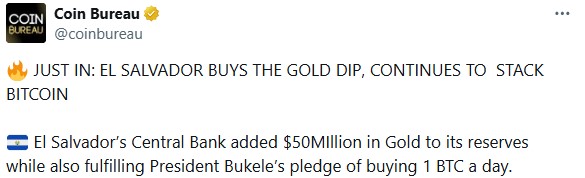

El Salvador, known for its Bitcoin strategy, has once again made headlines but this time with gold. On January 29, 2026, El Salvador’s Central Bank added $50 million worth of gold to its reserves during a sharp price dip, where the precious metal had just fallen from its ATH of $5,600 per ounce, creating a buying opportunity.

Source: Coin Bureau

The recent purchase has again drawn global attention towards Gold vs Bitcoin narratives. As the country, famous for its strategic BTC accumulation and a long-term confidence in the asset, chooses bullion at the time when the digital asset's prices are sharply falling and bullion is gaining strength, starts debate.

However, as markets are frequently turning volatile, El Salvador is exploring other alternatives also while continuing its daily BTC buying plan, honoring President Nayib Bukele’s long-standing pledge of buying 1 BTC every day.

The precious metal recently hit a record high near $5,600 per ounce before falling to $5,200 on January 29. Prices dropped as much as 4–5% intraday due to profit-taking after a massive rally.

Source: Trading Economics

Even after the dip, the precious metal remained up over 20% on monthly and 86.2% on yearly basis, showing its strongest phase in decades.

El Salvador gold purchase reflects how traditional reserves still rely on hard assets as a trusted store of value. Even after the dip, central banks around the world are increasing gold holdings, and investors are following the same trend.

Key reasons the bullion is gaining trust include:

Long history as a store of value

Strong performance during inflation fears

Independence from digital systems

From here, traditional assets look to pull investors away from digital assets. But rallies of precious metals are not a single factor for this shifting, the continuous pressure on the crypto market accompanied the trend.

The digital coin dropped to the $82,000–$84,000 range, falling more than 7.3% in weekly and 21% in yearly comparison. This drop triggered increasing outflows from ETFs while many investors reduced crypto exposure as markets turned cautious.

Source: Binance

After hitting an all time high of $126K in October 2025, the asset is frequently failing to hold above 100K level and touching $80-90K ranges.

For some investors, this price dip weakened Bitcoin’s store-of-value narrative. However, this does not mean Bitcoin is failing, but it shows that trust in the coin is still price-sensitive, especially during risk-off market conditions.

Despite recent gold-buying, El Salvador is firm on its BTC strategy. Treating the coin as a long-term reserve asset rather than an everyday payment tool, the Central American country continues to add 1 BTC per day under President Nayib Bukele’s strategy.

As of late January 2026, the country holds 7,547 BTC, valued at around $625 million.

President Bukele has repeatedly stated that the government has no plans to sell its Bitcoins holding, even during sharp market drops.

Alongside Bitcoins, the Central Bank’s recent purchase pushed national gold-reserves to over $360 million, showing a clear diversification strategy.

BTC’s recent dip has tested trust levels, while the metal's powerful rally has restored confidence among investors and nations alike. The gold vs Bitcoin debate is no longer theoretical, it is playing out in real time, with price action guiding trust.

For now, gold looks safer, while Bitcoin remains a long-term bet.

Disclaimer: This article is for informational purposes only and should not be considered financial advice.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.