Key Highlights:

Crypto Fear & Greed Index at 9 (Extreme Fear).

BTC and ETH decline slightly as overall sentiment weakens.

WLFI leads gainers; OP, H, and ZEC among top losers.

Overall Crypto Market Update, 19 February 2026: The cryptocurrency slipped 1% to $2.36 trillion as Bitcoin and Ethereum posted minor losses. Extreme Fear dominates sentiment, while select altcoins show mixed momentum.

Source: Forex Factory

The global cryptocurrency market today reached a capitalization of $2.36 trillion, noted a drop of 1% in the last 24 hours, whereas Total trading volume was recorded at $89.8 billion.

Bitcoin’s (BTC) dominance over the industry remains intense, with 56.2%, while Ethereum (ETH) carries 9.99%. The largest gainers in the industry over the past day are Polkadot and XRP Ledger Ecosystem.

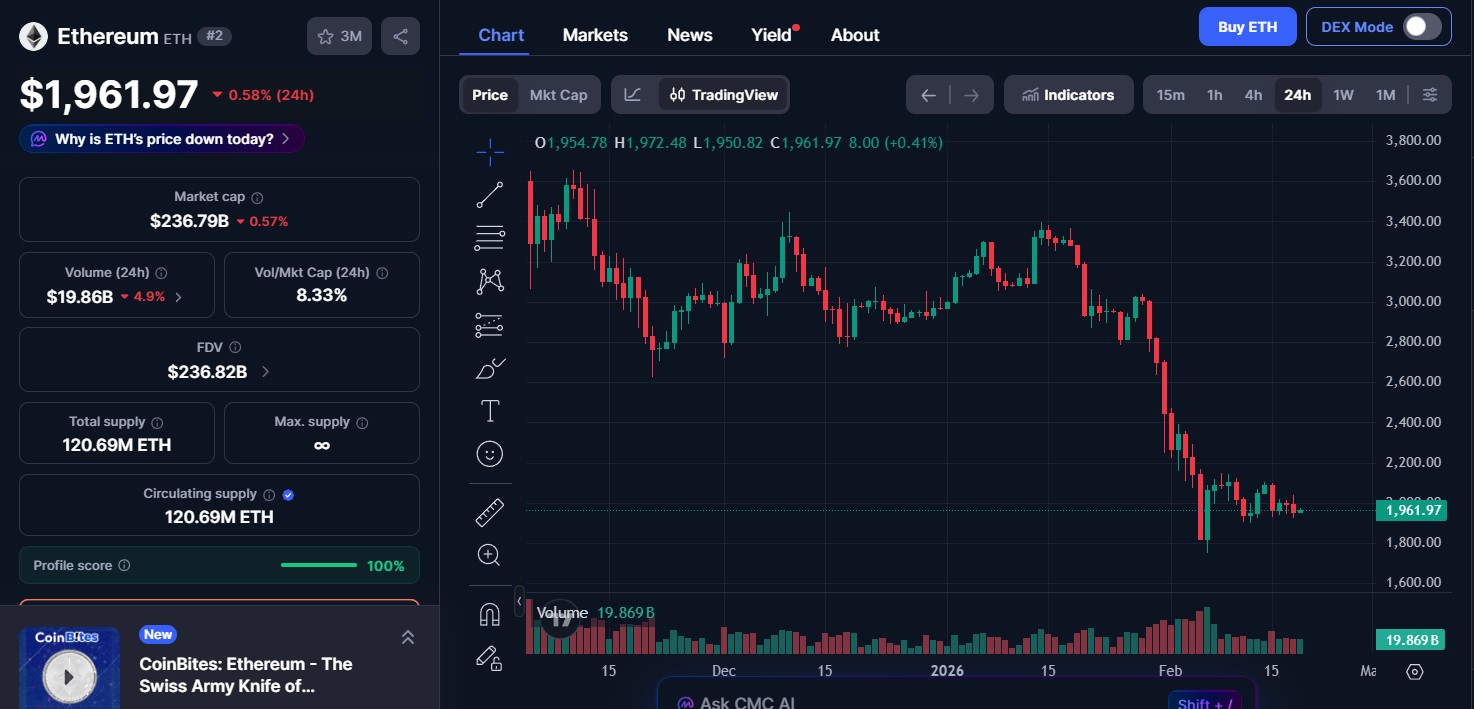

Bitcoin (BTC) and Ethereum (ETH) Price Analysis:

(Note: BTC and ETH are often viewed as less volatile historically, but still risky. The data recorded from CoinMarketCap)

Bitcoin (BTC) price today reached $66,668.87, fell 0.55% in the last 24-H, with a trading volume of $33.06 billion and a market cap of $1.33 trillion.

Ethereum (ETH) price today is at $1961.97, drops 0.58% in 24-H with a trading volume of $19.26 billion and a market cap of $236.79 billion.

