With less than eight hours left for the FOMC meeting, the crypto market is holding its breath. Traders are asking one question—will the Fed’s final rate decision of 2025 affect XRP price prediction? The Ripple community is watching closely, especially as macro events and on-chain sentiment collide.

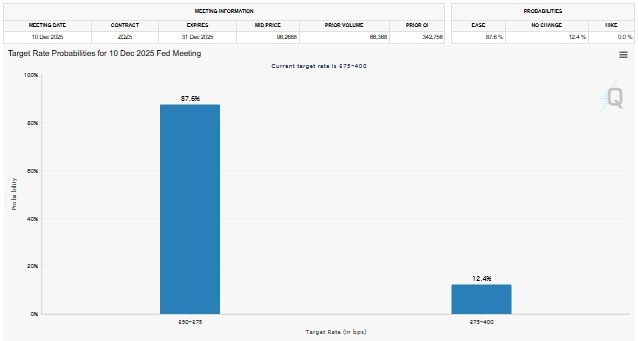

According to the FedWatch Tool, the December 10 meeting will confirm whether the Federal Reserve goes ahead with a third rate cut of the year. Two cuts have already been implemented, but the probability of another is lower. Still, hopes remain high.

Source: FedWatch Tool

Current projections show:

87.6% probability of a 25 bps cut

12.04% probability of a 50 bps cut

The target range currently sits between 3.75%–4.00%, and Jerome Powell’s speech could determine how risk assets—especially XRP—perform in the coming days. Searches for FOMC meeting today live, Powell speech today, and Fed meeting news have surged across financial platforms.

At the time of writing, XRP price trades at $2.07, showing a mild intraday gain of over 1%. Its market cap stands at $125.45B. Over the past week, it slipped 5.14%, falling from $2.19 to $2.00 before bouncing back slightly.

Source: CoinMarketCap

But sentiment shifted sharply after Ripple announced a massive $500 million funding round, the company’s strongest institutional milestone this cycle. This round pushed Ripple valuation to $40 billion and drew attention from major firms that have tracked its regulatory journey for years.

The excitement spilled onto social media as Bitwise showcased it prominently in Times Square—an unusual but symbolic move that many investors interpreted as a sign of institutional acceptance.

Community members are calling it: “XRP goes Wall Street. ETFs are finally paying attention.”

XRP’s next major move hinges on the Federal Reserve’s tone going into 2026. However, if Jerome Powell reaffirms a rate cut or moves to ease further, conditions will improve, and it will perform as it tends to react well to risk-on trades. In addition, lower interest rates and institutional investors moving to high-beta assets like XRP have been known to drive prices higher in the past, and it is likely that history will repeat itself.

Source: X

Technically, it is currently inside a tightening triangle pattern, which is usually a precursor to a strong breakout once the price gets out of this constricted range. The $1.94 support level is the most important pivot for the current bullish setup. As long as it holds above this level—currently trading near $2.07—an upside move toward the $2.45–$2.50 resistance zone remains realistic, aligning with a 16% potential upside shown on the daily chart.

Momentum indicators support volatility, with RSI around 45 showing neutral-to-slightly bearish sentiment but leaving enough room for a strong move. A dovish Fed could trigger a push to $2.30–$2.50 and possibly $2.70 under strong buying pressure. A hawkish stance risks a breakdown below $1.94 toward $1.80–$1.75. Sustained closes above $2.50 may later unlock a path to $2.80–$3.10, and potentially $3.50–$3.80 in 2026.

Today’s FOMC meeting is more than a macro event—it’s a sentiment catalyst for the entire crypto market. With trading near a major support and Ripple securing a landmark $500M raise, the stage is set for volatility. Whether a dovish Fed fuels a breakout or a cautious tone triggers a retest, XRP Price Prediction for the coming weeks will largely hinge on Powell’s speech today and the market’s reaction to the final rate decision of 2025.

Disclaimer: This is for educational purposes only. Always do your own research before any crypto investment.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.