Why is the launch of the new 21Shares SUI ETF creating buzz even as the coin price fails to show an immediate rally? This question has caught the attention of traders watching the latest news, especially after the SEC cleared the first-ever 2x leveraged SUI Exchange Traded Funds (TXXS).

On December 5, 21Shares introduced the 21Shares Spot SUI ETF’s leveraged counterpart, officially launching $TXXS—a product that gives investors amplified daily exposure to the Network, one of the fastest-growing Layer-1 blockchain ecosystems.

Source: X

According to ETF analyst Eric Balchunas, this development is rare because the coin’s very first ETF is leveraged—something that previously happened with XRP. This new product also becomes the 74th crypto Exchange Traded Funds launched this year and the 128th overall, reflecting how quickly regulated digital asset ETFs are expanding. Analysts expect another 80 ETFs to hit the market within the next 12 months.

Source: X

The 21Shares ETFs team explained that $TXXS allows investors to double their exposure to it without navigating traditional leverage hurdles like margin calls or account minimums. Instead, $TXXS offers simple entry and exit through a normal brokerage account, making it “simply amplified.”

The launch highlights Sui’s strengths—easy onboarding via Google or Face ID, sponsored transactions that remove network-fee friction, and a growing user base. As it steps into traditional markets through Nasdaq, many investors see this as an important turning point.

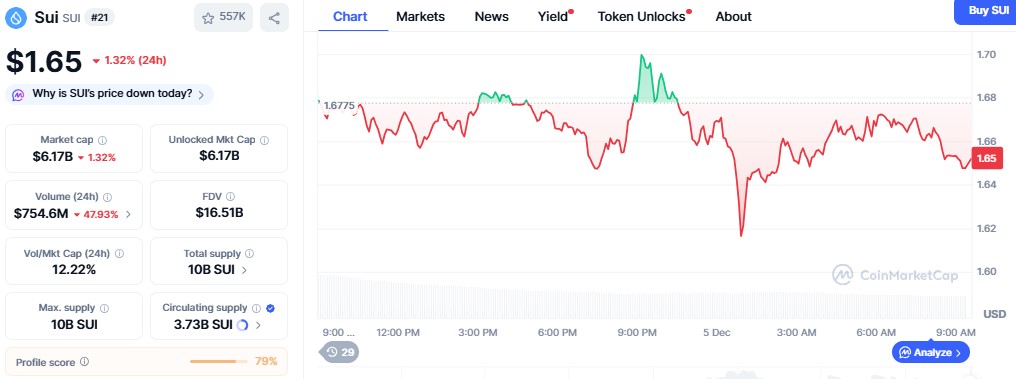

Even with the approval and launch, the SUI coin price did not deliver an instant jump. Instead, it dropped 1.32% in 24 hours, trading around $1.65 with a market cap of $6.17B and a strong 24-hour volume of $754.8M.

Source: CoinMarketCap

However, it registered a 7% upward spike on the weekly chart, indicating that broader sentiment remains cautiously positive.

From a technical viewpoint, it recently bounced back from a low level close to $1.20, with the RSI at 46.9, signalling neutral momentum, neither overly bullish nor weak enough to trigger panic.

It is likely that, over the coming weeks, the coin will trade between a range of $1.40–$1.80. Should it succeed in a breakout above the level of $1.85, it could be pushed up toward $2.00, but if momentum weakens, it may retest $1.35.

Between Q1–Q2 2026, reclaiming $2.50 becomes the key objective. If it crosses this level with rising volume, the next resistance lies between $2.80–$3.20, followed by a major hurdle at $3.50.

By late 2026, if the ecosystem keeps expanding and market conditions recover, it could revisit the $4.00–$5.00 zone, matching earlier highs near $4.30. A bearish macro trend, however, may cap gains at $3.00.

The launch of the 21Shares SUI ETF marks a major move for the coin entering regulated markets. Until now, the price of the coin hasn't shown a sharp reaction. The long-term outlook depends on ecosystem growth, trading demand, and broader market recovery. For now, it continues to build momentum as Exchange Traded Funds adoption opens a new path for investors.

Disclaimer: This is purely for educational purposes. Always do your own research before any crypto investment.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.