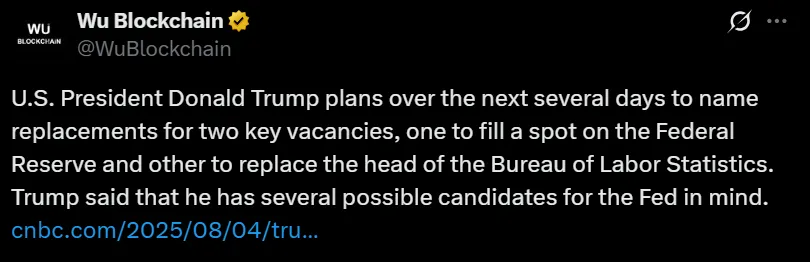

In the coming days, President Trump will reveal his picks for the Fed and BLS replacement—a move that could reshape interest rate policy and jobs data reporting. With two top economic posts open, markets and policymakers alike are hanging on every detail. This fast-developing story promises high stakes and broad implications.

Source: Wu Blockchain

What’s Unfolding Now? Here’s the Snippet

Fed Governor seat opened by the surprise resignation of Adriana Kugler.

BLS chief fired: Post vacated after Bureau of Labor Statistics Commissioner Erika McEntarfer was dismissed following a weak jobs report.

He has a shortlist in mind and aims to fill both the positions within days.

Kugler’s exit leaves an empty seat at the Federal Open Market Committee table, a spot that directly influences borrowing costs, inflation policy, and banking rules.

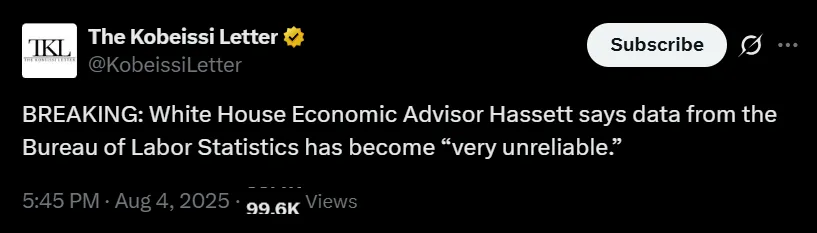

Source: The Kobeissi Letter X Account

Trump’s selection could lean toward aggressive rate-cut aligning with September hopes or those favoring cautious stability. Each path holds very different consequences for Wall Street and the cryptocurrency market.

Potential candidates remain unconfirmed, but market watchers believe he may favor voices aligned with his pro-growth, pro-market stance. Whoever gets the nod will hold a powerful vote capable of swaying the nation’s economic course.

Why Does It Matters?

| Position | Influence on Economy | Why It’s Crucial |

|---|---|---|

| Fed Governor | Sets interest rates, banking rules | Impacts inflation, borrowing cost |

| BLS Chief | Publishes jobs and labor statistics | Shapes how markets and analysts react |

The BLS role may seem technical, but its data drives trillions in financial decisions. This Trump fed news today firing of McEntarfer followed a weak July jobs report and a downward revision of earlier figures by hundreds of thousands. While revisions are common, Donald labeled them “the biggest miscalculations in over 50 years.”

Even, White House Economic Advisor Hassett confirmed that data from the Bureau of Labor Statistics has become very unreliable, and it cannot be trusted now.

His push for “modernized and transparent” labor statistics could change how markets react to employment updates—potentially altering investment flows and policy debates for years.

Cryptocurrency’s market cap, at the time of writing, was standing around $3.76T, reflecting a mild increase of 2%, however its trading volume was $127.53B.

In the crypto news today, Bitcoin is currently at $115,015, signaling high risk ahead, as other altcoins like Ethereum have seen an increase of around 6% today, currently standing at $3,668.83. This might confirm that the upcoming trump announcement will shape the forecast for both bitcoin and Ethereum for 2025. Yet volatility remains elevated until the actual names are announced.

Key Takeaways:

Expect fast-moving updates—two major nominations could arrive in days.

The Trump Fed and BLS replacement decisions may shift market expectations from rates to labor credibility.

Crypto and equities both remain on edge: pick signals could determine next direction.

With both critical posts vacant, Trump’s nominees will play a large role in shaping inflation control, financial stability, and trust in U.S. labor statistics. The Trump Fed and BLS replacement could very well define the economic narrative for 2026 and beyond. As investors and professionals wait anxiously, the question looms: will these picks calm markets—or spark fresh uncertainty?

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.