Investors around the world are asking one big question: Why Silver and Bitcoin are Falling today when there is no major macro shock? The truth is, the drop isn't because of fear or bad fundamentals. Instead, it’s all because both the asset’s markets are reacting to short-term technical pressure.

From a sudden Silver futures sell-off to massive $BTC liquidation news, let’s uncover the pullback reasons and what’s next for the assets.

Silver price crash hit the financial industry after a sudden wave of selling started in the futures market around 8 PM ET. This happened during a time trading activity is usually low, which made the drop look much worse than it really was.

According to expert Peter Spina , about 30 million ounces of the precious metal "on paper" were dumped in just minutes. This happened right after it tried to break through the $82–$83 resistance zone.

Once the price failed to move higher, selling pressure increased and the asset fell towards the $79 area. This is the major reason behind why Silver is falling today.

On the other hand, why Bitcoin crash news today is mainly about leverage. Many traders were using borrowed money to bet that it would go higher. When the $BTC price failed to stay above $94,000, those bets were "liquidated" (forced to close), causing a fast drop toward $91,600.

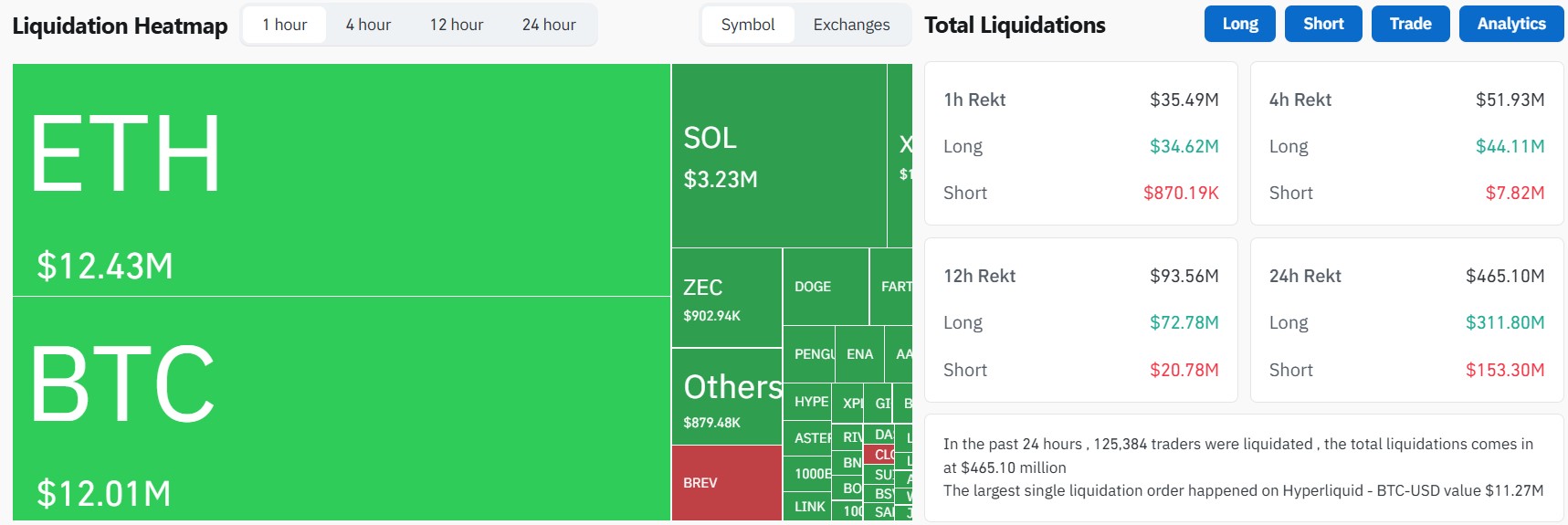

Data from CoinGlass liquidation chart shows that over 125,000 traders lost their positions in the last 24 hours, with total losses of $465.08 million. The biggest single liquidation was a $11.27 million BTC-USD position on Hyperliquid, which added more selling pressure.

This market research and analysis clearly states why Silver and Bitcoin are falling today, now let’s uncover what technicals suggest.

1. Even with the futures sell-off, the long-term silver price prediction 2026 remains strong. As long as the price stays above $76, many experts believe it could still reach $96 later this year.

Key levels to watch as per TradingView price chart are:

Major Support: $76.00

Resistance: $81.50–$82.00

MACD turned bearish, confirming short-term pressure.

RSI moved down to around 47, which means buying strength has slowed.

Still, this short-term pullback is just a normal correction, not a breakdown.

2. From a technical perspective Bitcoin price prediction looks weak in the short-term, but not broken. As long as it stays above its safety net of $90,500 level, the move looks like a normal pullback.

Key levels to watch are:

Major Support: $88,500

RSI near 35 shows momentum is weak

MACD is bearish, and price is making lower highs on short timeframes, as seen in the above chart.

Resistance zone: $94,000–$95,000

As per Coingabbar’s expert analysis, this kind of formation is often called a "healthy pullback." It clears out the risky traders and lets the market reset so it can grow more safely later.

Looking at both the asset’s charts, we see that both assets are just "taking a breather" after trying to hit new highs.

Silver price crash is now moving sideways near $79. If it falls below $78.5, price may test $76 level, but if it breaks the resistance zone, price may aim for $83-$85 targets.

$BTC is cooling near $91.6k after the massive liquidation update. Holding the $90k mark will keep the token safe, while if it breaks below it, the price could fall back towards the $88.5k mark. However if the asset breaks the resistance zone, then $100k might be the next bull target, as many crypto analysts are expecting Altseason 2026 soon. As history says ‘when altcoins run like bulls, $BTC usually rises.

The reason why Silver and Bitcoin are Falling Today boils down to technical selling and forced liquidations, not weak demand. In fact, institutional demand for digital gold remains very high according to the latest bitcoin news today.

The key to both the asset’s future now is whether the support holds or not. If they do, the bullish trend for 2026 is still on track.

YMYL Disclaimer: This article is for informational purposes only and is not financial advice. Investing in silver and crypto involves risk. Always do your own research or talk to a professional before investing.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.