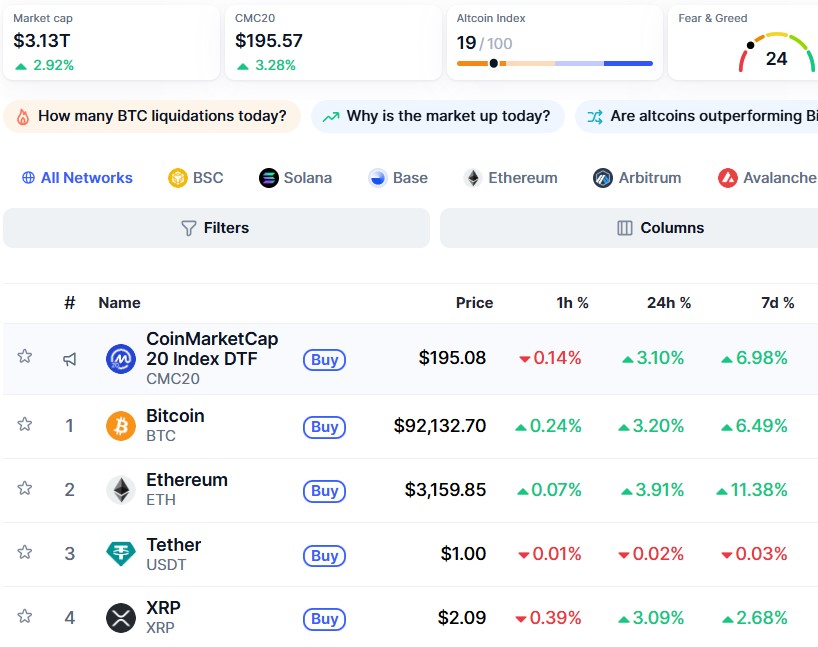

If the cryptocurrency marketplace is filled with extreme fear, then how is everything pumping so fast? That’s the biggest question today as the global crypto market cap jumps to $3.13 trillion, rising 3% in a single day, as seen in the CoinMarketCap chart.

This sudden move has created a lot of curiosity among traders searching for Why Crypto Market Is Up Today, especially when the Fear and Greed Index still sits at 20.

Bitcoin Jumps 3% as Altcoins Rally: What Started This Move?

In the last 24 hours:

BTC Price surged 3%, trading near $92,000

Ethereum rally hit 4% increase

XRP climbed 4%

Major altcoins Zcash, Solana, and more also turned green

This collective rise has fueled the traders' doubt of whether this sudden rise is real or just another industry manipulation.

Let’s understand the real reasons behind why Crypto Market is up today, and why sentiment is still fearful despite such strong price action.

1. MetaPlanet Plans to Raise More Money to Buy Bitcoin

According to Vivek Sen’s latest X post, MetaPlanet will raise new capital through stock issuance to buy more BTC. At the same time, Michael Saylor said he is “getting more bullish,” and supported a bold $13 million Bitcoin long-term forecast.

Such institutional confidence is one of the top crypto market surge reasons and is strongly influencing today’s move.

2. A Whale With a 100% Win Rate Longed the Market for $300 Million

A well-known Trump insider and mega-whale reportedly opened a $300 million long position. This trader has predicted almost every major pump correctly, which is why today’s long order is creating huge excitement in the industry. Whale activity like this is often seen before large cryptocurrency rallies.

3. FOMC Fed Rate Cut Expectations Ahead of the December 10 Meeting

On December 10, the FOMC interest rate decision and Jerome Powell’s press conference will take place. There is a 93% chance of a 25 bps rate cut, and this expectation is already boosting the crypto market news sentiment.

Some institutions even believe the Fed may begin buying T-bills in early 2026, which means more liquidity.

4. UAE Declares Bitcoin a Core Part of Its Financial Future

In a major global development, the UAE has officially stated that Bitcoin is a core part of its long-term financial strategy. Mohammed Al Shamsi also said, Bitcoin has become the key pillar in the future of financing. This strengthens worldwide adoption and positions BTC as a strategic asset.

5. Coinbase Reopens User Registration in India

Coinbase has reopened its platform for new Indian users and plans to launch a new INR-to-crypto ramp by 2026. The first launch in 2022 did not go as expected. Earlier, UPI support was removed within days after NPCI refused to acknowledge the exchange’s presence.

