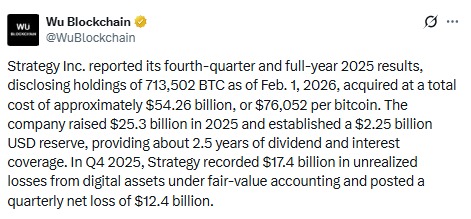

The Strategy 2025 Financial Results have added fresh pressure to the crypto market after the company reported massive losses tied to its Bitcoin holdings. Strategy disclosed that it owned 713,502 BTC as of February 1, 2026, purchased at a total cost of about $54.26 billion, or roughly $76,052 per BTC.

However, the Strategy 2025 Financial Results also revealed a quarterly net loss of $12.4 billion, mainly due to a $17.4 billion unrealized loss under fair-value accounting. These losses are not from selling BTC but reflect falling market prices. Even so, the update has raised concerns among investors.

Source: X (formerly Twitter)

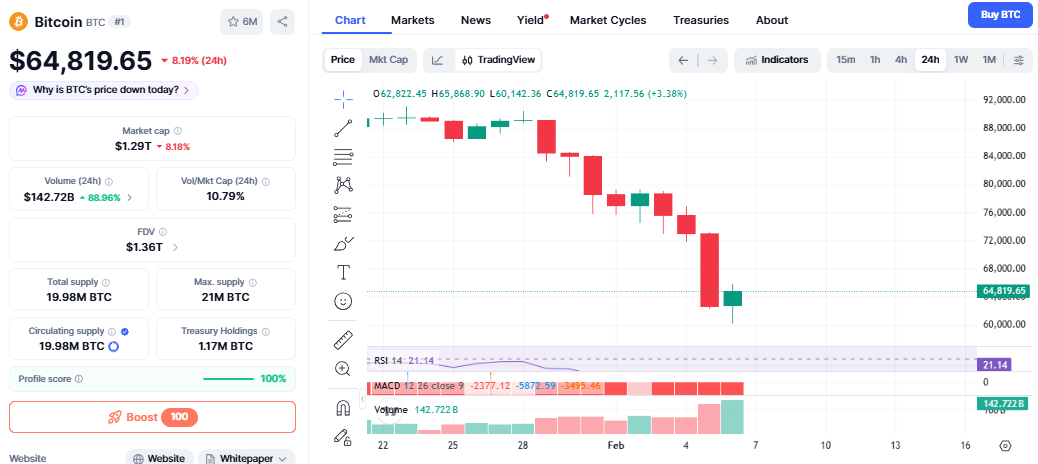

Soon after the Strategy 2025 Financial Results, it fell nearly 9.5% in 24 hours to around $64,245. The broader crypto market also dropped about 8%, bringing total market value close to $2.22 trillion.

Investor sentiment weakened sharply, with the Fear & Greed Index sliding to 5, signaling Extreme Fear. This level usually suggests panic-driven selling and low buying confidence.

Source: CoinMarketCap Chart

A major reason behind the decline is continued outflows from U.S. spot BTC ETFs. Assets under management fell from $107.41 billion to $102.57 billion, indicating that institutional investors may be cutting exposure during global uncertainty.

The Strategy 2025 Quarter 4 Results highlight how volatile corporate crypto exposure can be. Despite the losses, the organisation raised $25.3 billion in 2025 and built a $2.25 billion USD reserve, enough to cover about 2.5 years of dividends and interest payments.

CEO Phong Le said the capital supports the company’s BTC treasury approach, while Michael Saylor described the balance sheet as a “digital fortress.” Still, the MicroStrategy 2025 Financial Results have sparked debate about whether large corporate holders could face similar stress if the cryptocurrency remains unstable.

Market weakness intensified after nearly $1.34 billion in Bitcoin positions were liquidated within 24 hours. Forced exits from leveraged traders often accelerate price declines.

It also slipped below a key technical level near $65,201, and analysts are now watching the $60,074–$62,946 support zone closely. If this range breaks, the psychological $60,000 level could be tested soon.

The Michael Saylor firm's 2025 Financial Results also impacted the stock market, with MSTR shares falling over 17% to nearly $106.99 after the earnings update.

Investors appeared cautious following the company’s large unrealized Bitcoin losses, as MSTR stock typically moves in line with BTC performance.

Despite short-term pain reflected in the Strategy 2025 Financial Results, the company continues to focus on future growth. Saylor recently announced a Bitcoin Security Program to coordinate with global cybersecurity groups against potential quantum computing threats.

He also shared a bullish outlook, saying BTC could grow about 30% annually over the next two decades. According to Saylor, even a 1.25% yearly increase would allow the company to sustain dividends long term.

Bitcoin Price Prediction: Technical indicators suggest it is oversold, which can sometimes lead to a relief rally. A move above $65,201 may weaken the bearish trend.

However, if it fails to hold the $60K region, analysts warn it could fall toward the $50,000–$60,000 range. The next direction will depend largely on macro conditions and whether ETF flows stabilize.

The Strategy 2025 Financial Results arrived during one of the market’s most fragile periods. Macro-driven liquidations, institutional outflows, and extreme fear have shaken investor confidence.

While it remains committed to its Bitcoin-focused approach, the coming weeks will be crucial. If it holds above $60K, stability could return. Otherwise, traders should prepare for continued volatility.

YMYL Disclaimer: This content is for informational purposes only and not investment advice. Crypto and stocks are volatile; always do your own research and consult a financial advisor before investing.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.