Highlights

A Polymarket trader made an estimated $400,000 betting early on the demise of Nicolas Maduro Fall.

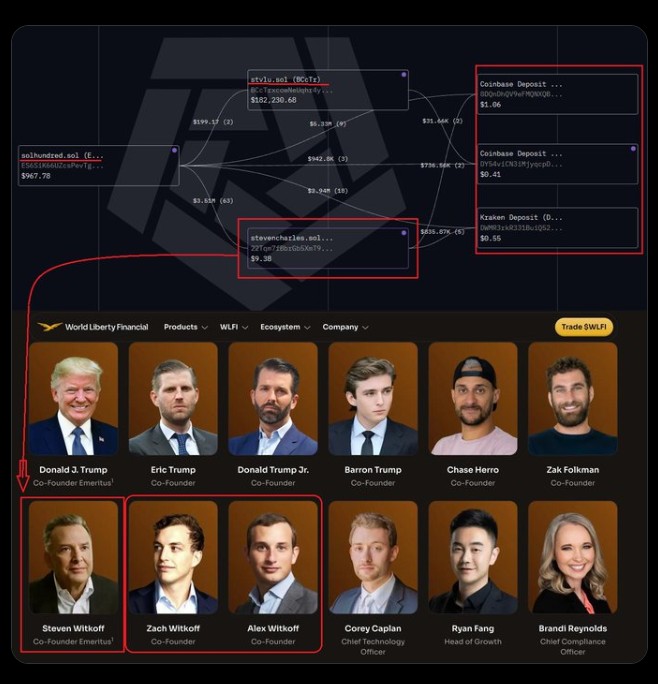

On-chain analysis connects funding wallets to ENS domains that belong to Steven Charles Witkoff.

The evidence is circumstantial, being grounded on blockchain flows, and without any responses by concerned parties.

One Polymarket trader made a profit of approximately $400,000 by betting early in the collapse of Venezuelan President Nicolas Maduro. On-chain analysts followed the money trail to wallets containing almost identical transfers of Coinbase and ENS names associated with Steven Charles Witkoff, which generated insider-trading speculation. There is no direct evidence and official reactions yet.

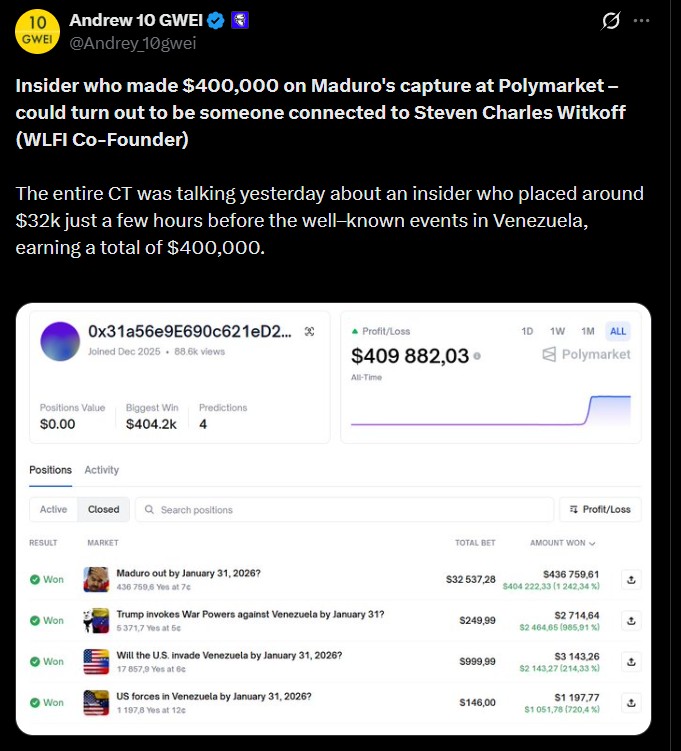

A Polymarket prediction market on-chain investigation by crypto analysts @Andrey_10gwei has caused controversy about a highly lucrative trade. It is said that the trader made approximately $400,000 betting on the political collapse of the Venezuelan President Nicolas Maduro, placing bets just hours before real-world events could be determined.

Source: Official Trader X

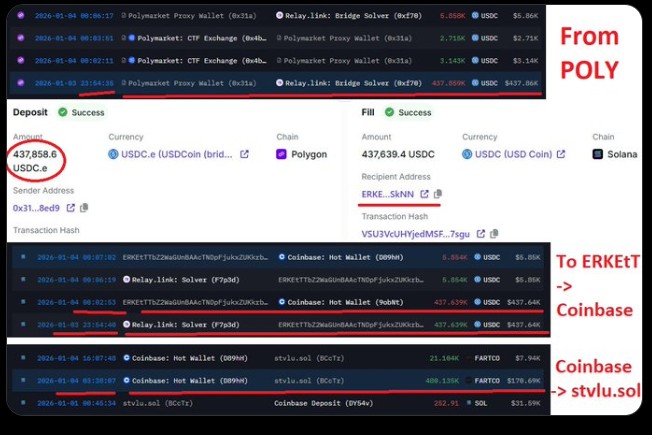

The market under consideration, which was solved after the U.S. seized Maduro on January 4, 2026, attracted attention because of the abnormally accurate timing and size of the winning bets. Crypto Twitter was soon theorizing about whether there was insider trading at play.

