The recent bloodbath in precious metals has frozen investors in place.

Watching gold and silver collapse in a single session felt like a warning shot. For many, it was the first time they saw safe assets break down this fast.

That fear is now spilling into crypto.

If even the strongest pillars of stability can fall in one day, the Bitcoin Price Prediction 2026 outlook suddenly looks fragile.

The idea of Bitcoin as digital gold is being tested at the worst possible moment.

Is Bitcoin really different from traditional metals?

Or will it react the same way when liquidity starts to vanish?

This is the same fear that appeared when Bitcoin entered crash mode.

Recent on-chain data shared by Tracer (DeFiTracer) points to large Bitcoin and Ethereum transfers linked to BlackRock-related wallets moving toward exchanges.

This behavior is being read as liquidation rather than accumulation.

When a major institutional name appears on the sell side, rallies lose credibility. Supply enters the market, buyers hesitate, and short-term sellers gain control.

As long as these flows continue, upside remains fragile and easier to sell into.

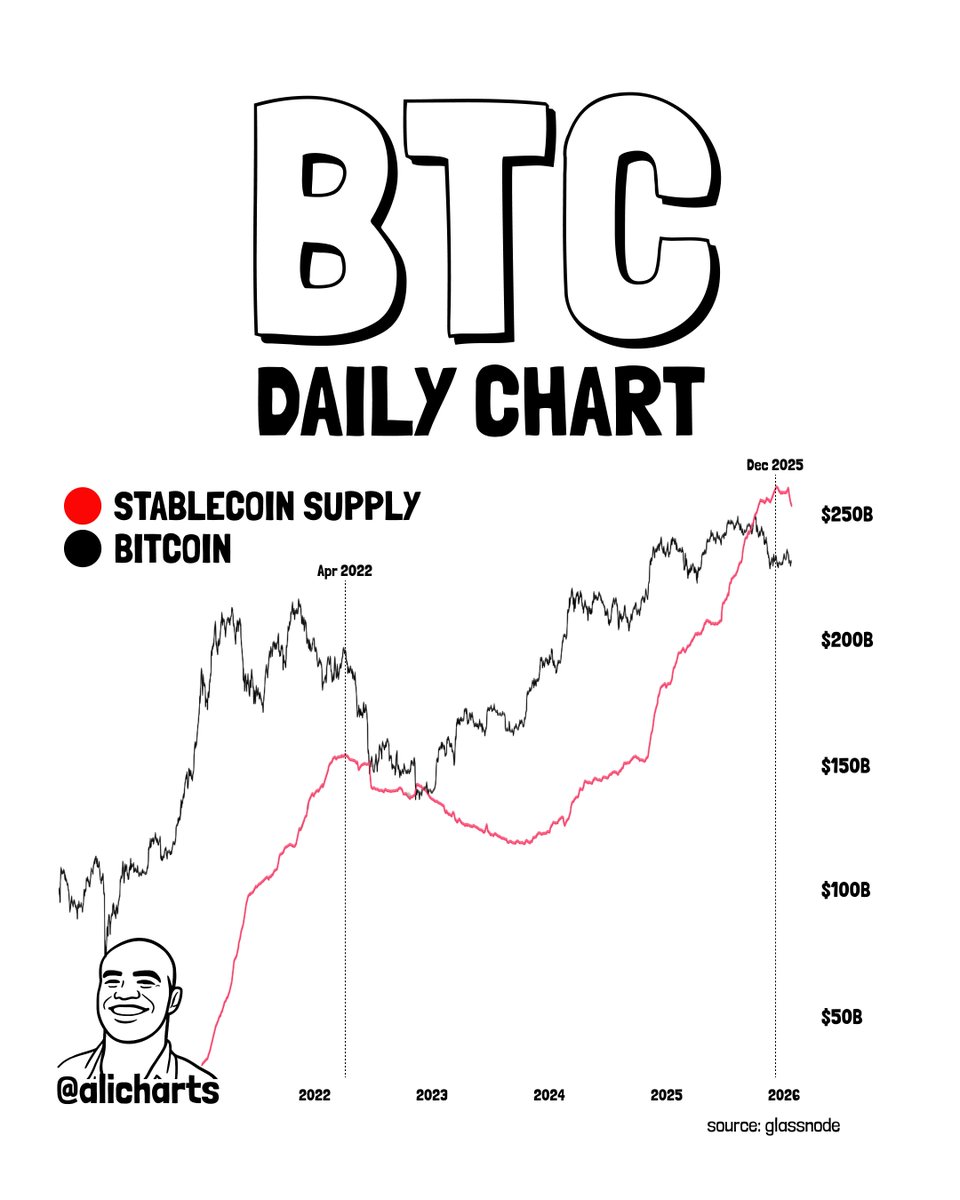

Recent Glassnode data, shared by renowned analyst Ali Martinez (ali_charts) on X, notes that the last major macro trend shift in BTC occurred around April 2022, when stablecoin supply began to decline.

