Can strong regulation and digital freedom move together? The India FIU decision to block registered exchanges from dealing in privacy-focused tokens has raised this exact question. Some see it as protection against misuse, while others feel it limits user choice. This step reflects a cautious but evolving stance toward digital assets in the country.

According to journalist Sapna Singh, the Financial Intelligence Unit has asked registered exchanges to stop trading assets like Monero and Zcash due to money laundering risks.

Source: Sapna Singh X Post

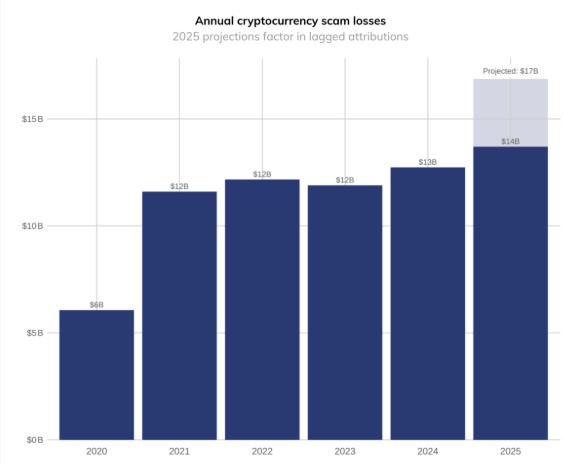

This move is backed by global data. Chainalysis reports that in 2025, on-chain scams reached at least $14 billion, rising sharply from earlier estimates of $9.9 billion in 2024, later revised to $12 billion.

Source: Chainalysis Report

The India FIU has made it clear that platforms must follow stricter compliance rules. These include appointing an AML officer, completing CERT-In audits, and sharing sender and receiver data, even for self-custody wallets.

This step targets hidden transaction systems that make tracking illegal activity difficult. Assets designed to hide wallet addresses and amounts create challenges for enforcement agencies. From a risk control view, the decision supports transparency and protects users from platforms being misused for scams or laundering.

This also shows that regulation is becoming structured, not random. The restriction applies only to a specific category, not the entire ecosystem. That difference is important.

Recent updates show tightened crypto KYC rules for new users, this indicate that the Indian FIU wants cleaner participation, not shutdown. They make platforms safer for long-term users and global partners.

At the same time, the RBI has suggested linking BRICS digital currencies to enable faster cross-border payments and reduce dollar dependency. This proposal may be discussed at the 2026 BRICS Summit hosted by the country, showing openness to regulated digital finance.

Privacy tokens are built to protect identity. Unlike open blockchains, they hide sender, receiver, and amount details. Supporters say this is about personal financial freedom, not crime.

The ban affects assets like Monero, Zcash, and Dash. For investors holding them, this is negative. They must either exit or shift to other categories. However, the wider ecosystem remains untouched, which signals selective control, not total rejection.

This balance is why the debate is intense. Safety and freedom are both valid concerns.

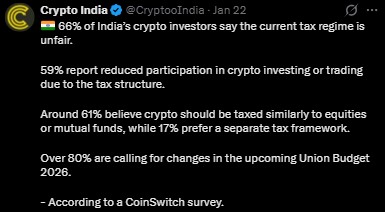

A CoinSwitch survey shows strong dissatisfaction with current policies:

Source: Official X

66% say the tax system is unfair

59% reduced participation due to tax pressure

61% want taxation like equities or mutual funds

Over 80% want reform in Union Budget 2026

Binance CEO Richard Teng also highlighted the country’s young and tech-driven population embracing blockchain tools. He pointed out how global leaders like Larry Fink and Jamie Dimon shifted from critics to supporters after understanding the system better.

In 2025, SIP-style investing in digital assets grew nearly 60%, and the country ranked #1 in global adoption. These facts show steady acceptance, just at a controlled pace. Furthermore, the upcoming meetings and policy decisions will help shaping the crypto market in India.

The India FIU privacy coin ban is not pure rejection. It is a slow filter. High-risk tools are restricted, while the wider system remains open. This approach protects users, builds trust, and prepares a stronger regulatory base. Controlled acceptance is replacing blind resistance.

YMYL Disclaimer: This article is for educational and informational purposes only. It does not provide financial, legal, or investment advice. Readers should consult certified professionals before making any financial decisions.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.