SharpLink is the first publicly listed company to adopt Ether as its primary treasury reserve asset. The strategy involves accumulating token, staking coin, and growing it per share using native staking, restaking, and coin based yield strategies to increase treasury value and create long-term shareholder value.

Source: Website

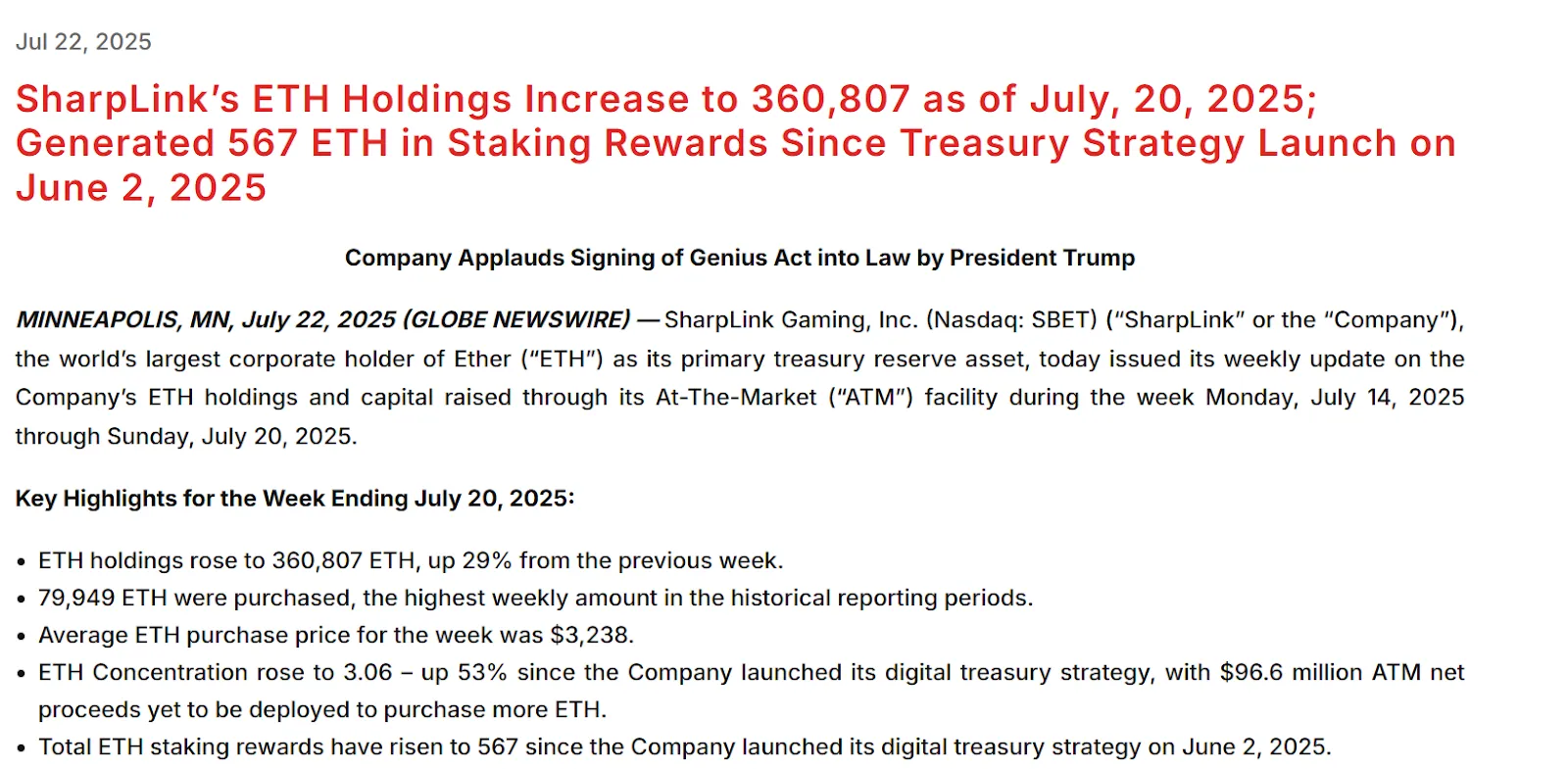

Sharplink accumulation of 79,949 ETH for $259M between July 14-20, marking the largest weekly purchase to date. The value-per-share has risen 53% since June 2, and $96.6M is available for future acquisitions. Cumulative staking rewards have reached 567 ETH. The asset is $ETH and the ticker is $SBET.

Source: Arkham Exchange

In the last 24 hrs the firm is continuously buying the layer-1 token. According to Arkham data total current holdings of ETH is 18.923 which is valued around $70k.

Source: X

As the layer-1 token provides secure and scalable infrastructure for Stablecoins. Popular stablecoins, like Dai and USDC, are issued on Ether. The company talks openly about the Ether’s ecosystem on social media that it's a home for Stablecoin. Since Stablecoin serves as a bridge between traditional finance and digital assets many US banks see opportunity in managing crypto assets. Seeing this institutional interest in Ether, Sharplink Gaming Ethereum buying is vigorously expanding. It is the biggest and most efficient stablecoin factory, not because of the number of stablecoins it hosts. Token's dominance comes from the market cap, liquidity, and the extensive use of its stablecoins within it's ecosystem and beyond. Users can make instant dollar transfers, for almost zero cost, on Ether. Recently Sharplink CEO Joseph Lubin explained in a podcast why this is becoming the world’s most important asset.

Source: Yahoo finance

The current Share price of the company is $27.40 with a hike of 2.15. The Sharplink Gaming Ethereum holdings has become the largest global acquisition in the crypto market, following a successful $413 million raising of over 24 million shares at the At-The-Market between July 7 and 11.

Since this year's spot ETH ETF approvals, huge funds have increased their exposure, resulting in a strong wave of institutional buying.

Fidelity added almost 34,000 coins, valued at approximately $124 million, making it its largest daily Ether acquisition to date. It now has over 629,000 coins, worth $2.33 billion, in total holdings.

Additionally, BlackRock expanded its position by acquiring approx 27,000 token through its iShares EthereumTrust, which now holds 2.59 million, the largest Ether holding among ETFs.

The token's weekly inflows nearly doubled their previous top performance, hitting a record $2.12 billion. The Sharplink Gaming Ethereum purchase comes after an aggressive $3 billion coins acquisition in July. While rival institutions add hundreds of thousands of coins, ETHA leads daily ETF inflows. The coin is currently trading at $3,712.30, up 0.8% over the last day. In the past 30 days, the layer-1 currency has experienced a tremendous 65% increase. Institutional buying and ETF approvals shows its faith in long-term utility and value, now big companies are moving towards surpassing previous waves of bitcoin adoption.

Sheetal Jain is a seasoned crypto journalist, content strategist, and news writer with over three years of experience in the cryptocurrency industry. With a strong grasp of financial markets, she specializes in delivering exclusive news, in-depth research articles and expertly optimized on-page SEO content. As a Crypto Blog Writer at CoinGabbar, Sheetal meticulously analyzes blockchain technologies, cryptocurrency trends and the overall market landscape. Her ability to craft well-researched, insightful content, combined with her expertise in market analysis, positions her as a trusted voice in the crypto space.

6 months ago

🙃🙃🙃🙃🙃🙃

3 months ago

A good article to read. The writer has effectively managed the data to make the article engaging. In my opinion, this is an excellent article.