That period marked the start of a prolonged market slowdown.

A similar pattern is emerging again. Stablecoin supply has been trending lower since December 2025, even as BTC remains near higher levels.

Since stablecoins act as market liquidity, a falling supply suggests weaker buying power and raises the risk that the current price structure is being supported by thinning demand rather than fresh inflows.

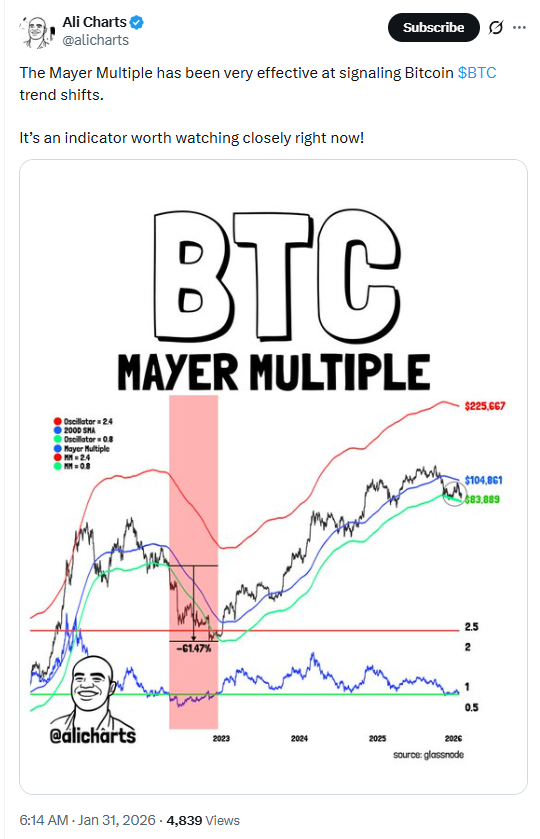

Another data point shared by analyst Ali Martinez (ali_charts) is also flashing caution.

Recent data from Glassnode’s Mayer Multiple shows BTC trading close to levels where previous rallies started losing strength.

This indicator compares price with its 200-day moving average, which acts as a long-term balance line for the market.

When BTC trades too far above this average, the move starts looking stretched.

The upper oscillator band near 2.4 has historically marked overheated zones where upside momentum slows.

On the other side, the 0.8 band has often acted as a long-term reset area after deeper corrections.

In earlier cycles, price entering this upper range was followed by fading momentum and rising volatility.

Together with shrinking liquidity, this stretched positioning adds to the risk that the current move is running out of fuel rather than building fresh support.

The weekly chart shared by Washigorira shows BTC forming a bear flag after a sharp drop.

This structure often appears when price pauses before another move lower.

The projected breakdown target lies around the $53,000 support zone, which marks a previous base area.

With the bear flag already breaking down, recent bounces look more like weak reactions than the start of a recovery.

Analyst Colin Talks Crypto (ColinTCrypto) suggests that if Bitcoin entered a bear market around October 6, 2025, the decline has already lasted close to four months.

Historically, major Bitcoin bear markets have taken around one year from top to bottom.

That would mean the current phase could already be about one-third complete.

What makes this important is awareness.

In past cycles, most traders only recognized the bear market after significant damage had already occurred.

If this pattern repeats, the recent weakness may not be a sudden breakdown but part of a longer process that began earlier than many expected.

These price targets are based on current market structure, weakening liquidity, and the breakdown patterns seen on higher timeframes.

The levels reflect where price has historically reacted during similar phases of market stress.

Short-term target zone: $85,123 – $80,997

Long-term risk zone: $75,920 – $66,980 – $53,000

Short-term invalidation: If Bitcoin sustains above $90,000, near-term downside pressure weakens.

Long-term invalidation: A sustained move above the $97,000–$100,000 range would challenge the broader bearish structure.

Bitcoin Price Prediction 2026 is being shaped by rising stress across the market.

Liquidity is weakening, momentum looks stretched, and breakdown patterns are becoming harder to ignore.

This phase feels less like the start of a new rally and more like a market under pressure. Until structure and liquidity improve, downside risk remains part of the outlook.

YMYL Disclaimer: This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile, and market conditions can change quickly based on macro data. It is always essential to do your own research before making any investment.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.