The Tok Coin Listing Date is becoming one of the most discussed topics in mobile mining right now. Bonuses are live, mining is active, and KYC is closer than many think.

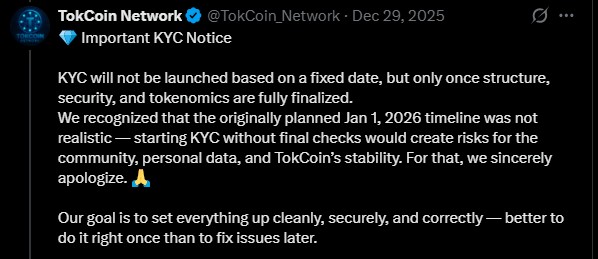

But at the same time, the team has delayed the originally planned January 1, 2026 Tokcoin KYC timeline. For many users, this sounds worrying. In reality, this delay is about safety, legal protection, and long-term stability of the project.

The TokCoin network on its official X account has made it clear: rushing identity verification or exchange listing without full checks would damage the project and put user data and token value at risk.

The Tok Coin Listing Date cannot be fixed without a secure KYC system. The team explained that global identity verification is not simple. It involves compliance rules, data protection laws, and exchange requirements. Large projects like Pi Network also needed years to complete this step-by-step.

Starting it too early would create risks. That is why the Q1 2026 launch plans were delayed. The new tokcoin KYC update will be shared only when all technical and legal checks are done. This protects users and avoids future problems that could harm the network.

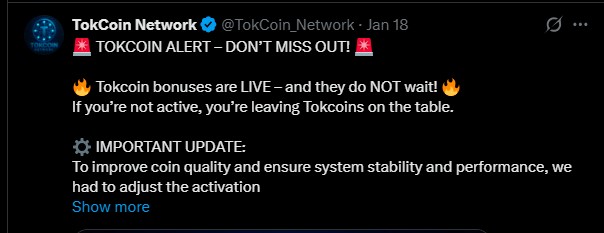

TokCoin airdrop live rewards are now time-based. Bonuses can be activated every 2, 3, 4, 5, and 6 hours. This means users cannot activate everything at once. Continuous mining and real activity matter.

Every account will be reviewed before the verification phase. Those who pause or stay inactive may not qualify. This system filters serious users and strengthens the network before the TGE and exchange debut.

As per top cryptocurrency analysts, this change also improves system performance and coin quality. It makes the asset more stable for its future market entry.

The community selected Option A. The 8M coins for users remains fully secured and is converted 1:1 from points. No tokens are lost. The total supply is capped at 20M coins. The remaining tokens will be released through lockups, vesting, and planned burns.

There will be no random minting. This protects long-term value and supports a realistic launch range of about $0.8 to $2, shaping future Tok coin price prediction models. This structure helps avoid oversupply when the TokCoin Listing Date finally arrives.

The 2026 roadmap shows that exchange launch is targeted for Q1/Q2 2026, but most experts believe quarter-2 is more realistic. Without an announced KYC date yet, a Q1 listing seems difficult.

Experts believe the debut date may now be announced in Q2 2026, most likely between April and June. That makes the TokCoin Listing Date more realistic,and safe. Mining continues, and airdrop rewards stay safe. No gas or identity verification fees will be charged to the community. The team is working behind the scenes, and serious progress is being made.

The Tok Coin Listing Date is not about speed but about strength. KYC delay shows responsibility, not weakness. Bonuses reward real activity, supply is controlled, and user tokens are protected. A stable Q2 2026 launch builds trust, protects value, and gives the network a stronger future in the crypto market.

YMYL Disclaimer: This article is strictly for informational purposes only and does not constitute financial or legal advice. Cryptocurrency investments involve risk. Always do your own research (DYOR) before making investment decisions.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.