JPMorgan has reduced its Coinbase price target from $399 to $290 for this year, fueling the questions among the community whether the largest crypto exchange of the US is losing its value or just facing a short-term slowdown due to the recent market volatility.

Even after lowering the year-end target, the bank kept its “overweight” rating on Coinbase stock. Here, the reduction in price is due to the increasing impact of crypto market activity on the platform's upcoming Q4 2025 earnings, which is seen as lower than expected.

Source: Coin Bureau

This also underscores the close ties of the exchange with overall cryptocurrency market performances, especially Bitcoin price movements.

Ken Worthington, Senior analyst at JPMorgan, highlighted major factors behind the price target reduction:

Crypto trading volumes fell around 25% year over year, hurting transaction revenue

Slower growth in USDC circulation, impacting stablecoin-related income

Softer cryptocurrencies prices and cooling retail participation

A tougher operating environment for digital asset exchanges despite cost controls

Pressurized from these trends, Coinbase’s Q4, 2025 revenue is widely expected to sum-up around $1.8–$1.9 billion, showing close to 19% down on a yearly basis. Although subscription and services revenue contribute more steadily, major risks arise from potentially lower staking yields and stablecoin trends as per JPMorgan.

The market conditions since late-2025 adds fuel to the topic. The overall market has lost more than 27% value year-to-date. Bitcoin also faced a 31.85% decline in the same period and is currently trading near $66,700.

Other major tokens like Ethereum, BNB, Solana, XRP have also seen weaker and unstable price actions. This wide market weakness has pushed down crypto trading volumes, a key capital generating source of the exchange.

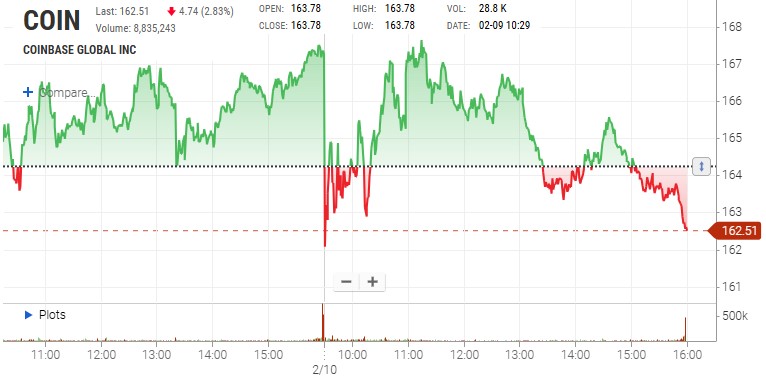

Coinbase share, $COIN, has already witnessed the impact. Stocks are down ~30% on yearly comparison, currently trade around $162, well below the highs of $420 in 2025. The downtrend mirrors Bitcoin’s pullback of nearly 15% in early 2026, underscoring the sensitivity of the exchanges to digital space cycles.

Source: Nasdaq Official

This volatility explains why the Coinbase price target was adjusted, even as long-term optimism remains.

Despite the reduced price tags, broader marketplace pressures, and weakening sentiments, the exchanges always showed significant over-comes, and JPMorgan’s decision to keep an overweight rating proves the confidence the exchange has.

In the 2022 cryptocurrency winter, $COIN dropped as much as 80–90% from highs.

In 2023, the stock rallied roughly 391% as Bitcoin and markets recovered.

Through 2024, continued gains aligned with broader cryptocurrency strength.

In 2025, the stock hit new highs (~$420) during the bull momentum before correcting in 2026.

These scenarios suggest Coinbase's potential to achieve 200%+ rebounds when trading volumes and sentiments show improvement confirming JPMorgan’s long-term stance.

The recent Coinbase price target reduction shows current market challenges which do not influence its long-term valuation. The stock will regain once trading volumes surge, crypto assets stabilized, and Bitcoin achieves a steady way. That will help the US-based crypto platform to pave new revenue streams.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.