What happens when over $237 million worth of crypto tokens suddenly enter the market in just seven days? That is the key question investors are asking as Token Unlocks this week bring fresh supply pressure to several major cryptocurrencies.

Data from Tokenomist shows that both cliff and linear token unlocks will shape price action across the market.

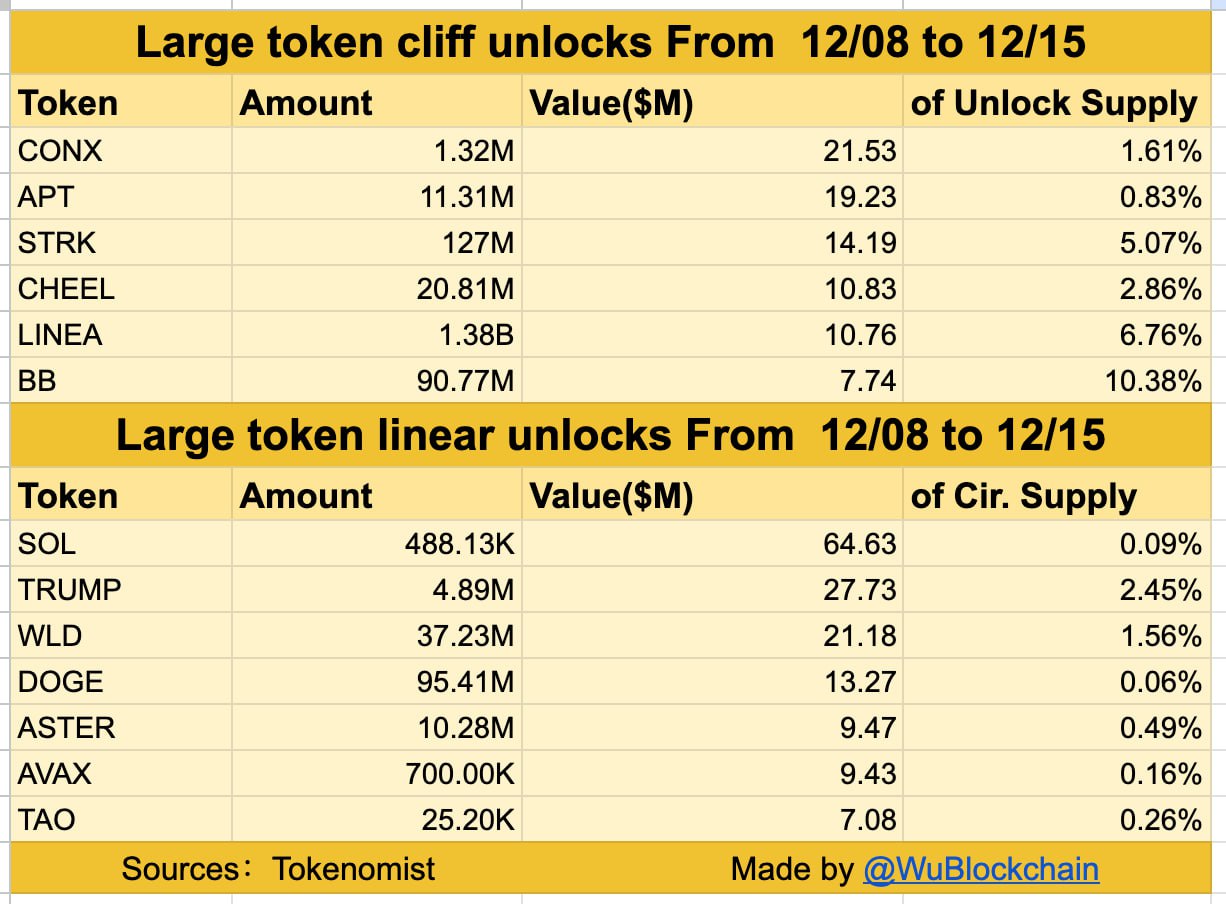

Major names like Solana (SOL), TRUMP, Worldcoin (WLD), Dogecoin (DOGE), Aster (ASTER), AVAX, and TAO are all part of this unlock cycle. At the same time, large one-time releases from CONX, APT, STRK, CHEEL, LINEA, and BB are also scheduled.

According to Tokenomist, major cliff token unlocks worth more than $5 million each will release a large amount of supply at once.

Source: X (formerly Twitter)

These include:

CONX unlocking $21.53m worth of cryptos, APT with $19,230,000, STRK with $14.19m, CHEEL at $10.83m, LINEA at $10.76 million, and BB with $7.74m.

This can create sudden selling pressure because large investors often receive these tokens in bulk.

On the other hand, linear happen gradually each day.

This week, Solana will see over $64.63m unlocked. TRUMP faces $27,730,000, WLD $21,180,000, DOGE $13,270,000, ASTER unlock $9,470,000, AVAX $9.43 million, and TAO $7.08 million.

These steady releases add slow but constant supply pressure and are a key part of upcoming token unlocks that traders track closely.

Even with heavy token unlocks, Solana was up 0.96% in the last 24 hours to $134.42, outperforming the broader crypto market. It also holds a strong 5.78% gain on the week. The rally is supported by a technical breakout, bullish MACD signals, and renewed ETF interest after $4.6 million flowed into Solana ETFs.

However, in light of the continuously increasing Bitcoin dominance, investors are currently eyeing the $132 support. If BTC continues to show strength, Solana might resist further losses despite pressure due to this event.

While Solana held its ground, OFFICIAL TRUMP (TRUMP) fell 0.85% to $5.69 as the gradual linear unlocks of tokens by Trump-linked entities raise dilution risks. Regulatory concerns also continued to weigh on the currency.

Aster falls 2.29% to 0.961, hurt by profit-taking after hype surrounding the 2026 roadmap.

The pressure extends to the broader DEX sector. Rival Hyperliquid has lost 30% in a month, hitting confidence across decentralized exchange tokens and making un-locks even riskier for ASTER holders.

These will increase supply. When demand fails to catch up, prices tend to weaken; this is a reason traders closely track the top token un-locks and readjust positions early. While the new supply might be absorbed efficiently by some projects, others could see sharp price moves.

With more than $237 million coming into circulation, this could spur the volatility of the wider market in the short term. These events likewise present long-term investors with opportunities to buy quality assets at discounted levels if the project fundamentals remain strong.

Disclaimer: This article is for informational purposes only, kindly do your own research before investing.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.