The financial world is buzzing today following the news of a Grant Cardone Bitcoin Strategy, a move that highlights a radical shift in high-net-worth capital allocation. Just days after the real estate mogul confirmed his firm, Cardone Capital, was aggressively buying Bitcoin at the $72,000 level, he announced the sale of his "2024 Bombardier Global 7500." While a Grant Cardone private jet sale might look like panic to some, seasoned analysts view it as a calculated move to prioritize "hard money" over depreciating luxury assets during a market dip.

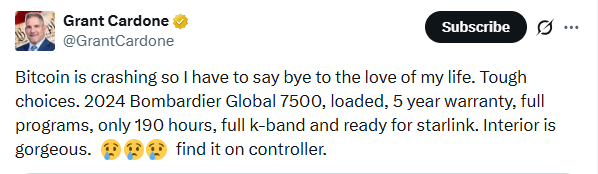

For most investors, selling a private plane during a market crash signals a liquidity crisis. However, in the context of the Grant private jet sale, the motive appears to be strategic reallocation. Cardone recently took to social media to state, "Bitcoin is crashing so I have to say bye to the love of my life." He was referring to his top-tier aircraft, which is currently listed on Controller with only 190 hours of flight time. This shows that he was just influencing people to buy bitcoin but as he fall short of money due to market crash and no improvement in the price of BTC, he have to sell his jet

Source: X(formerly Twitter)

By offloading a high-maintenance asset, He is freeing up significant cash flow to fund his goal of accumulating 3,000 BTC by the end of 2026. This "hybrid" investment model mixing real estate rent checks with digital asset scarcity is a hallmark of the current Grant Cardone strategy.

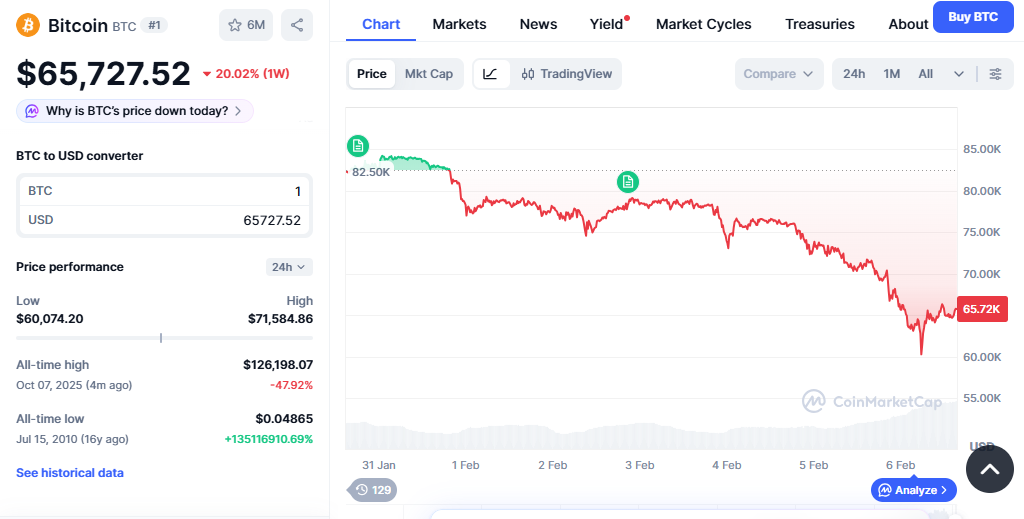

The Grant private jet sale occurs as Bitcoin faces intense pressure, trading near $65,700 after a 20% weekly drop. While spot Bitcoin ETFs recorded massive outflows of $1.2 billion, He is doing the opposite of the crowd. He has publicly dismissed the idea of BTC falling to zero, calling the current crash a "discount" for those brave enough to act.

Source: CoinMarketCap BTC price

Market Signal | Data Point (Feb 2026) |

BTC Support Level | $65,000 - $69,000 |

His Buy Price | ~$71,000 - $72,000 |

Asset Sold | 2024 Bombardier Global 7500 |

Market Sentiment | Extreme Fear |

The Grant private jet sale is a masterclass in capital discipline. In 2026, the cost of maintaining a private flight department has skyrocketed. By divesting from a "liability" (the jet) and moving into a "liquid reserve" (Bitcoin), Cardone is strengthening his balance sheet. This allows his firm to withstand deeper market pullbacks without being forced to sell his core real estate holdings. If BTC rebounds to $100,000 later this year, the value gained from the extra BTC will likely far exceed the cost of chartering a jet when he needs one.

Yash Shelke is a crypto news writer with one year of hands-on experience in covering cryptocurrency markets, blockchain technology, and emerging Web3 trends. His work focuses on breaking crypto news, token price analysis, on-chain data insights, and market sentiment during high-volatility events.

With a strong interest in DeFi protocols, altcoins, and macro crypto cycles, Yash aims to deliver clear, data-backed, and reader-friendly content for both retail investors and seasoned traders. His analytical approach helps readers understand not just what is happening in the crypto market, but why it matters.