Now, the Coinbase India return is happening at faster speed as registration is open for everyone, allowing crypto-to-crypto trading directly from the app.

All these bullish factors clearly demonstrate why the Crypto market is going up today. Now the questions remain till when will this momentum continue?

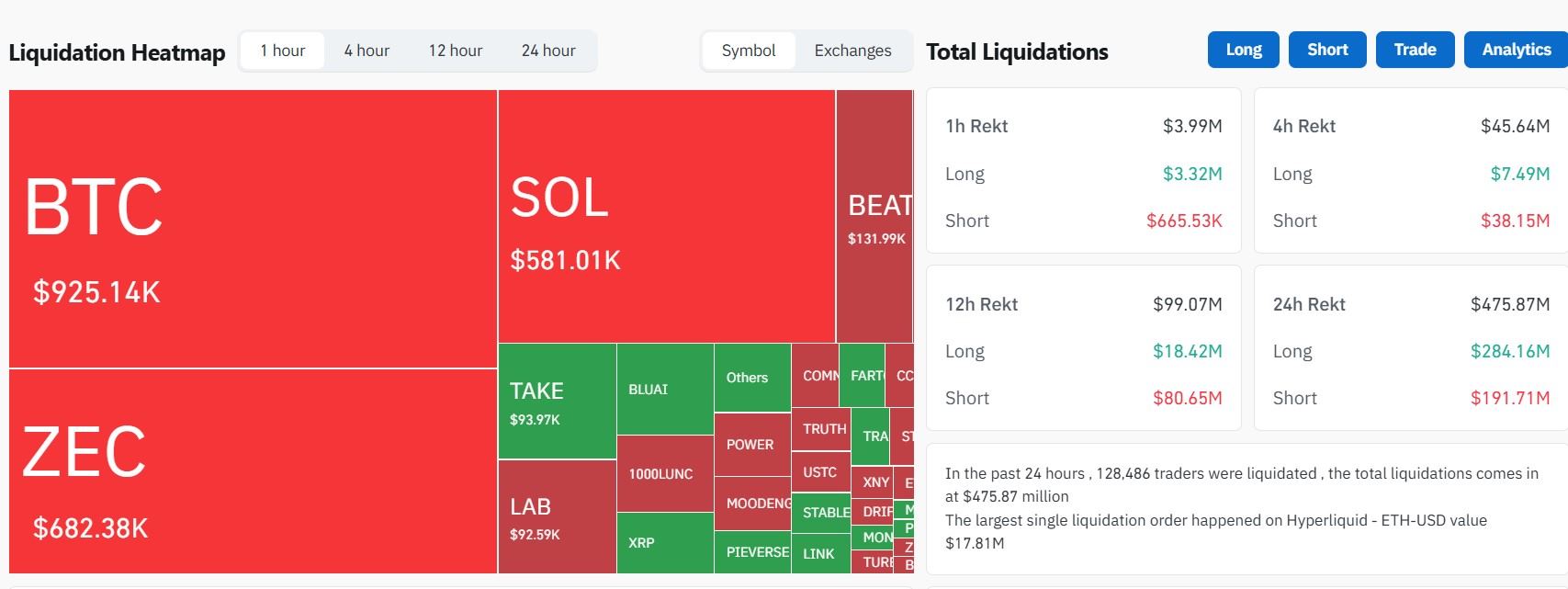

As per CoinGlass data, In the past 24 hours:

128,371 traders were liquidated

Total liquidations: $473.46 million

Biggest liquidation: Hyperliquid ETH-USD worth $17.81M

This level of forced liquidation is extremely dangerous because it shows the industry is running on high leverage and weak hands. Such huge wipeouts can quickly flip bullish momentum into sudden crashes.

Many top analysts believe December has turned bullish for $BTC. Some experts even expect it to reach $145,000 by March 2026.And historically, when crypto king rises sharply, Ethereum follows, Altcoins rally, and a broader bull cycle begins. So, traders now expect a strong December rally and a positive Q1 2026 which is even bullish.

Only time will tell, for how long this surge will continue, but as per my crypto analysis, this bull run is here to stay for a while.

Disclaimer: This article only provides industry information, and does not support any financial advice. DYOR before investing.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.