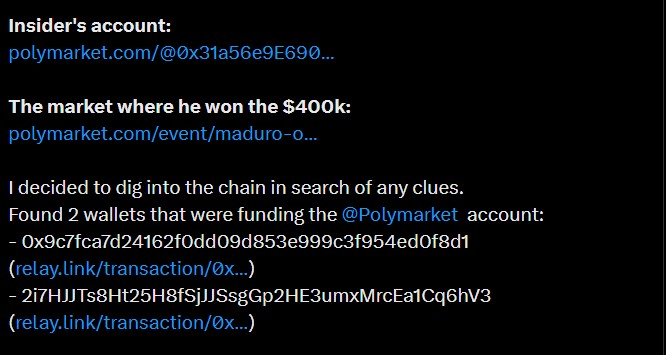

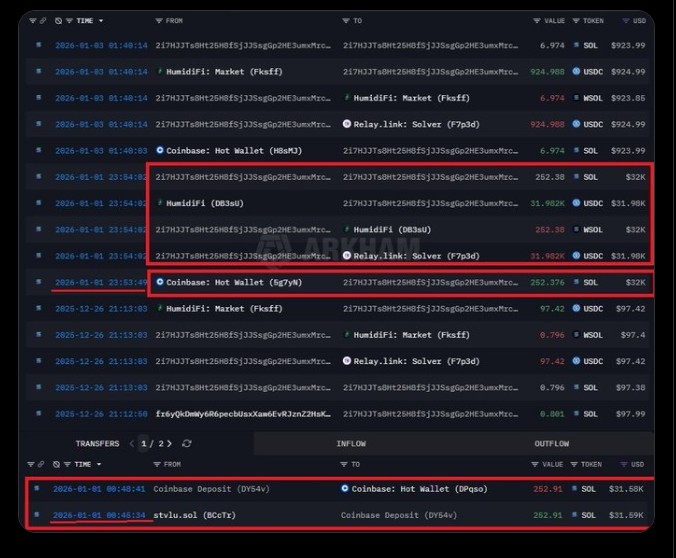

Based on the analysis, two wallets were found to fund the Polymarket account that won the trade. The two wallets were not very active in terms of any activity other than being fed with money by Coinbase and deposited into Polymarket, a trend commonly linked to burner or intermediary wallets.

One of these wallets, 2i7HJJ... was filled with 252.39 Solana by Coinbase at 23:53 UTC on January 1. Thereafter, investigators sought similar inbound Coinbase exchange deposits before this transaction.

Source: X

A striking match emerged. Approximately 23 hours before, a wallet (BCcTrxcow...) had put in 252.91 Solana tokens to Coinbase--nearly the same sum, within a range of error of about 99%. This near numerical and time coincidence sounded off alarms to analysts.

This was further complicated by the fact that the STVLU.SOL wallet had registered several Solana Name Service (SNS) names such as StCharles.SOL.

Source: X

Additional on-chain research showed that the original source of funding for STVLU.SOL was Solhundred.sol, a wallet that has made roughly 11 million transactions with another wallet called StevenCharles.sol.

The overlap in ENS/SNS naming, StevenCharles.sol and StCharles.sol, has made analysts suggest the possibility of a relationship to Steven Charles Witkoff, co-founder of World Liberty Finance (WLFI), a venture that has been associated with high-profile political connections.

Interestingly, the three wallets seem to have similar Coinbase deposit trails, which enhances the impression of a connected funding system.

Source: X

Further investigation was conducted after the Polymarket winnings were withdrawn. Approximately 3-4 hours following the movement of the insider account profits to Coinbase, some 170,000 worth of Fartcoin were transferred out of Coinbase into the STVLU.SOL wallet.

Although this is not a direct indication of profit recycling, the timing has given rise to speculation that some of the Polymarket proceeds were reinvested in speculative crypto assets.

Source: X

Although the on-chain movements are very strong, analysts point out that the results are not conclusive but rather deductive. There is no direct evidence that the wallets in question were under the control of Steven Charles Witkoff or any of the affiliates of WLFI. At the time of publication, no response has been made by any of the involved parties.

Also, the crypto project of the Trump family, World Liberty Financial (WLFI), has declared that a governance proposal with 77.75% of the votes, allowing the unlocked treasury to be used in incentivizing USD1 adoption, has been passed. The vote indicates the high level of community engagement and the importance of token holders in the development of the WLFI token ecosystem.

Source: Wu Blockchain X

The Polymarket Maduro trade points out the visibility of suspicious trends due to blockchain transparency, but without attribution, the situation is still speculative, which raises still-persisting worries about the insider privileges in crypto prediction markets.

Disclosure: This is not financial advice. Do your own research (DYOR) before investing. CoinGabbar does not incur any financial losses. Cryptocurrencies are extremely volatile, and you will lose all your investment

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.