Investor interest is getting bigger and bigger, with Binance Alpha confirming ACU as its first and main project. An airdrop, community-first tokenomics, and early access trading have already made strong market hype—and it’s still the beginning.

As of January 20, when trading goes live, there will be many users whose question would be: where could the ACU price go next? So we are going to discuss the whole scenario step by step.

Binance Alpha is confirming Acurast as its first and main project. Binance Alpha invests in early-stage, high-potential crypto projects. With the selection of Acurast, Binance shows its conviction in the long-term value. In addition, early adopters will receive an exclusive ACU airdrop that will have an impact on visibility, demand, and audience engagement.

The early exposure generally allows the new tokens to build liquidity more quickly and to have more community participation, which are the two accidental factors that will help in the stability of price after the launch.

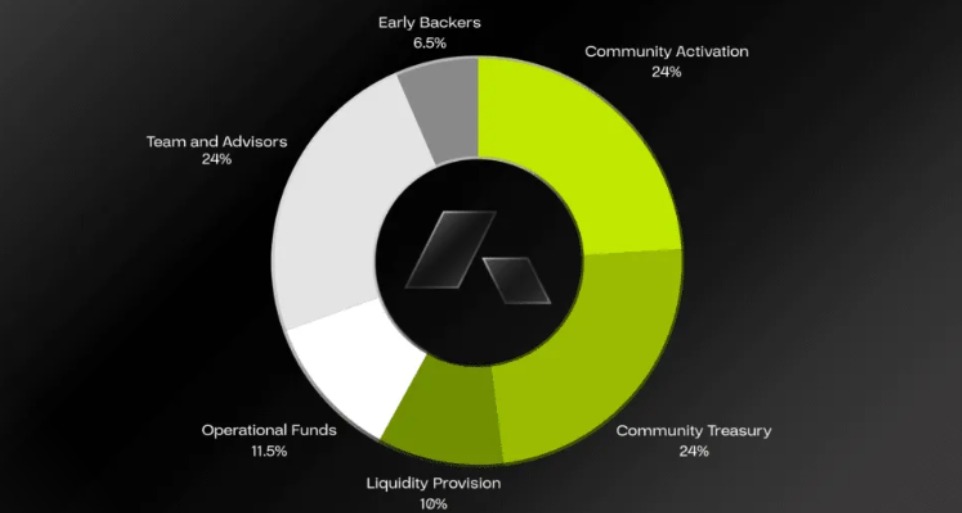

Acurast comes with one billion ACU tokens as the total supply that is to be used up in a way that ecosystem growth is the only purpose, and not to favor early and existing ones.

Nearly 70% allocated to the community and ecosystem

24% Community Activation

24% Community Treasury

11.5% Operational Funds

10% Liquidity Provision

24% Team and advisors

Only 6.5% for early backers

This system minimizes early sell pressure greatly and allows a much fairer price discovery.

At its debut, it is anticipated to be listed at a price between $0.03 and $0.06. This price bracket indicates the presence of a good liquidity situation, a small allocation for the early supporters, and a high demand from the community.

If the overall market perception remains good, it is not unlikely that the price will very soon, after the listing, go as high as $0.07, mainly because of the claims of the airdrop and the starting trading activities.

Initially, for a short period, it might be priced at low and at high respectively, that is, between $0.05 and $0.10.

Such a price range might be supported by the following:

More extensive stakeholder participation

Higher demand for computing power

Good ecosystem incentives

Although there will be ups and downs in the price, the heavy use of the network might keep the price above the price at which it was initially listed.

In the future, ACU’s long-term value will be driven by the adoption route. If the need for decentralized compute continues to grow, ACU can be quoted in the price range of $0.20-$0.40 in one to two years.

In case of a vibrant crypto market cycle, along with partnerships and usage, then the price levels of $0.50+ need to be watched out for. The building of the reputation of such growth will depend on the delivery of utility, not on the promotion of hype.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.