The Federal Reserve is widely expected to maintain current interest rates following its July 30 policy meeting. This would mark the fifth consecutive meeting without any rate changes, as inflationary concerns persist and economic growth remains firm. Markets are closely watching for any forward guidance on a potential September rates cut, though expectations are beginning to fade.

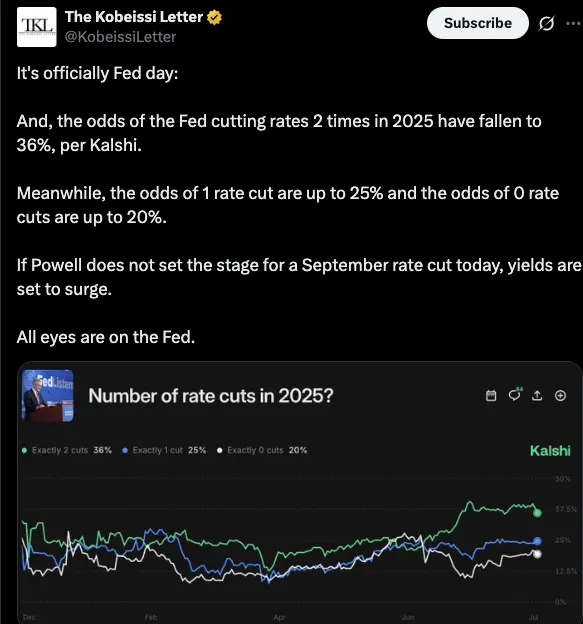

According to data from Kalshi, the likelihood of two interest rates cuts in 2025 now stands at 36%. This marks a drop from previous months when two cuts seemed more probable. The odds for just one cut have climbed to 25%, while chances of no cuts at all have risen to 20%.

Source: tweet

Throughout early 2025 rates outlooks, expectations shifted gradually. Initially, projections for zero and one cut were nearly neck-and-neck. By June, however, sentiment shifted noticeably toward the possibility of two cuts. That scenario gained momentum and became the leading forecast until recent data tempered those hopes.

Recent stronger-than-expected economic indicators have contributed to cooling expectations for rate reductions. The U.S. economy expanded at a solid pace in the second quarter, with GDP advancing 3.0%, surpassing forecasts of 2.4%. The robust growth adds weight to the Federal Reserve case for holding rates steady in the near term.

Despite President Donald Trump's continued push for rates cuts, including his public criticism of Federal Reserve Chair Jerome Powell, the central bank has shown no urgency to pivot. Trump had threatened to remove Powell but recently softened his tone after visiting Fed headquarters.

Traders and analysts believe the Fed prefers to wait for more consistent inflation progress before shifting course. Treasury Secretary Bessent also emphasized he does not expect any policy change during today’s announcement.

Interestingly, all focus is on the post-meeting statement. Investors are searching indicators that possibly show a policy change towards the later part of the year. The hope of a September cut may be rekindled by a dovish message of Chair Powell.

Nonetheless, in the absence of a definitive signal, yields can jump sharply as the market expresses disappointment.

Markets such as PolyMarket are almost sure that there shall not be rate change today and contracts are even at 98 and 99 percent odds that there shall be no rate change today.

Although retailers still expect some shortenings in 2025, the changing odds are indicating a decline in the confidence with monetary ease. The level of Kalshi forecast is an up-to-date measure of how investors consume data and Fed communications.

In conclusion, the future of cuts still has its door open, but recent events show that rate reductions might be not so early as it was expected before. As usual, incoming economic data and Fed commentary will play the key role in determining the changing picture.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.