Why is Crypto Down Today, even after a strong first week of January? That is the question traders are asking as prices suddenly turned lower. After climbing from $3.04 trillion to $3.29 trillion in six days, sentiment flipped fast. At the time of writing, the global market cap stands at $3.24 trillion, down 1.5% in 24 hours. Daily trading activity is $148 billion. Bitcoin dominance is 56.5%, while Ethereum dominance is near 12%.

Let’s break down what caused today’s dip and what could come next.

Bitcoin, Ethereum, XRP Fall Together: Why is Crypto Down Today when no major negative headline hit overnight? Price action itself tells part of the story.

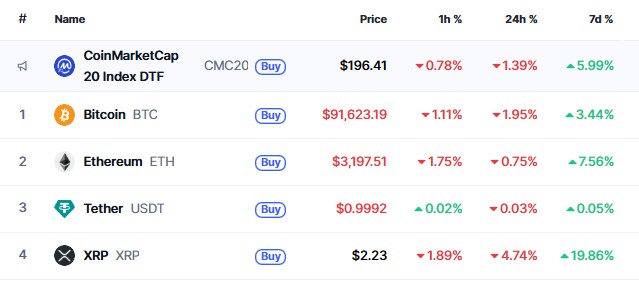

According to CoinMarketCap data:

Source: CoinMarketCap Data

Bitcoin Price Today is $91,631.44, down over 2%

Ethereum price today is $3,199.07, down 0.66%

XRP dropped sharply by 4.75% and is trading near $2.23

When large assets fall together, it usually points to traders reducing risk rather than reacting to a single coin issue. This is often the first sign of a short-term pullback, not panic selling.

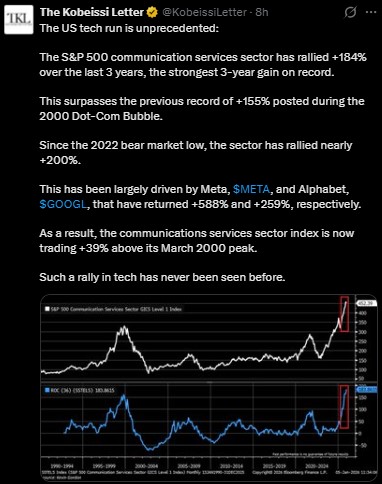

S&P 500 Rallies Today: Another major reason behind why the market is down today is happening outside digital assets. According to The Kobeissi Letter, the S&P 500 communication services sector is up 184% over the last three years. That beats the 2000 dot-com peak. Since the 2022 low, the sector is up nearly 200%, led by Meta (+588%) and Alphabet (+259%).

Source: The Kobeissi Letter

The index is now trading 39% above its March 2000 peak. Such strength in stocks often pulls large capital toward traditional assets. This supports the view that some large holders are temporarily shifting funds, increasing pressure on digital assets.

Arbitrum Vault Exploit Triggers Short-Term Fear: Security concerns also played a role in why crypto market is falling today. On January 6, 2026, a suspicious transaction hit the USDC Fusion Optimizer Vault on Arbitrum. A legacy vault lost $336,000 USDC. While this is a small fraction of total funds, it reminded traders how smart contract risks still exist.

The concern was first raised by cybersecurity firms Hexagate and Blockaid, but SEAL is assisting with remediation. However, occurrences like this can produce a degree of short-term fear among parties, which leads to a degree of circumspect trading activity.

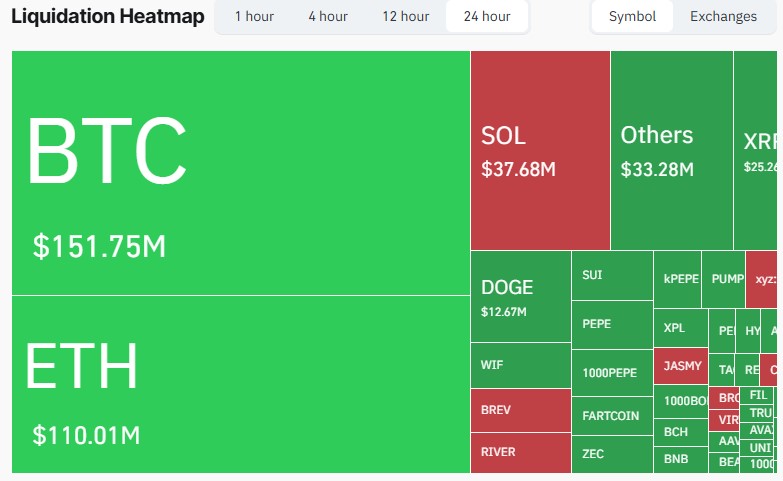

Liquidations Spike as Leverage Flushes Out: Another factor contributing to the current downturn in cryptocurrency markets is forced selling. According to data by Coinglass, in the last 24 hours, the following activities were recorded:

Source: CoinGlass

125,307 traders were liquidated

Overall liquidations reached $465.07 million

The biggest order in a single execution related to a BTC-USD liquidation worth $11.27 million on the Hyperliquid platform

As leverage grows through the rally, sometimes even a slight pullback starts a ripple effect. This selling further feeds into overcorrection.

Fear and Greed Index Still in Fear: Crypto remains in fear territory; the sentiment charts are also responsible for the drop in the crypto market on this day. Current reading of the Fear and Greed Index for crypto is 42, which is still in the fear zone. While it did manage to recover from the fear levels of around 20 last month, it is still holding on to that level.

Source: Fear and Greed Index

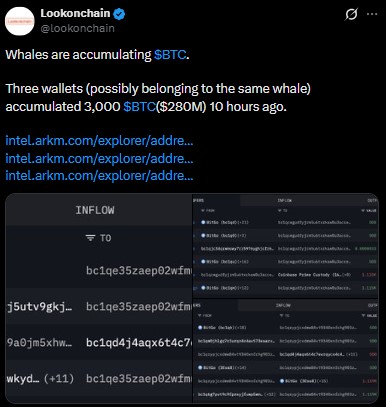

Despite today’s drop, this looks more like a correction than a full crypto market crash. Importantly, on-chain data shows confidence from large holders. According to Lookonchain, three linked wallets accumulated 3,000 BTC worth roughly $280 million just 10 hours ago. Accumulation during dips often signals long-term conviction.

Source: Lookonchain Data

In addition, Tom Lee Ethereum prediction remains extremely bullish. He has estimated Ethereum could rise toward $250,000 long term, valuing the network near $30 trillion. He also sees Bitcoin reaching $250,000 by 2026. Some interpret this as a sign that the market could recover.

Why is Crypto Down Today comes down to profit-taking, stock market strength, liquidations, and short-term fear. With whales buying and long-term forecasts like Tom Lee Ethereum prediction staying bullish, this dip looks corrective, not destructive. Traders now watch for stabilization before the next move.

YMYL Disclaimer: This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile. It is always essential to do your own research before making any investment.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.