Is the Zama price crash a warning sign for investors, or just another short-term shakeout during a crypto market crash? The token debuted on February 2 at $0.03837 across major exchanges such as Coinbase, Kraken, Binance, OKX, ByBit, Bitget, and KuCoin. Since then, value has dropped nearly 50%, now hovering around $0.01768, down 6% in 24 hours.

Market activity also weakened. Trading volume slipped 11.3%, landing near $91.82M, according to the CoinMarketCap chart. Supply dynamics add pressure as well — from an 11B total supply, only 2.2B coins circulate, increasing short-term selling weight.

Now, let’s look at the technical indicators, is there any recovery potential, and its 2026 outlook.

The latest TradingView 1-hour chart on Coinbase shows that the price is close to $0.0174, continuing a steady downtrend after failing to defend the $0.030–$0.032 consolidation range earlier this month. The Zama price crash chart pattern shows the price making lower highs and lower lows, a common sign that sellers are controlling the trend.

Technical indicators also reflect weakness. The RSI is around 41, which means buying interest is still low but the token is not yet in the oversold zone. At the same time, the MACD remains slightly negative, suggesting that downward pressure has slowed but has not fully disappeared yet.

Macro conditions worsen the picture. Global market cap fell to $2.29T (-2% in 24h), while BTC, ETH, XRP, and SOL declined 1–3%. The crypto fear index sits in extreme fear at 8, up from 5 yesterday, highlighting fragile sentiment. Combined with resistance rejection, these factors explain why is Zama price falling today.

If $0.017 support breaks, analysts see risk toward $0.015–$0.016. Recovery above $0.019–$0.020 would signal early stabilization.

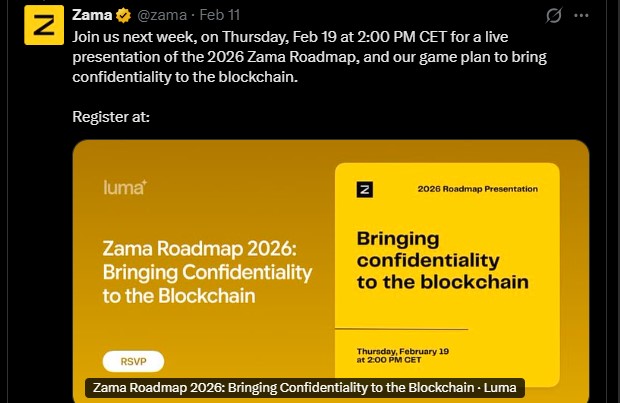

Despite the current price crash, several triggers could improve outlook. The latest Zama crypto news highlighted three ecosystem developments: a developer program, upcoming staking, and a live presentation of the new roadmap 2026 scheduled for Thursday, Feb 19 at 2:00 PM CET.

Source: Official X account

The project has already surpassed 350+ tokens staked across operations, showing early participation. Another catalyst comes from the Zama coinstore listing.

Source: Coinstore Exchange

Deposits opened Feb 12 at 17:00 (UTC+8), while withdrawals started Feb 13 at 17:00, a move that could introduce fresh investor momentum.

Short-Term (2–3 weeks): After the current crash, outlook stays cautious. If support near $0.016 holds, consolidation between $0.016–$0.022 looks likely, with a rebound toward $0.024 possible.

Mid-Term (3–4 months): If more coins enter the market slowly and the team keeps launching updates, selling pressure could reduce. If overall market mood improves, the price may slowly move between $0.022 and $0.035, range.

Long-Term (end of 2026): As per Coingabbar’s expert technical observation, if the technology gets popular and more people stake tokens, the price could rise to $0.045–$0.070. But if adoption stays slow, it may remain around $0.03.

Expert Observation: Early-stage assets often face volatility after listing, especially during a crypto market crash. Strong roadmap execution, and liquidity growth, usually decides whether a project stabilizes or continues going lower.

The Zama price crash reflects technical rejection, limited circulation, and fragile market mood. Yet staking progress, roadmap clarity, and the new exchange debut provide possible recovery signals. Traders should now closely watch the support levels before expecting sustained upside.

YMYL Disclaimer: This article is strictly for information only and does not provide any financial advice. Cryptocurrency investments carry high risk. Readers should always do their own research before investing.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.