The cryptocurrency world woke up to red screens and rising anxiety because of the updated SEC Crypto Roundtable plan scheduled on December 15, along with the upcoming Fed rate cut December 10 meeting.

This SEC crypto news quickly became the focus, as the meeting included top privacy-tech founders like Zooko Wilcox of Zcash.

Source: Coin Bureau X Account

Important Takeaways:

Organizer: U.S. Securities and Exchange Commission

Theme: Financial Surveillance & Privacy in Digital Assets

Date: December 15, 2025

Aim: To discuss regulatory clarity, privacy tech, surveillance standards, and the next phase of digital asset compliance in the U.S.

Opening remarks will be shared by Richard B. Gabbert, Chairman Paul S. Atkins, Commissioner Mark T. Uyeda, and Commissioner Hester Peirce.

The crypto task force roundtable sec meeting aims to give better regulatory clarity on privacy tech, compliance rules, and digital-asset monitoring.

Industry speakers include Zooko Wilcox (Zcash), Jill Gunter (Espresso Systems), Koh (Aleo), Simon Letort (Digital Asset), Nikhil Raghuveera (Predicate), and Wayne Chang (SpruceID).

A key discussion will be moderated by Yaya J. Fanusie from the Cryptocurrency Council for Innovation.

The discussion may shape future rules for privacy coins, ZK systems, decentralized identity, and how these technologies fit into the U.S. regulatory system.

The SEC crypto roundtable meeting may guide exchanges and institutions on how to follow new compliance standards going into 2026.

Now the big question comes: Are we heading for a brutal Dec market crash, or the quiet beginning of 2026’s bull run? Let’s break it down.

As soon as this update became public, the market reacted sharply. Traders saw a fast and overall crash of around 3%. As seen in the below Fear and Greed Index dropped to Extreme Fear: 23, showing very weak investor confidence.

Here is the simple breakdown:

Bitcoin stands at $89,577.42, down 3% in 24 hours.

Ethereum stands at $3,036.83, down 4% in 24 hours.

XRP stands at $2.04, down 2%.

As per Coinglass data, 132,576 traders were liquidated in the last 24 hours, with a total liquidation amount of $414.28M. The biggest single liquidation was on Hyperliquid — BTC-USD worth $8.50M.

Many analysts believe this reaction is connected to fears around the SEC Crypto Roundtable news.

A second source of tension is rising: The Federal Reserve’s December 10 meeting, where they will decide whether to cut interest rates.

Latest inflation data:

US PCE: 2.8%

Core PCE: 2.8%

Both numbers show cooling inflation. This increases the chance of a Fed rate cut, which is now a major discussion in financial markets.

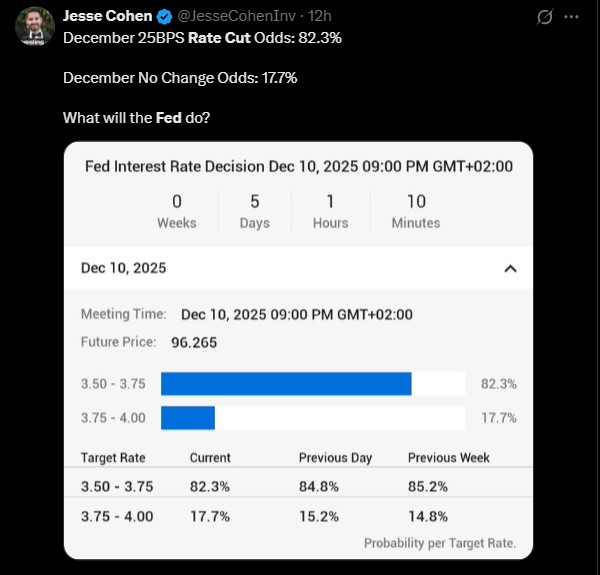

According to analyst Jesse Cohen:

25 bps Rate Cut Odds: 82.3%

No Change Odds: 17.7%

This makes the December 10 decision crucial for traders tracking both the fed rate cut narrative and the SEC Crypto Roundtable outcome.

Short-Term Scenario: Expect volatility as the market may stay unstable because of the weak price momentum in Bitcoin and Ethereum. Altcoins showing no strong support.

As per my analysis being a digital asset expert, this pressure is normal when both economic policy and regulatory policy collide in the same week.

Medium-Term: Possible recovery after discussion effect settles.

Bitcoin price may move back toward $95,000

Ethereum may rise toward $3,500

Privacy coins like Zcash may see strong recovery

Long-Term: 2026 could start a bull run. If everything remains positive then the market may enter an accumulation phase, slowly building power for a new bull run.

This could be the real impact of both the news surfacing today.

December may remain rocky, but the macro + regulatory combo appears to be building the foundation for a surprise bull run into 2026. What looks like fear now could become fuel later.

For now, the world is watching two dates: December 10 FOMC and December 15 SEC Crypto Roundtable. What happens there will shape the industry's next big chapter.

Disclaimer: This article is for informational purposes only. It is not financial advice. Digital asset markets are risky, always research before investing.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.