Top Trending Crypto Coins Price in 24 Hours:

(Trending data is based on a combination of 24-hour price movement, trading volume, and CoinMarketCap.com trending metrics.)

World Liberty Financial price (WLFI): $0.1191, jumps 12.19% in the last 24 hours, TV: $525.1M.

Solana price (SOL): $81.65, dips 3.2% in the last 24 hours, TV: $3.16B.

Collect on Fanable price (COLLECT): $0.07342, down 6.32% in the last 24 hours, TV: $572.39M.

Bitcoin price (BTC): $66,659.97, slips 0.71% in the last 24 hours, TV: $32.89B.

BNB price (BNB): $604.28, declines 1.71% in the last 24 hours, TV: $1.42B.

Top 3 Crypto Gainers in 24 hours:

(Ranked by 24-hour percentage gain)

World Liberty Financial price today (WLFI): $0.1186, jumps 11.64%, trading activity $524.19M.

Sky price today (SKY): $0.06709, climbs 8.82%, trading activity $24.57M.

Kite price today (KITE): $0.2225, rises 8.50%, trading activity $187.22M.

Top 3 Crypto Losers in 24 hours

(Ranked by 24-hour percentage loss)

Optimism price (OP): $0.1635, down 12.02%, trading activity around $103.52 million.

Humanity Protocol price (H): $0.1607, lower by 11.75%, with trading volume near $55.78 million.

Zcash price (ZEC): $264.07, slipped 10.16%, trading activity close to $351.41 million.

Stablecoins and Defi Update:

Stablecoins reflects 0.1% positive change over the past 24 hours, with a market capitalization of $309 billion and trading volume of $70.4 billion.

The Overall (Defi) Decentralized Finance market declined 2.6% over the last 24 hours, recording a market cap of $49.2 billion and trading volume (TV) at $3.26 billion. Defi dominance globally marked 2.1%.

Source: Alternative Me

Crypto Fear & Greed Index at 9 today, signaling Extreme Fear. Yesterday scored 8, last week 5, while last month was 32. Numerically, sentiment worsened sharply. Theoretically, such lows reflect panic selling, volatility spikes, and weak investor confidence.

(Note: All of these updates have an effect on traders, as they affect liquidity, sentiment, and potential returns, and thus have to be monitored closely.)

1. Coinbase Expands On-Chain Lending With New Collateral Options: Coinbase added XRP, DOGE, ADA, and LTC as collateral on Base, letting eligible U.S. users borrow up to $100,000 in USDC.

2. Goldman Sachs CEO Backs Crypto Clarity Act: At the World Liberty Forum, Goldman Sachs CEO David Solomon backed Treasury Secretary Scott Bessent’s Clarity Act, urging clear crypto rules and noting limited Bitcoin holdings.

3. OpenAI, Paradigm Launch EVMbench: OpenAI and Paradigm launched EVMbench to test AI on Ethereum vulnerabilities. GPT-5.3-Codex scored 72.2% in exploitation, but discovery and fixes remain limited.

4. Kraken Acquires Magna Ahead of IPO Plans: Kraken acquired token management platform Magna last Friday, supporting early-stage issuers. The undisclosed deal marks its sixth acquisition ahead of a planned IPO.

5. CFTC Backs Crypto.com in Nevada Dispute: The CFTC filed an amicus brief supporting Crypto.com, saying its sports event contracts are federally regulated derivatives, not gambling, opposing Nevada’s attempt to expand authority.

6. Grayscale Sui Staking ETF to Debut on NYSE Arca: Grayscale’s GSUI ETF will start trading on NYSE Arca tomorrow, offering SUI exposure and staking rewards, without 1940 Act protections.

Compared to February 18, when the crypto market cap stood at $2.39T with a 1.4% decline and Fear Index at 8, February 19 shows a further drop to $2.36T with sentiment slipping to 9 but still in Extreme Fear. Bitcoin dominance slightly increased from 56.1% to 56.2%, while overall trading volume fell from $94.4B to $89.8B, signaling sustained caution.

Investors face heightened volatility as sentiment remains in Extreme Fear. While blue-chip assets show limited downside, altcoins demonstrate sharp price swings. Liquidity remains active, but cautious positioning, risk management, and close monitoring of macro and regulatory developments are essential.

Risk Context: This commentary is not about long-term conditions and is merely informational. It does not point in the direction of the price or show an action to be taken on the investment.

Based on the 24-hour update, appears risky in the short term due to weak sentiment and declining capitalization. However, selective opportunities exist in strong-volume assets. Conservative strategies and disciplined risk control are advisable until sentiment stabilizes.

Disclaimer: This content is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile and risky. Always conduct your own research and consult a qualified financial advisor before making investment decisions. Not all regions can offer some of the services or assets discussed.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.