The market feels like it is slipping into chaos, and Ethereum is taking the hit right in the middle of it.

While Bitcoin is already showing signs of weakness, ETH looks even more exposed after breaking below the $2,800 psychological level.

In the last 24 hours, price action has turned into a bloodbath across the market.

For those following Ethereum price predictions, this move feels less like a pullback and more like a warning.

When whales push billions of dollars worth of ETH onto exchanges and demand from the US market dries up, fear spreads fast.

If Bitcoin keeps crashing and Ethereum cannot hold its ground, then recovery is no longer the focus.

What worries the market is that it may be heading toward a much deeper crash than most traders expect.

What is hitting Ethereum right now is not random panic.

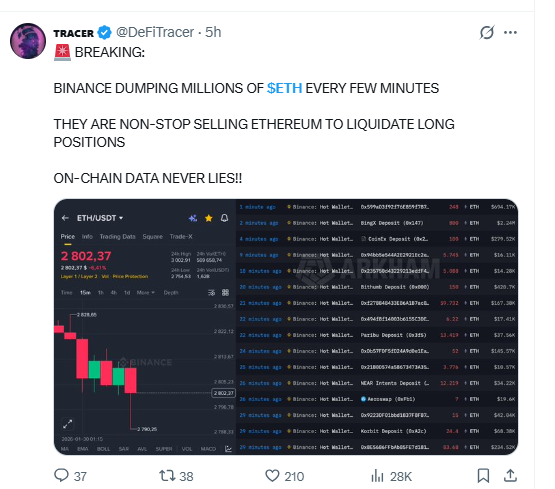

According to recent on-chain data shared by DeFiTracer, Binance has been dumping millions of ETH every few minutes. This selling is not accidental. It is happening as long positions are being forced out of the market.

When large amounts of ETH move from exchange wallets into active selling, price does not get time to breathe.

This kind of flow shows pressure, not distribution.

And when pressure comes from the top, the rest of the market follows.

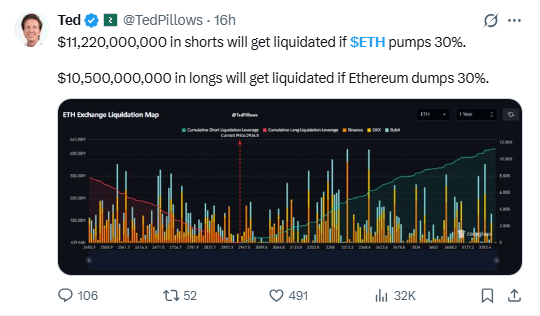

Ethereum is now sitting inside a liquidation trap.

Data shared by TedPillows shows that around $11.22 billion in short positions will get liquidated if ETH pumps by 30%. At the same time, nearly $10.5 billion in long positions face liquidation if Ethereum dumps 30%.

This means both sides of the market are overloaded with leverage.

Any sharp move can trigger forced selling, making price swings faster and more violent.

Instead of stability, the current conditions is now built on pressure.

On the TradingView 4-hour chart, price has slipped out of its rising channel, ending the slow recovery phase. The 9 EMA has crossed below the 21 EMA, showing that short-term momentum is now leaning bearish.

Price is currently trading near $2,740, with the immediate support area sitting around $2,780 to $2,720.

If this zone fails to hold, the next area where buyers may react lies near $2,640, followed by a deeper level close to $2,490.

On the upside, recovery attempts are facing strong supply near $3,060, with heavier resistance stacked around $3,180 and $3,310.

Until price moves back above these zones, rebounds look more like relief moves than trend reversals.

On the daily chart, ETH is following the downside scenario highlighted by Crypto analyst MoreCryptoOnline.

The latest drop strengthens the view that price is moving along the lower path of the structure, with the previous recovery leg showing weak strength.

With the recent rejection, focus shifts to lower reaction zones near $2,626, followed by $2,258.

If pressure continues, a deeper move toward the $1,820 area cannot be ruled out.

For now, the structure suggests caution rather than confidence.

Renowned technical analyst Bitcoinsensus points out that price has slipped below its 50-week EMA, a level that has often decided its long-term direction.

The last time ETH lost this support, price did not pause for long and crashed straight into the $1,400–$1,500 zone.

This time, price is again stuck below the same line and failing to show strength. Instead of bouncing, price is drifting lower, which reflects weak structure and fading buyer confidence.

If this breakdown holds, the market may be staring at a retest of the old macro bottom.

The $1,500 area is now back on the map, and for many traders, that level feels uncomfortably close again.

With US demand weakening and leverage still high, altcoins is now reacting more to fear than fundamentals.

In this environment, even small price moves can trigger large liquidations, making volatility more dangerous than usual.

Right now, Ethereum price prediction is being driven more by fear than by fresh buying. Rallies are short, and sellers are still waiting above price. That tells its own story.

As long as ETH stays below the $3,000 area, the downside stays open around $2,780 and $2,640.

Until price can move back above broken resistance, this market looks more like damage control than recovery.

Traders are not chasing upside here.

They are mostly trying not to get caught on the wrong side.

YMYL Disclaimer: This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile, and market conditions can change quickly based on macro data. It is always essential to do your own research before making any investment.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.