Why is Donald Trump once again speaking about who should run the Federal Reserve?

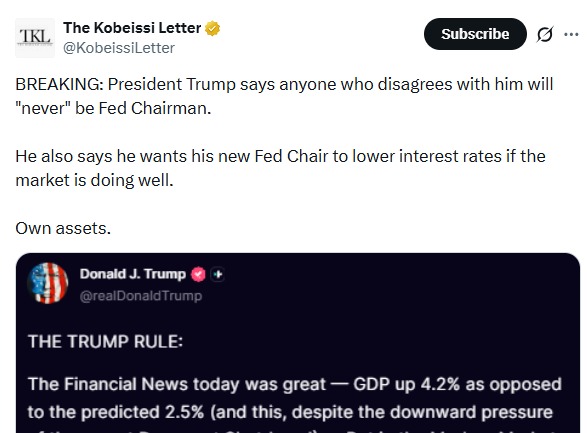

That question is gaining attention after the US president said that anyone who disagrees with him will never become the Fed Chairman. The comment has started a fresh discussion about how much control a president should have over the central bank.

Trump Fed Chairman remark shared on Truth Social after new economic data showed that the US economy grew strongly in the third quarter.

GDP rose by 4.3%, beating expectations. But instead of markets moving higher, stocks slipped. He blamed this reaction on fears that interest rates could stay high or rise again.

Source: X (formerly Twitter)

According to the president, markets should not fall when the economy is doing well. He believes that strong growth does not automatically cause inflation and that interest rates should be lowered when conditions are positive.

The Trump Fed Chairman remark was very direct. He said that policy agreement matters and that anyone who openly disagrees with his views on interest rates should not expect to lead the Federal Reserve.

He also said that he wants his next chairman to lower interest rates if markets are performing well. He argued that high rates hurt growth, investments, and asset prices, while inflation can “take care of itself” over time.

These comments reflect the president's long-held belief that the Federal Reserve should support economic expansion and market confidence rather than slow things down with tight monetary policy.

Jerome Powell’s term as Chair is set to end in May 2026. While the president did not directly say he would remove Powell early, his statement has raised questions about whether pressure on the chair could increase before that date.

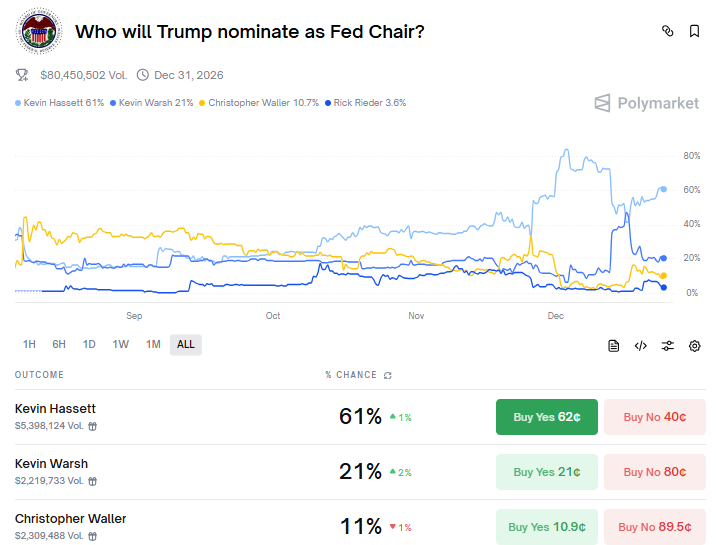

This has once again brought attention to the balance between political power and central bank independence. The Trump Fed Chairman discussion is also visible in prediction markets.

Source: Polymarket

Polymarket odds currently show Kevin Hassett as the leading candidate, followed by Kevin Warsh and Christopher Waller.

These candidates are seen as more aligned with Trump’s preference for lower interest rates and stronger asset prices.

The Federal Reserve reduced interest rate thrice in 2025. The target range was lowered to 3.50% - 3.75%. The move was geared towards helping the economy as the inflation slowed.

However, markets currently expect that any further rate cuts may be paused. Forecasting platforms indicate that there is currently an 86% probability that the central bank will not reduce rates in the upcoming FOMC meeting in January 2026. This follows robust GDP growth and inflation remaining around 2.9%, still above 2% that the central bank targets.

Apparently, Jerome Powell has also stated that “the Federal Reserve is well-positioned to wait and see” how the market performs.

This depicts an element of politics to an already complex market environment. Market players are now following three things very closely: the economic numbers, future central bank decisions, and Trump’s role in selecting the next Fed Chairman.

Bitcoin is steady at around $87000, which kind of indicates that while the markets are uncertain, they're not exactly in a state of panic.

Trump's remarks are more than an insight into leadership qualities. Trump's declarations have brought into focus an underlying controversy associated with the function of the Federal Reserve in the country and who should control it in the nation.

Disclaimer: This article is for informational purposes only, kindly do your own research before making any investment decision.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.