1.33% today, and total market capitalization has slipped below $3 trillion again. In a weak market environment, high-flying tokens like RIVER tend to feel the pressure first.

This leaves traders with a tough question:

Is this just a pause after a massive rally, or the start of something worse?

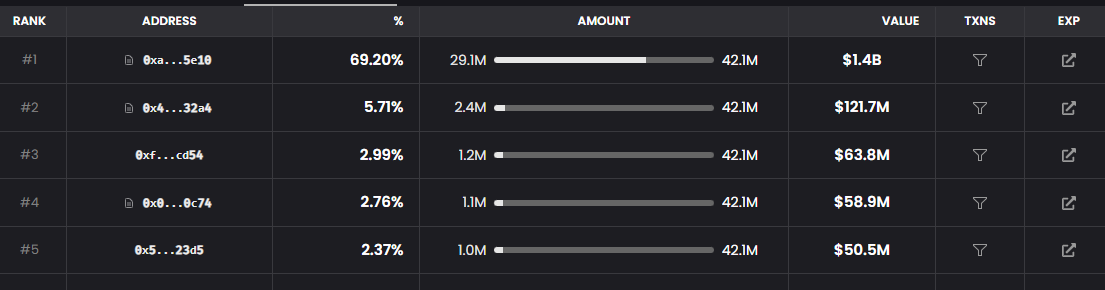

On-chain data on DexScreener shows that River’s supply is highly concentrated among a few large wallets. On the holder side, the top address alone controls about 69% of the total supply, while the next few wallets also hold meaningful shares.

This kind of structure means price movement depends heavily on the actions of a small group rather than broad market demand.

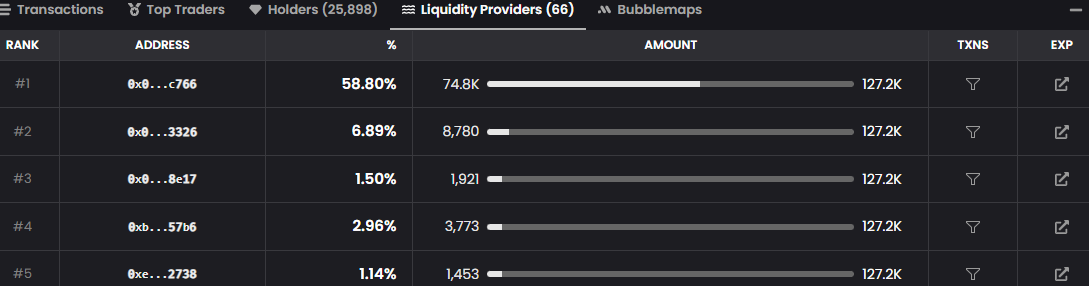

Recent liquidity data on DexScreener tells a similar story. One liquidity provider controls close to 58% of the pool, with the rest split across much smaller participants. When liquidity is this uneven, even moderate selling can move price sharply.

It also increases the risk of sudden drops if a major provider decides to reduce exposure.

Together, these two signals explain why token feels fragile after the rally.

With both supply and liquidity dominated by a few large players, profit-taking can turn into fast downside pressure instead of a slow, healthy correction.

After making the rally price take a pullback, price was started moving inside a rising channel on the 4-hour chart. Profit booking started near the top at the $80-$87 area, and price failed to hold above the $63 support zone, where selling pressure returned.

That rejection broke the channel structure and pushed price lower, turning a normal pullback into a short-term weakness phase.

Even so, price is now trying to stabilize near key technical supports, suggesting the move may be cooling rather than fully breaking down.

What the Indicators Say

RSI: RSI on the 4-hour chart is near 44, showing weak momentum but also leaving room for a bounce if buying interest returns.

100 EMA: Price is currently holding near the 100 EMA, which is acting as short-term support and helping slow the decline.

Trendline: The rising trendline from the bottom of the move is still intact and continues to act as a support guide.

Key Support and Resistance Levels

Resistance: Immediate resistance sits near $63, followed by the $80–$85 zone from the previous supply area.

Support: Key demand zone lies around $49–$45, with the next major support near $38 if selling pressure increases.

Overall, while River lost its short-term structure after the January peak due to profit booking and a sharp pullback, price is now sitting on multiple support layers.

If these levels hold, the chart still leaves room for a recovery attempt rather than a full trend reversal.

On the daily chart, price is now trading inside a healthy pullback zone. When Fibonacci is drawn from the start of the rally to the top, price is sitting inside the 0.5–0.618 retracement area, which is often where strong trends pause and reset.

This shows the move looks more like a correction than a full trend break.

What the Indicators Show

RSI: RSI is near 52, which keeps momentum in the neutral-to-buying zone. It is not oversold and not overheated, suggesting the market is stabilizing after profit booking.

21 EMA: Price is holding near the 21 EMA, which is acting as dynamic support and helping maintain the broader uptrend structure.

Trendline: The rising trendline from the start of the rally is still intact and continues to guide price higher from below.

Key Support and Resistance Levels

Support: Strong support lies in the $45–$50 zone, aligned with the Fibonacci area, 21 EMA, and rising trendline.

Resistance: On the upside, price faces resistance near $70, followed by the $90 zone from the previous high area.

Overall, the chart shows price in a consolidation phase after a sharp rally, with technical structure still leaning toward continuation as long as the current support zone holds.

Short-Term Price Outlook: Price is holding near the 100 EMA. If it holds, price can move toward $60–$70.

Invalidation: Below 100 EMA and $45 weakens the setup.

Mid-Term Price Outlook: Structure still allows a recovery toward $70 and then $90 if momentum returns.

Invalidation: Loss of the rising trendline and 21 EMA.

Long-Term Price Outlook: The Fibonacci 1.618 extension points to a potential upside near $140+ over time.

Invalidation: A sustained break below $38–$40 ends the bullish view.

Looking at the structure, this drop feels more like profit booking after a wild rally than a full breakdown. Supply is tight in a few hands, so when selling starts, price falls fast. That part looks ugly, but higher-timeframe support is still holding.

So for now, this move looks closer to a cool-off phase after January’s run than the end of the story. As long as key support zones stay intact, the RIVER Price Prediction 2026 outlook leans toward recovery attempts, not a failed trend.

YMYL Disclaimer: This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile, and market conditions can change quickly based on macro data. It is always essential to do your own research before making any investment.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.