The crypto market crash narrative is back, and this time the trigger is not internal weakness but a serious macro shock. The US shutdown 2026 is already active, and the next 12 hours are being watched as a make-or-break phase for global space. With political deadlock freezing key economic functions, investors are facing fear, confusion, and fast price swings.

This is not panic for clicks. It is about understanding what the data already shows and what could come next.

The partial US shutdown came into effect on January 31, 2026, with no clear end date. Historically, shutdowns shave around 0.2% off GDP for every week they last, but this time the impact looks faster and deeper.

Source: Official X

According to The Kobeissi Letter, silver saw an intraday fall of nearly 35%, the largest in history, before still closing the month up 19%. Gold suffered an even bigger shock, losing about $6.3 trillion in value within 24 hours—roughly $263 billion per hour. At the time of writing, gold close below $4,900 and silver around $85.238.

This matters because when traditional hedges break, risk assets rarely stay calm for long.

Despite a small bounce in total value, signals point to stress, not recovery. Data from CoinMarketCap shows the global market cap up just 0.33% to $2.82 trillion, masking deeper weakness.

Bitcoin price today: $83,281.97, down over 10% in a week

Ethereum: $2,666.20, after a 2.58% intraday drop

XRP: $1.71, down 2.40% in a day

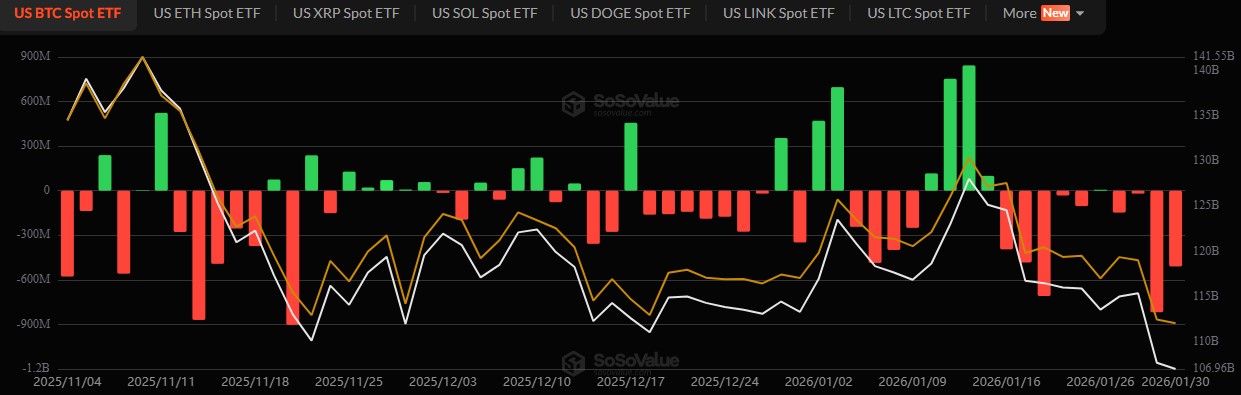

ETF flows confirm the risk-off mood. Bitcoin ETFs saw $653.98 million in daily outflows, while Ethereum ETFs lost $113.83 million, based on SoSoValue data.

Source: SoSoValue

This is why many traders see the current crypto market crash phase as unfinished.

If the shutdown drags on, a data blackout becomes a real threat. CPI, PPI, GDP, PCE, and CFTC positioning reports may pause. Without these inputs, policy decisions turn reactive instead of measured. Historically, the space dislike uncertainty more than bad news, which explains why the crypto market crash story is gaining momentum.

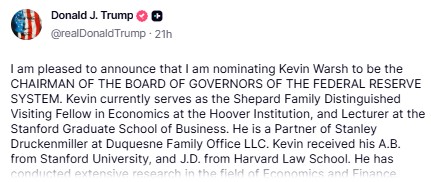

Amid the turmoil, Kevin Warsh and crypto discussions are heating up. As Trump Fed pick speculation grows, some investors see hope. Warsh previously invested in the project Basis and advised Electric Capital. According to Trump’s public statements, Kevin Warsh was the youngest Federal Reserve Governor at 35 and represented the central bank at the G-20.

Source: Truth Social

If confirmed as New Fed chair, sector will closely watch his stance on rates and liquidity. A more growth-friendly approach could stabilize sentiment, but expectations alone will not stop a crypto market crash without clear policy signals.

The biggest crypto market crash risk of 2026 is being driven by politics, not blockchain flaws. With the US shutdown active and safe havens shaking, caution dominates. Whether this becomes a historic buy zone or a deeper exit signal depends on policy clarity, not hope.

YMYL Disclaimer: This content is for informational purposes only and does not constitute financial advice. Digital assets are highly volatile, and readers should consult financial professionals before making investment decisions.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.