A US Bank failure was officially confirmed on January 30, 2026, after U.S. regulators shut down a Chicago-based bank. While the bank was small and limited, the timing of the closure sent shockwaves through prediction markets, commodities, and crypto, reviving fears of deeper financial trouble.

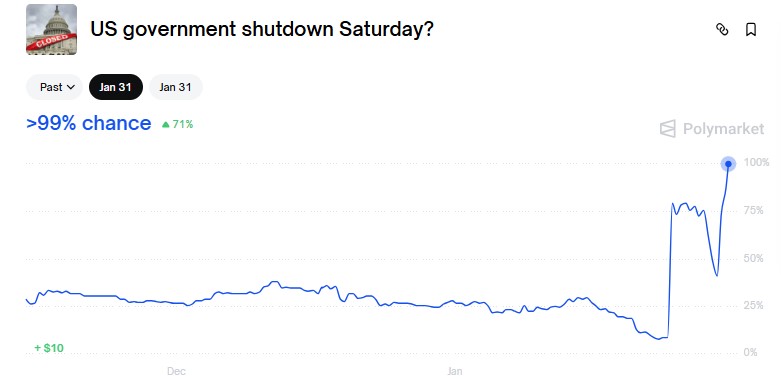

Source: Polymarket Official

Within hours, Polymarket odds for a US Bank failure by January 31 surged above 100%, triggering intense discussion about whether this was an isolated event, or the first crack in a fragile system.

On January 30, the FDIC shut down Metropolitan Capital Banks & Trust, a small regional bank in Chicago, after finding unsafe financial conditions and weak capital. The bank held around $261 million in assets and $212 million in deposits.

To prevent any customer losses, regulators quickly transferred most deposits and assets to First Independence Bank of Detroit. The shut down will cost the FDIC insurance funds about $19.7 million.

The incident is the first US bank failure of 2026, despite the fact that the crisis is not as major as previous ones. Still, people strongly believe that it could lead to major losses as the US government shutdown has already been started partially even after the approval of a long-stretched funding bill by the Senate.

Unlike major banking crises, this failure was not caused by a system-wide fault like interest-rate shocks, crypto exposure, or mass withdrawals. Instead, the closure points to bank-specific problems – poor loan quality, capital shortfalls.

However, the market reacted strongly because of the timing. The closure came during a period of high financial sensitivity and frequent changes in assets prices.

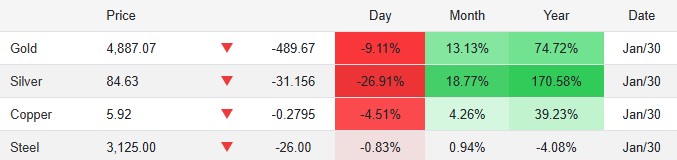

It happened on the day gold and silver prices crashed sharply after performing their all time bests:

Gold dropped 8–11% from record highs of $5,500-$5,600 to around $4,700.

Silver fell 17–31%, from above $120 to $78–$95, marking the worst single-day crash since 1980.

Source: Trading Economics (Data Varied on Different Platforms)

Earlier that day, some analysts warned of a sharp metals crash tied to an undisclosed bank’s insolvency, however, no official confirmation links the banking institute directly to metals losses.

U.S. stocks also ended Friday in the red, with the S&P 500 and Dow Jones slipping 0.4% while the Nasdaq slid a sharper 1.3%.

People are betting on the government shutdown for being stretched to over 3 days.

Banking stress events like this one, have generally shown mixed impacts on crypto markets, especially Bitcoin.

In March 2023, during the Silicon Valley Bank collapse, Bitcoin dropped around 11% from above $22,000 to $19,670, while the whole crypto market showed a slight change.

On the other hand, in a crisis like Europe’s debt turmoil (2010-2012), Cyprus in 2013, and Greece in 2015 , Bitcoin price surged in the context of safe alternative assets rather than decline. In SVM crises too, after experiencing the dip, BTC rebounded 30–40% within weeks after regulators stepped in.

From this scenario, we can say that banking crises often result in the favor of crypto coins for their ability to operate outside the traditional financial systems.

But the question still wonders, if it is a good signal for crypto, why are investors still panicking? The answer is simple with the current nature of the broader market.

After the 2025 crash the market’s nature became more volatile and sensitive to every news. Bitcoin price hovering at $83,822, still struggling to hold above the $100K mark after its 126K ATH of Oct, 2025. Ethereum and other altcoins are also experiencing the same.

While with the news, which is generally seen as a positive sign, short term swings are expected, rising in demand is anticipated by many of the market watchers. However, any further shocks could trigger renewed selling before a potential rebound.

For now, the data suggests containment, not contagion, however, additional small banks failure, ongoing volatility in metals and macro markets can shift sentiments.

Disclaimer: The article is for informational purposes only; It does not constitute any financial or legal advice.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.