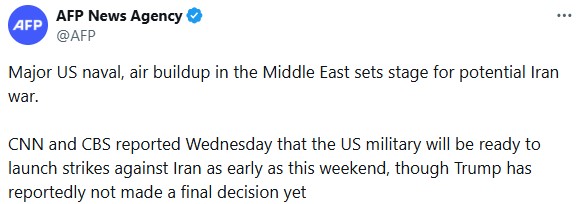

According to reports from CNN, the United States military is prepared for possible strikes on Iran as early as this weekend (around Feb 21, 2026). The US has increased its military presence in the Middle East, including multiple aircraft carrier strike groups, fighter jets, guided-missile destroyers, and thousands of troops. However, the final approval by President Donald Trump has not been given yet.

Source: US Iran War: Official

At the same time, indirect nuclear talks between the U.S. and Iran, mediated through Oman in Geneva, have stalled, pushing global uncertainty higher.

For now the biggest financial risk tied to a possible US Iran war is energy supply, which, somehow, also binds the risk assets sentiments including cryptocurrencies.

Iran recently conducted live-fire naval drills through its Islamic Revolutionary Guard Corps, temporarily restricting parts of the Strait of Hormuz. While this was not a full blockade, it sent a clear signal of control over one of the world’s most critical oil routes, which roughly manages 20% of global oil shipments.

This is where crypto comes into focus. Any serious US-Iran conflict risks could push oil prices sharply higher, which feeds directly into inflation.

When inflation concerns rise, central banks tend to stay hawkish–keep interest rates high, liquidity tightens, and risk assets react.

This chain: war risk → oil spike → inflation fear → market volatility, has played out many times before, and Crypto, especially Bitcoin, reacts strongly to this macro pressure.

The crypto market has already responded defensively. Over the past 24 hours, total crypto market capitalization dropped 1.27% to around $2.3 trillion, driven largely by a Bitcoin-led sell-off.

Source: CoinMarketCap Data

Key data points:

Bitcoin has pulled back, trading around $67k, as investors reduce exposure to risk assets

U.S. spot Bitcoin ETFs have seen escalating outflows measuring -$133.27M in yesterday data, with total assets under management falling from around $125 billion to $83.63 billion over the past month

Market sentiment is deeply negative, with the Fear & Greed Index sitting near “Extreme Fear” (around 11)

In early stages of geopolitical stress, this pattern is common. Bitcoin usually falls first, while altcoins see even sharper drops due to lower liquidity.

Once the initial panic settles, the narrative often shifts, on which market analysts hoped to bring a positive or upward momentum in the sector. Bitcoin, not controlled by any government, cannot be printed, and operates outside traditional financial systems, seen as digital gold during times of global instability.

Historically, war headlines and geopolitical shocks have caused short-term Bitcoin volatility of 5–10% within 24–48 hours, followed by renewed interest from long-term holders.

Institutions often view Bitcoin as a hedge against currency debasement and political risk, especially when inflation fears return.

At the same time, stablecoin demand also often rises. Traders move funds into USDT, USDC, and other stable assets while staying on-chain, waiting for clearer signals. This behavior usually shows that capital is cautious, not exiting crypto entirely.

The US Iran war risk has not turned into direct conflict yet, but markets are reacting to the uncertainty. In the short term, crypto may stay volatile and defensive. Over time, if tensions persist and inflation fears grow, Bitcoin’s hedge narrative could strengthen again.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.